The UNSW survey sought to explore attitudes toward an economically modelled policy proposal for a market-based approach to reducing emissions through a company emitter tax that is redistributed progressively to Australian households.

The proposed Australian Carbon Dividend Plan (ACDP) would tax carbon dioxide at $50 per metric ton (MT) at the source, such as a mine or well or port, with the revenue generated returned to every voting-age Australian at an estimated $1300 a year each.

One wonders which ‘community’ UNSW surveyed considering the polarising effect of the last so-called ‘carbon-tax’, Julia Gillard’s Clean Energy Act 2011. Gillard’s ‘carbon tax’ was set at $23 per ton and led to one of the most divisive elections in Australian history, culminating in a landslide victory for the Coalition and Tony Abbott.

However, Australian National University (ANU) estimated Gillard’s scheme did produce the largest reduction in carbon emissions since records began.

The ACDP does not seem radically different than Gillard’s carbon pricing scheme. ACDP similarly looks to encourage companies to reduce their emissions via a tax which would be redistributed to offset any potential price increases. Considering the Coalition victory over a Bill Shorten led Labor Party which had campaigned vigorously on environmental terms in the most recent election, it seems unlikely such a scheme could be introduced any time soon.

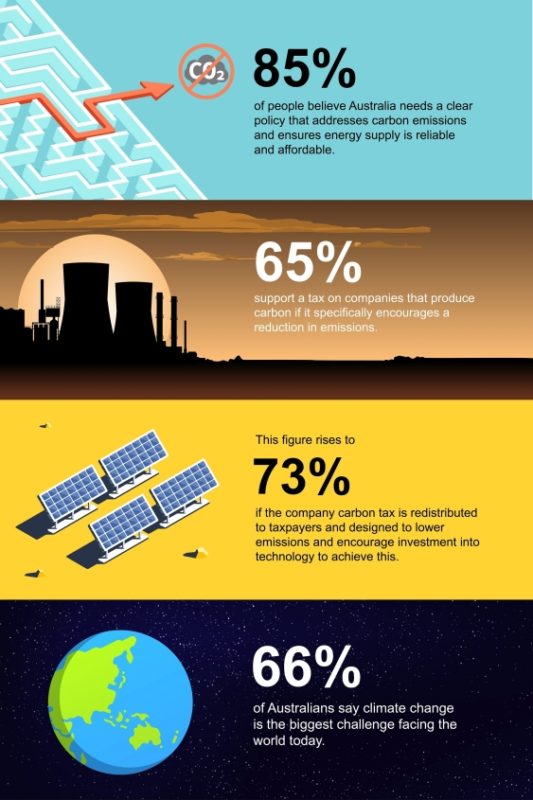

Nevertheless, the findings of UNSW Sydney Professors Rosalind Dixon and Richard Holden find that two of every three Australians believe climate change is the biggest challenge facing the world today.

“A carbon dividend is strongly supported by Australians which should be great news to our political leaders who could adopt this model to help our country address one of the greatest and most pressing moral challenges of our time: climate change,” Holden said.

“Australia, like many other countries, is committed to the Paris Agreement goal of keeping the rise of the globe’s temperature below 2 degrees to cut emissions by 26-28% by 2030, but to date no policy has used a market-based approach to reduce emissions while providing a practical and progressive means of compensating Australian households.”

It is unclear where Holden is drawing the line as regards to policy, if he is marking time from Australia’s signing of the Paris Agreement, or from the beginning of Prime Minister Morrison’s government, then it is certainly true there has been a distinct lack of policy market-based or otherwise. Indeed, the federal policy vacuum post-2020 is a growing concern, growing rapidly like a poisonous plant in the dark.

However, as mentioned above, Australia did have a ‘carbon-tax’ and, at least in political terms, it went down about as well as a cyanide cocktail. Nor, it must be said, did Gillard’s Labor government fail to implement offsetting redistribution, her government reduced income tax and increased welfare payments to cover the expected price increases.

The survey also found significant discrepancies depending on how the proposed plan was worded. 65% of those surveyed agreed that they would support a tax on companies that produce carbon specifically to encourage a reduction in emissions. However, that figure rises to 73% if it is further explained that the tax is redistributed to taxpayers and designed to lower emissions and encourage technological investment.

Unsurprisingly, support drops to 52% when the proposition only mentions the redistribution to taxpayers and does not mention the environmental benefits and market changes.

“The case for our federal government to do more to reduce emissions is clear from these new survey results but now there is also strong community support for a new type of tax on companies that produce emissions if funds raised go back to taxpayers and the policy achieves reduced emissions,” Holden maintained.

Holden failed to mention the fact that the plan’s authors suggest ACDP would enable the government to roll back subsidies for renewable energies as they could be seen as redundant with a carbon tax. But even someone with the most rudimentary understanding of economics knows that governments tax the things they want to discourage, and don’t tax the things you want to encourage. Though effectively, ACDP’s architects seek only to discourage the cause of climate change (a global industrial system lacking in central regulation), at the expense of encouraging the cure (the transition to renewable energies).

“This really is a win-win,” persisted Holden, “it seems there is a widening gap politically about how to address emissions. While a type of carbon tax nearly became law in Australia under the then Prime Minister Gillard in 2011, it is clear the time is right to now introduce a progressive emissions tax and dividend model to help Australia take a leadership position on what most people in our survey say is the biggest challenge facing the world today.”

Image: UNSW

Professor Holden’s motives are admirable, but his wilful ignorance will prove about as conducive to pragmatic politics as a terrorist attack. The “type of carbon tax that nearly became law” was almost the exact same “type” Holden is suggesting, and Gillard’s tax did become law, hence why Abbott won an election on his promise to repeal it.

It is true, a carbon tax could be a very useful tool in reducing Australia’s carbon emissions and helping out the battling Australian taxpayer. But is such a politically divisive issue in Australia a good place to expend political credit? Perhaps instead of focusing on taxing carbon-emitting industries, our efforts might be better focused on building clean industries and hustling the reindustrialisation of Australia, the nation’s destiny.

An updated version of the Australian Carbon Dividend Plan can be downloaded here.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.