As vast amounts of both rooftop and large-scale solar PV come online, the National Electricity Market (NEM) energy supply mix is undergoing a major transformation. According to Australian Energy Market Operator’s (AEMO) latest Quarterly Energy Dynamics report, the changes are happening to the detriment of coal as a result of an increase in rooftop and grid solar generation with 2,173 MW of new grid scale capacity commencing generation since Q1 2018.

Compared to the same quarter a year ago, the share of black coal reduced by 133 MW on average as a result of three factors: displacement by solar during the daytime; shifts into higher priced bands; and a 217 MW reduction in average availability, AEMO finds.

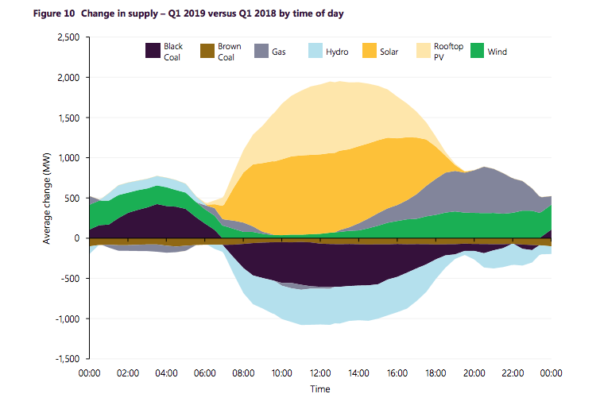

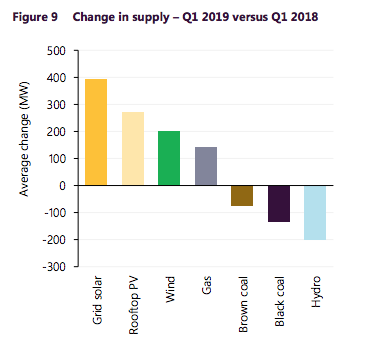

While the most significant change in the NEM was made by rooftop and grid solar generation with an increase of approximately 700 MW on average versus Q1 2018, the share of wind went up by 200 MW. Hydro output decreased by 200 MW on average due to dry conditions over the quarter and low storage levels, while gas rebounded from record low levels increasing by 143 MW on average compared to Q1 2019. AEMO explains that this increase occurred predominantly in the evening peak period, coinciding with higher spot electricity prices and declining solar output.

But, while the share of black and brown coal decreased, shifts in black-coal fired generator offers were still one of the main drivers of wholesale electricity prices in Q1 2019. AEMO finds that approximately 800 MW offered below $100/MWh in Q1 2018, was moved to prices above this threshold, noting that some generators highlighted coal conversion and/or quality issues as reasons for their changed offers.

On top of that, gas remained one of the main price setters with 250 MW shifted to prices above $100/MWh. This was coupled with hot weather, which drove demand up by 243 MW compared to Q1 2018, and dry conditions which prompted hydro generators to shift approximately 800 MW of capacity above $100/MWh.

Storage doing its bit

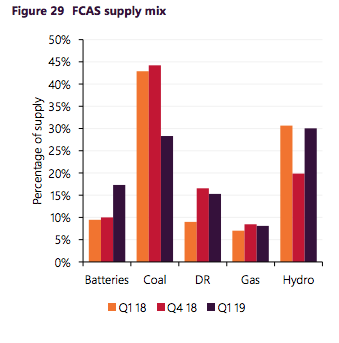

The growing number of big batteries in the NEM has translated into downward pressure on the overall costs as frequency control ancillary services (FCAS) costs amounted to $36.5 million, representing an $18 million (-33%) reduction on Q4 2018 levels. AEMO finds that batteries have increased their share in the FCAS markets from 10% in Q4 2018 to 17% in Q1 2019.

While the share of Hornsdale Power Reserve, also known as South Australia’s Tesla big battery, has remained relatively stable, the increased FCAS provision in Q1 2019 came from the 30MW/8MWh Dalrymple North battery storage in South Australia which accounted for 5%, and the 30 MW/30 MWh Ballarat energy storage facility in Victoria with a 3% share.

“This additional supply displaced higher-priced supply from other technologies, largely coal,“ AEMO says in the report, noting that another driver of decreased FCAS costs was a reduction in the price of offers from some hydro providers, resulting in increased dispatch.

In terms of revenues, batteries recorded park spreads of approximately $21/MWh, a slight increase over the prior quarter, while park spreads for the pumped hydro facilities were much lower at $1/MWh, AEMO finds.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.