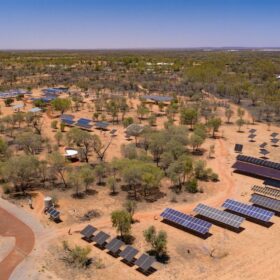

Renmark-based Yates Electrical Services began its Red Mud Green Energy project three years ago with the first 187 kW commercial farm joining the electricity grid in September 2016.

Since then 50 farms have been built up to 1 MW in size on sites ranging in area from 4000sq m (1 acre) to 2 hectares (5 acres). About% of the farms are in the Riverland but plants have also been built in other parts of the state including Eyre Peninsula and the Mid North.

Yates Electrical Services Managing Director Mark Yates said the farms had delivered between 14 and 19% return on investment for clients by selling the energy and the LGCs (large-scale generation certificates) on the National Electricity Market.

“The majority of the clients are in agribusiness whether it be broad acre, vines or citrus and we’ve had a couple of clients doing it purely for investment purposes utilising self-managed superannuation money and pure equity investors as well,” he said

“The Red Mud side of things is still humming along – we’ve got about 10 sites under construction and that business is going strong.

“We’ve built about 50 plants now since we started a couple of years ago so it’s been really, really busy and we’ve probably done a touch over 20 MW now.”

The Riverland is about 250km east of the South Australian capital Adelaide and stretches for 120km along the banks of Australia’s biggest river, the Murray.

Originally a citrus and stone fruit growing region, the Riverland turned to wine grapes in the 1980s and ‘90s and now accounts for more than a quarter of Australia’s annual crush.

Yates Electrical Services last week won a Fast Movers SA Excellence in Business Award recognising its growth, innovative strategies and market leadership.

The company has also recently formed a new entity, Green Gold Energy, in a joint venture with Chinese-based Golden Investment Group to engineer, procure and construct small solar farms across South Australia.

Construction of the first Green Gold project – a 2 MW farm on 2.5ha (10 acres) near Port Pirie – has just been completed.

Work is expected to begin in late June or early July on 4.95 MW farms on 10ha sites in Kadina and Port Pirie.

Yates said Green Gold Energy had an agreement with a major international client to develop a portfolio of small solar farms in South Australia totalling 65 MW over the next three years.

He said keeping the individual farms under 5 MW meant there was no requirement to register the asset with the Australian Energy Market Operator (AEMO) and it also simplified the application process through electricity distributor SA Power Networks.

“There are going to be projects popping up all over the state. We’ve got a licence so at this point in time we’re going to be the retailer for their sites so we take a margin on the energy they generate,” Yates said.

“What we’re finding is they work well in areas where there is high voltage capacity and generally it’s in areas where there is mining or heavy industrial operations.

“We’ve got our supply chain set up so effectively we just arrange the shipment direct from the factory overseas and bring it in to the Adelaide port. Then we use local freight companies to take the containers to each site. – each 25 acre site is about 50 containers.”

A growing team of about 40 electricians, apprentices, trade assistants and office staff have been driving the Red Mud and Green Gold projects.

Yates said the concept of solar farming and people’s acceptance of it had become a lot more mainstream since he first had the idea for the Red Mud Green Energy project in 2015.

“The farming we are getting into has progressed a long way since we started, people are becoming a lot more comfortable and are starting to understand the concept of solar farming whereas a few years ago it was a bit of a pie in the sky idea,” he said.

“But now we’ve demonstrated the viability of it, it just makes it a simple business decision for an investor or a landowner to take up an offering of a solar farm and add it to their existing farming or investment portfolio.”

This article was originally published on The Lead. It is republished with permission.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.