This coming weekend, in the mountain resort of Karuizawa in Japan’s Nagano prefecture, G20 Energy Ministers will be presented with an International Energy Agency (IEA) study on the global state of play of clean hydrogen, along with recommendations for immediate practical steps to accelerate the development of hydrogen as the world’s most significant clean energy delivery and storage mechanism, capable of decarbonising major global industrial sectors from electricity supply to transportation, from agriculture to steel making.

If you think you’ve heard it all before, even the IEA blog refers to the old joke that “Hydrogen is the fuel of the future — and always will be.” But the Australian Federal Government, Australia’s Chief Scientist Alan Finkel, the Australian Renewable Energy Agency, CSIRO, Andrew Forrest of Fortescue Metals and numerous research hubs around the country believe hydrogen’s time is near, for three reasons:

- The imperative to decarbonise human endeavours on earth is undeniable, and areas of wind and solar resource require an energy-export method beyond transmission lines to expand their reach, range of application and reliability.

- Japan and South Korea, countries reliant on energy imports, have established roadmaps to incorporate hydrogen as a major fuel in their economies, along with immediate demand for clean hydrogen in bulk.

- And, “In parallel with that pull,” says Dr Daniel Roberts, Leader of the CSIRO Hydrogen Energy Systems Future Science Platform, the cost of “key technology components, in particular fuel cells and electrolysers, and renewable energy are coming down to a point that is beginning to see them approach or even get to parity with some of the systems they’re seeking to replace.”

Roberts was one of a panel of experts convened on Thursday by the Australian Science Media Centre to explain the opportunities and challenges of a national hydrogen industry to science writers and reporters, in the interests of correctly informing the Australian public of hydrogen’s potential.

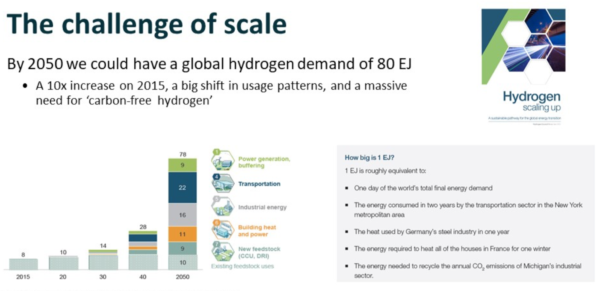

Graph: Hydrogen Council

An export to replace coal

Whatever you think of the sense or nonsense of breaking ground on new coal mines in Australia, Professor Ken Baldwin, Director of of the Energy Change Institute at the Australian National University, says, “The interesting future that we have in front of us is that as the world goes to a carbon-neutral economy towards the middle of this century the demand for coal and gas and other fossil-fuel exports will eventually decline. What will replace it?”

The use of hydrogen fuel cells to power not only cars, but buses, heavy vehicles, trains, materials handling (forklifts and cranes) and shipping is being explored, if not yet widely deployed, all over the world.

Australia’s hydrogen export industry is already a reality says Professor Douglas MacFarlane, leader of the Energy Program in the ARC Centre of Excellence for Electromaterials Science. A Victorian brown-coal gasification program, producing what’s known as black — or non-renewable — hydrogen is set to supply some of Japan’s 2020 Olympic Games energy requirements. And Queensland’s University of Technology last week exported its first green hydrogen, using a concentrated solar PV array developed by Japan’s Sumitomo Electric Industries to convert toluene into the safely transportable hydrogen carrier, methyl cyclohexane.

This breakthrough represents one potential pathway for overcoming the cost and transport barriers to a full-scale export industry.

What’s keeping the lid on hydrogen?

MacFarlane explains that although the cost of renewable energy, particularly solar energy, is competitive and still declining, the equipment required for catalysing water into its component parts of hydrogen and oxygen is expensive and as yet not efficient enough to make the most of the energy required to drive the process.

In addition, he says, current low-pressure water-splitting technology can only “produce hydrogen in the tens of atmospheres”, a product suitable for directly mixing hydrogen with existing gas supply (similar to adding ethanol to petrol). But, says MacFarlane, “700 atmospheres is the sort of pressure that the hydrogen needs to be for electric-vehicle fuel stations”. The R&D task, he says, is to reduce the cost of generating hydrogen at a higher pressure suitable for both refuelling and for export.

Transportation is another cost challenge, current methods of shipping hydrogen in a liquified form that requires cooling it to an extreme degree, are very expensive in terms of energy. Developing pathways to efficient catalysis of hydrogen into ammonia, says MacFarlane, would allow movement of hydrogen “in shipping and piping technology that is already well established in the ammonia-for-fertilisers industry”.

Roberts agrees that, “Ammonia is almost a ready-to-go solution that needs to be transitioned into the energy context.”

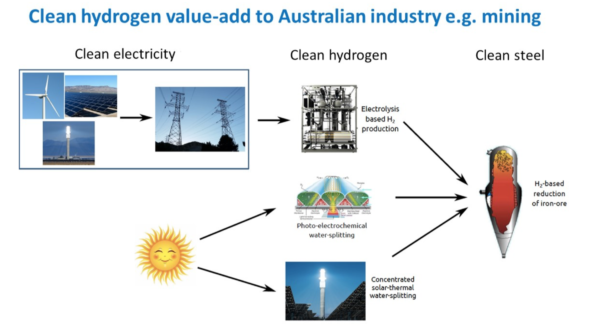

Steeling ourselves for new exports

One of Australia’s biggest potential applications of hydrogen as stored and readily available renewable energy is in decarbonising the energy-intense process of transforming iron ore into steel. Onshore manufacturing this value-added product of Australia’s mineral industry would provide an export to fill the void left by declining demand for the country’s coal.

Image: Professor Ken Baldwin, ANU

This is part of the vision of the Asian Renewable Energy Hub, the 11 GW of renewable energy generation (7.5 GW wind; 3.5 GW solar ) proposed for the Pilbara in north Western Australia, with 8 GW currently earmarked for hydrogen production and another 3 GW set aside for energy users in the region.

A feature of hydrogen as a renewable-energy storage medium, says Roberts, is the ability of electrolysers to quickly absorb excess energy. “They can respond very quickly to fluctuations in the grid and store the hydrogen in the peaks and use it up during the troughs.” In this application, he says, electrolysers can be used to build bigger, more stable grids based on renewable energy.

Although Australia is unique in its remarkable potential to generate huge amounts of solar energy, Chile and Middle Eastern countries are also preparing to exploit their solar resources for hydrogen production and export.

As part of his panel presentation for AusSMC, MacFarlane displayed the well-ogled heat map of the world that shows Australia as the biggest landmass in the path of the greatest solar intensity. On the map he had superimposed a tiny yellow square to scale, which represented an area 250 km by 250 km (or roughly the area of Australia’s four biggest cattle stations) and said that, “If you put standard commercial solar cells over that land area, you can generate 25 petawatt hours per year of energy, which is the total electricity demand of the whole world — just from that little box.”

His point is that Australia has the renewable-energy capacity to build a hydrogen industry, and its research efforts are now focused on reducing costs and demonstrating scaleability of various water-splitting technologies.

“The other thing we must never forget in the Australian context is water supply,” says MacFarlane. At the very large scale, it’s obvious he says that Australia would have to utilise sea water for hydrogen production, which means integrating the process and cost of desalination into the hydrogen-production equation.

All three experts believe that worldwide carbon pricing is an inevitability and that this factor, imposed on fossil fuel sources and fossil-fuelled processes will help to make the price of green hydrogen more attractive. “The price issue hasn’t played out fully yet,” says Baldwin, who adds, “the technology is rapidly and advancing and government systems around the world are moving towards having a price on carbon eventually.” We’ll have to “see what happens in a carbon-constrained world”.

The IEA says it “will help governments craft the right policies” in relation to hydrogen. Tune in this weekend.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I must be missing something here. I just cannot be excited about hydrogen as a possible practical fuel of the future. Firstly, just the fact that it takes more energy to produce hydrogen than is produced by the hydrogen as a fuel. Hydrogen requires 148 MJ/kg to produce but produces 142 MJ/kg. Next is the issue of water. As I understand it 8 liters of water is required for each kg of hydrogen produced. If there is to be a plant in the Pilbara then where does the water come from? Is, for example, solar power used to desalinate the water as well as for the electrolysis of the water? I do not want to be negative, I simply do not understand so if someone can explain in simple language I would appreciate it.

In the Australian context, the water invariably would be sea water, ie requiring desalination.

The obvious question then is how could desalination plus water splitting driven (with energy losses such as that you mentioned) from PV ever undercut natural gas on a HHV basis?

I would argue the most likely scenario is not a plant in a remote location with dedicated PV but actually an industrial city with a demand for reliably grid electricity (because of the presence of smelters, steel and commerce, etc.), and the dual function of the hydrogen plant for grid stabilisation services covering the capital costs and discounting the operating costs of the plant. There are several cities on the Eastern Seaboard exposed to high natural gas prices that comes to mind, such as Gladstone and Newcastle. Both Gladstone and Newcastle also have Ammonia plant, so you only need to beat blue hydrogen (ie from natural gas) on a HHV basis, and not natural gas itself.

With the right electrolyser technology, green hydrogen is favourably competitive including desalination…

Japanese are taking a serious interest in this technology …

http://www.ectltd.com.au/shareholder-update-hydromor-cohgen-development/

http://www.ectltd.com.au/hydrogen-the-next-lng/

http://www.ectltd.com.au/ect-chairman-attends-jogmec-seminar-on-hydrogen-from-latrobe-valley-brown-coal/