Smart Energy Council pushes for a NO vote on Battery Standard AS/NZS 5139

Standards Australia has progressed AS/NZS: 5139 draft battery standard to the ballot stage for committee voting. The Smart Energy Council (SEC) believes the draft standard, while required to meet the needs of the fast growing battery segment, is not sufficiently thorough in addressing safety concerns.

ABB exits solar inverter business

This Swiss giant is following a trend as large multinational high-tech companies see their role as redesigning infrastructure rather than supplying inverters at ever lower margins. Schneider Electric has pulled out of large scale solar, Siemens’ Kaco acquisition and Junelight launch show increasing interest in the C&I and residential markets, and GE is likely to divest its power conversion business due to low profit margins in that sector.

IHS Markit: Global EPC market grew 34% last year

China’s slowdown in installations last year was more than made up for by expansion elsewhere, according to IHS Markit. The news comes amid increasing market fragmentation – with the biggest engineering, procurement and construction business boasting less than 3% market share – and internationalization, with almost half of the top 15 companies operating across more than one region.

Queensland government opens funding for new hydrogen projects

Applications are now open for the Queensland government’s $15 million Hydrogen Industry Development Fund, which will support sustainable and renewable hydrogen projects across the state.

IEEFA Energy Finance 2019: Coal pipeline shrinking, stranded asset risk ballooning, renewables ever cheaper

Coal fleets represent huge financial risk to shareholders and investors write Tim Buckley IEEFA’S Director of Energy Finance Studies, Kate Finlayson the organisation’s Senior Communications Strategist.

Battery sector heeding findings of independent testing

Intensive testing has exposed a range of faults in both lithium-ion and lead-acid batteries and battery management systems. ITP Renewables shares some key findings from its testing program and findings and how its program is providing valuable feedback to suppliers and the wider industry.

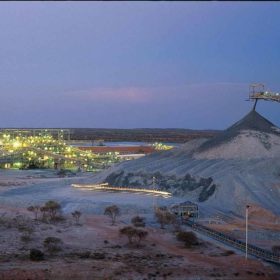

2019 shaping as watershed year for renewables in resource sector

As one of the most energy-intensive industries, the resource sector is getting serious about integrating cheap wind and solar energy into its mix to boost bottom lines. Although still predominantly underpinned by gas or diesel, mine operations are increasingly deploying hybrid solutions pointing to the potential of the sector transitioning to 100% renewables – particularly as momentum builds for green hydrogen to play a role in future microgrids.

‘Turbocharging’ silicon PV: MIT scientists scratch the surface of singlet exciton fission

Scientists at the Massachusetts Institute of Technology have developed a device they say could “turbocharge” a single-junction silicon PV cell, pushing the technology beyond its theoretical limit to efficiencies of 35% and higher.

Octopus Energy Investments picks a side as the global energy investor rebrands as Octopus Renewables

Octopus Energy Investments, the UK’s largest investor in utility scale solar, which set up an office in Melbourne last year, has rebranded itself as Octopus Renewables as the £3 billion (AU$5.3 billion) global fund manager looks to throw its considerable weight behind the global energy transition to renewables.

EnergyAustralia integrates solar PV into its C&I offering

EnergyAustralia has acquired a 49% stake in the Echo Group of companies which tailors energy efficiency solutions and solar installations for commercial and industrial energy consumers.