From pv magazine global

The global PV market is forecast to see a 25% increase in new deployments this year, according to the Global Market Outlook for Solar Power published by SolarPower Europe.

According to the Medium Scenario presented in the report, which the association sees as the most likely outcome, new global capacity additions will reach 128 GW this year, up from 102.4 GW in 2018. China is still expected to be the largest market with around 43 GW and the authors of the report claim that the Chinese government is now acting faster than previously anticipated with the restructuring of its incentive scheme for solar. They say that this could lead to sustained growth, despite the weak numbers for new solar deployments that have already been announced this year.

SolarPower Europe also provided two more potential outcomes that it sees as less likely: a Low Scenario predicting only 85 GW of new growth, based on possible cuts to solar support in several countries, and a High Scenario delivering an astonishing 165.4 GW. The latter forecast sounds extremely optimistic and is also very improbable, but solar has often provided positive surprises in the past, the association says.

Under the Medium Scenario, the U.S. and India are expected to install more than 10 GW this year — 11.8 GW and 12.9 GW, respectively. Europe is forecast to install approximately 20.4 GW of new solar in 2019, which would represent an 80% increase from the 11.3 GW the Old Continent added last year.

“2018 was a unique year for the entire global solar industry, as we exceeded the magic installation mark of 100 GW per year for the first time, which led the solar power sector to grow to over 500 GW or 0.5 TW, ” says the association’s president, Christian Westermeier.

Nice prospects up to 2023

SolarPower Europe’s Medium Scenario also envisages that global solar demand could grow by 12% year on year to 144 GW in 2020. In the following three years, new additions could reach 158 GW (+10%), 169 GW (+7%), and 180 GW (+6%), respectively. If those numbers are achieved, the world’s cumulative installed PV capacity would increase from around 600 GW at the end of this year to 900 GW in 2021, 1.1 TW in 2022 and about 1.3 TW by the end of 2023.

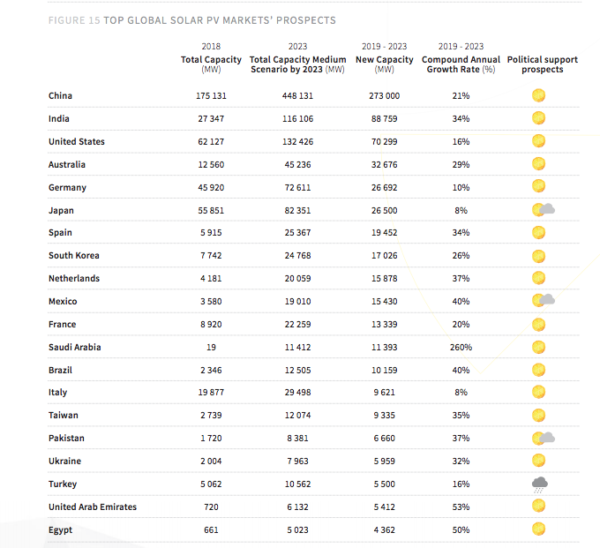

China’s installed solar power is expected to increase by another 273 GW to 448 GW by 2023. India, which may become the world’s third-largest market by the end of the 2019-2023 period, could reach 116 GW, with new additions hitting 88.7 GW.

The U.S. market is forecast to add 70 GW over the next five years to bring its cumulative solar capacity to 116 GW, which would make it as the world’s second-largest PV market. Japan will remain one of the world’s largest markets by 2023, with an expected cumulative capacity of 82.3 GW, but new deployments for the 2019-2023 period will only reach roughly 26.5 GW.

Australian market

Noting that several emerging markets showed impressive growth in 2018, SolarPower Europe says Australia was probably the solar shooting star of the last year. The country established itself as the world’s fifth largest market and turned into a +10 GW solar power generation capacity market on the back of of its 2018 growth that led to a total installed capacity of 12.6 GW.

“The country and continent accelerated its stellar growth pace in 2018, adding 5.3 GW, up nearly 300% from 1.3 GW in 2017 – and this high demand is supposed to continue,” the report states.

Under both the low scenario and high scenarios, Australia is poised to emerge as the world’s fourth largest market in terms of PV addition, following China, India and the US. The anticipated installation volumes between 2019 and 2023 under the low scenario stand at 19 GW, while under the most optimistic forecast Australia’s PV additions could reach 45.7 GW. The medium scenario forecast for Australia is nearly equal to the high scenario one and stands at 45.2 GW.

Major markets to drive Europe’s growth

Germany will remain the largest PV market in Europe for years to come, with an expected newly installed solar capacity of 26.7 GW by 2023, bringing its total capacity to 72.6 GW. Spain will be the second-biggest market with new additions reaching 19.4 GW and its cumulative total hitting 25.3 GW by the end of the 2019-2023 period.

Over the next five years, the Netherlands, France and Italy will likely add 15.8 GW, 13.3 GW and 9.6 GW, respectively. They will be followed by Ukraine and Turkey, with 5.9 GW and 5.5 GW of respective projected growth.

Stronger push needed for renewables

Despite the positive outlook, SolarPower Europe believes that the deployment of solar must be accelerated to meet targets set in the Paris agreement.

“Solar is ready in terms of both technology and affordability for a much greater uptake of our clean energy source to help mitigate the climate crisis,” says Michael Schmela, executive advisor of SolarPower Europe.

However, the association also notes that the International Renewable Energy Agency (IRENA) is recommending an average deployment of more than 400 GW of renewables per year until 2050 to keep global temperature rise below 2°C. Last year, only about 180 GW of fresh renewable power capacity came online.

A week ago, the International Energy Agency (IEA) also pointed out that 2018 marked the first time the volume of new renewables had not risen year on year since 2001. It said last year’s additions were not enough to keep the world on track to achieve the objectives defined in the Paris climate change agreement.

Localized by Marija Maisch

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.