From pv magazine global

The results, from the latest large-scale solar tender round, published in February in Germany, show that PV project prices are climbing slightly again. Whereas in October 2018, the average winning tender price stood at €0.0469/kWh, the price rose to €0.048. Overall, 24 projects placed were successful in the round, 22 of which are located in Bavaria. One of the reasons projects in Bavaria have been so successful is that the state had made use of a law that allows for repurposing low yield agricultural land and other green fields for PV farms.

The move to open up new land for PV systems is not without criticism and only goes to show the urgency of the new conundrum Germany’s energy transition has yet to solve. Germany is inching towards the point at which most prime locations for PV are taken. Unless, that is, solar developers look beyond the rooftop, and dry land.

In neighboring Netherlands, the adoption of floating PV at scale has captured headlines in recent months. The EPC Groenleven, for example, is set to install Europe’s largest floating PV station – with a 48 MW array to be installed on a former sand extraction site.

Support for the Groenleven project comes from the Dutch water authority Rijkswaterstaat, which announced its intention to install a floating PV system on its premises. Additionally, the Dutch Foundation for Applied Water Research STWO, recently published a guideline on regulations administering the deployment of such systems, aiming to create a blueprint for PV plant developers.

The Netherlands has enormous potential for floating PV, as it has approximately 52,000 hectares of shallow inland water. It is not farfetched to think that floating PV’s watershed moment has arrived. The trickle of announcements of new floating PV projects in the Netherlands is rapidly becoming a flood.

One of the many projects being realized at present is from mounting structure specialist Zimmermann PV-Stahlbau GmbH. The company has installed a 2 MW pilot project using its newly released ZimFloat-System. Franz Krug, Project Manager with Zimmermann, explains to pv magazine: “In general, the market for floating PV is growing strongly worldwide. Especially in Asia floating PV is already playing an important role. China, Japan, and Vietnam are leading countries. In Europe, there is huge potential and demand for floating PV – especially in the Netherlands and France, but also southern regions where a symbiosis of preventing water evaporation and energy production can be realized.”

First swimming lessons

As with any foray into new technology there are engineering challenges to overcome. Mooring systems must be designed to withstand the dynamic forces of waves and strong winds, and had presented a challenge, Krug reports. “We simulated the dynamic forces in an extensive software [package] for dynamic analysis which was accompanied by several structural engineers and specialists in structures on water.” Krug continues to say that the installation of the mooring system was further complicated by the fact that mooring specialists have limited experience in applying the technology to floating PV plants. Floating PV installations are always moving to some extent, which increases, of course, with wind loads.

Zimmermann designed its system to cope with a wind-exposed side (fetch) of upt to 1,000 meters. Depending on the surrounding conditions a specially designed wave breaker can be integrated to absorb dynamic forces. “But the layout and mooring will be designed for each project individually since factors like depth of water, length of fetch, wind zone, and terrain category must be considered,” Krug adds.

Aside from questions about space, system designers must account for a myriad of other factors – some of which bring operational benefits. The unique design of the Zimmermann system places the modules directly above the water, allowing for improved air circulation and evaporative cooling from the water. This reduces modules’ temperature more effectively than is the case with many other suppliers of floating PV mounting structures, Krug asserts.

Repurposing coal pits

Zimmermann’s Krug sees the large-scale potential for the technology not only in the Netherlands but also in Germany’s open-cut lignite coal pits. “There are more than 100 open cut mining lakes that are more than 50 hectares in size”.

One company has been tapping this resource already in China. Sungrow has developed a 150 MW floating PV power station on a lake at a coal mining subsidence area in Guqiao, in Fengtai. According to Sungrow, the Guqiao site is the world’s largest floating PV power station.

Sungrow says the costs to construct floating PV stations are coming down rapidly, and in many places have reached parity with the seven meter pile foundation method. “Considering the extra 10% power generation gain, the electricity cost is already lower than that of some ground-mount PV plants,” says Daniel Li, Deputy General Manager with Sungrow Floating Systems Division.

Alongside coal pits, hydropower reservoirs and other artificial bodies of water have enormous potential. The World Bank’s floating solar market report Where Sun Meets Water, published in Q4 2018, asserts that global floating PV installed capacity was just shy of 1.1 GW at that time. According to the World Bank ground-mounted PV surpassed this milestone in 2000.

Alongside coal pits, hydropower reservoirs and other artificial bodies of water have enormous potential. The World Bank’s floating solar market report Where Sun Meets Water, published in Q4 2018, asserts that global floating PV installed capacity was just shy of 1.1 GW at that time. According to the World Bank ground-mounted PV surpassed this milestone in 2000.

The growth trajectory of floating PV, sometimes called ‘floatovolatics,’ is pronounced. At 453 MW and 512 MW in 2017 and until September 2018 respectively, the last two years accounted for the vast majority of floating installations. A confluence of technological maturity, space limitations, falling PV component costs, and the growth of bifacial technology are just a few reasons for the development.

Despite PV’s bullish growth rate in recent years, it remains in the shadow of hydropower generation. According to the Renewables Global Status Report 2018, by the Renewable Energy Policy Network for the 21st Century (REN21), the latter accounts for nearly three times the installed PV capacity around the globe.

Cumulative global solar installations in 2018 amounted to 400 GW, whereas global hydropower deployment reached 1,114 GW. Hydropower, the top dog in the renewable energy business, could be matched by solar through co-locating the two technologies. The reservoirs for hydropower cover a surface area of approximately 265.7 km2 with the potential to host 4,400 GW of floating PV at 25% reservoir surface coverage and generate around 6,270 TWh of electricity.

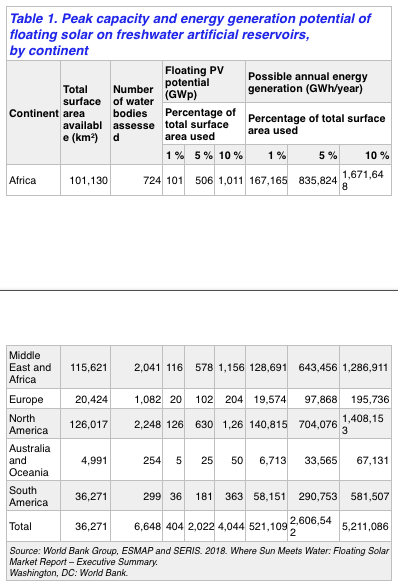

This capacity could be extended to 5,700 GW and about 8,000 TWh of electricity if all reservoirs (hydropower and those for other purposes) were 25% covered by PV. The World Bank, in partnership with the Solar Energy Research Institute of Singapore (SERIS), calculated the potential for the majority of artificial freshwater reservoirs on each continent, counting 6,648 bodies of water, with a total surface area of 404,454 km2. If just 1% of that surface area was used for floating PV, the world could double its solar capacity. At a 5% utilization rate, the PV output would come in at 2,022 GW.

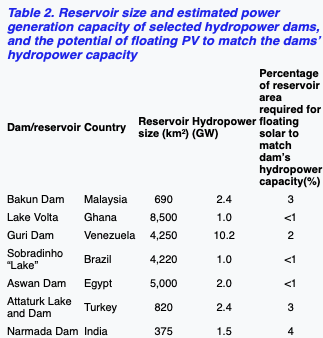

That the throne of hydropower is not untouchable is also demonstrated by the fact that according to the World Bank report’s authors it would require just between one and four percent of existing hydropower reservoir surface area to match the production capacity of the hydropower dam, for some of the largest gigawatt-scale dams in the world. With that market potential in sight, it is not at all surprising that solar companies are putting their efforts into engineering solutions to improve floating PV structures.

That the throne of hydropower is not untouchable is also demonstrated by the fact that according to the World Bank report’s authors it would require just between one and four percent of existing hydropower reservoir surface area to match the production capacity of the hydropower dam, for some of the largest gigawatt-scale dams in the world. With that market potential in sight, it is not at all surprising that solar companies are putting their efforts into engineering solutions to improve floating PV structures.

Hand in hand on the water

With utility-scale power electronics and grid-connection already established, co-locating PV with hydropower offers significant added value. Statkraft, a Norway-based independent power producer with many hydro assets around the world, announced that it is constructing a 2 MW floating PV plant in Albania. The 72 MW Banja dam is the first step in a cascade on the Devoll River. “Floating solar PV is considered a promising technology with advantages linked to our hydropower assets and makes it interesting to assess whether this technology could play a role in combination with our existing power plants in emerging markets,” says Tom Kristian Larsen, Country Head Albania of Statkraft.

Statkraft uses a very different technology, provided by the company Ocean Sun, for its project in Albania. The Ocean Sun system consists of a trampoline-like flotation device, 72 meters in diameter, accommodating 500 kW of PV. Glass-glass modules are mounted onto special rails, in a way that the modules will be in permanent contact with a thermal membrane that sits on the water’s surface. The water cools the membrane which in turn cools the modules. According to the company, the membrane has been designed to withstand mechanical stress and sun exposure. The system has been tested on the rough and cold seas of Norway. According to the IPP, the investment costs for the 2 MW site were about €2.3 million. “Today, the most cost-efficient floating solutions typically require 15% to 20% larger investment and probably 50% higher O&M expenses, depending on accessibility and location, compared to ground-mounted installations.”

Originally published in the September edition of pv magazine global

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.