From pv magazine 02/2020

Demand for replacement PV inverters comes from customers that own old inverters that are beginning to underperform or fail, or can no longer easily be serviced with replacement models or spare parts. Demand also comes from customers that own relatively young PV inverters that are underperforming due to either poor installation, system design, or quality issues.

Asia gaining ground

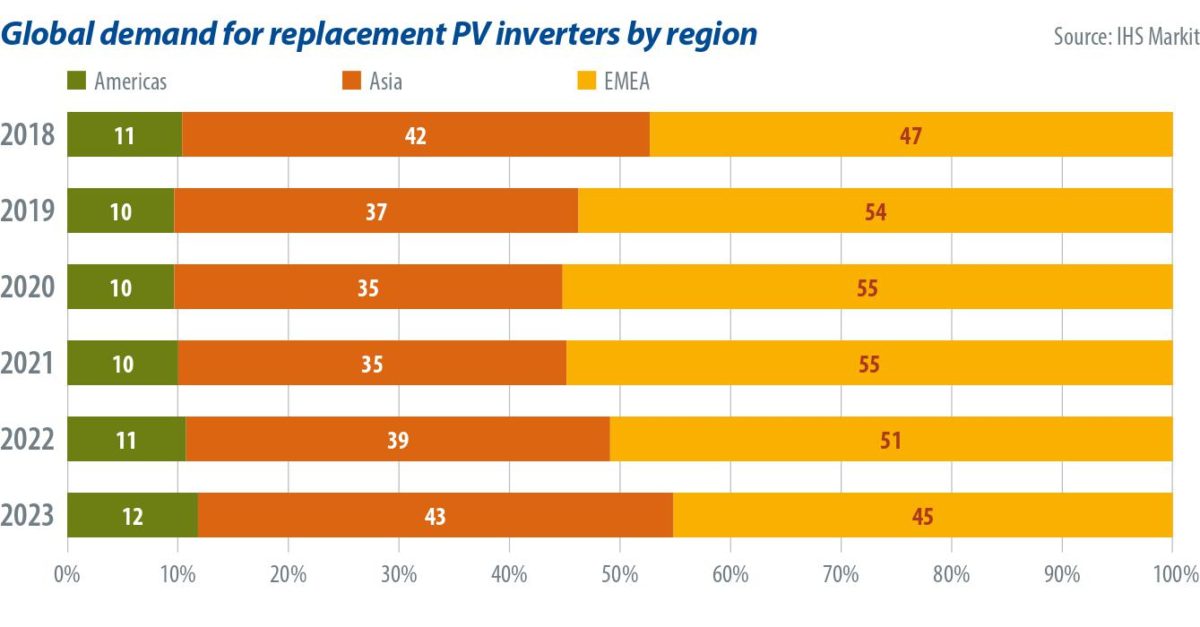

Europe/Middle East/Africa (EMEA) has been the largest region for replacement PV inverter demand historically, as the region experienced an early boom in solar in core markets such as Germany, Italy, Spain, Czech Republic, and Bulgaria, and now has the largest installed base of PV systems older than five years. Replacement demand in the EMEA region reached 3.4 GW in 2019, driven largely by aging installations between 10 kW and 5 MW in size. The largest markets are Germany, Italy and Spain, which together accounted for more than 70% of replacement demand in the EMEA region.

Asia is the second-largest region for replacement inverters due to older large PV installations in China and more-recent massive growth, which will continue to fuel demand across the region. Demand for replacement PV inverters is expected to come primarily from utility-scale (>5 MW) installations. In Japan, demand will also be driven by residential and commercial installations, as the country experienced early growth in solar and now has the largest installed base of residential installations over five years old in the world.

Demand for replacement PV inverters in the Americas region is expected to grow rapidly, driven primarily by the United States, its largest market. Replacement demand in the Americas region is forecast to grow at a CAGR (2018–23) of 130% and account for 12% of global replacement demand in 2023. The United States has proven to be a volatile competitive landscape for inverter suppliers, with many having entered and exited the market. Certain suppliers such as Satcon and Advanced Energy that had a large market share but are no longer active in the market have created an opportunity for existing suppliers to provide replacement inverters.

Furthermore, evolving technical regulations and import tariffs continue to make the United States a challenging environment for suppliers to keep investing in next-generation product and hence, may also cause suppliers to exit the market. However, despite some of these challenges, it remains a highly lucrative market as suppliers fight to capture an increasing number of new installations, and as customers seek ways to replace a growing installed base of aging systems, particularly in the utility-scale segment.

Working together

Developers, EPCs, O&M providers, and PV inverter suppliers are all seeking new ways to maximize the value from investments in replacement PV inverters. Straight one-to-one replacement of old inverters is currently the most common route that customers take. For example, an older 1 MW central inverter model is replaced with a new, modern 1 MW central inverter.

However, as inverter technology develops, new inverter types are being used to replace older-generation inverters with the aim of maximizing yield, simplifying O&M, and reducing the levelized cost of energy. Customers are increasingly considering changing the overall system architecture, for example, by replacing an old central inverter with string inverters or by introducing string-level power optimizers. Overall, modern inverters are being designed with a plethora of advanced features such as artificial intelligence, monitoring, and autonomous control functionality. Advanced software capabilities allow customers to upgrade their existing systems by replacing inverters.

O&M service providers have stepped up to offer services to ensure that customers reduce downtime and maximize yield and revenue from their PV systems by helping to meet the challenges that come with a growing installed base of aging PV inverters. Firstly, real-time monitoring can allow O&M providers to spot potential issues with inverters deployed within a system. On top of that, predictive analytics is starting to help O&M providers and customers to get ahead of potential issues. New methods including thermography and aerial photography are also providing new data streams for O&M providers to study for potential inverter issues.

Regardless of these advanced methods of monitoring, O&M service providers face a significant challenge regarding the sourcing of replacement inverters and spare parts. Replacement inverters for older-generation models may simply not be available anymore. Spare parts may be difficult to source and may require O&M service providers and customers to be creative about harvesting spare parts from decommissioned inverters or even other types of power electronics equipment. O&M service providers have started to develop in-house expertise dedicated to inverter repair, which involves hiring experienced engineers and seeking advanced training, sometimes directly from PV inverter suppliers, in addition to warehousing their own inventories of spare parts and spare inverters.

For their part, inverter suppliers have also begun to invest in their own departments dedicated to addressing the market for replacement PV inverters. For example, SMA has established its own replacement/repowering department, which is focused on consulting and selling kits specifically for replacement projects. However, IHS Markit notes that this market is still in its infancy and inverter suppliers that invest time and resources into helping to serve this market can capture significant opportunity for themselves in the next five years, as the market segment is set to

grow rapidly.

About the author

Miguel De Jesus is a solar market analyst with the clean technology and renewables research team at IHS Markit. He is responsible for research and data collection on the global photovoltaic inverter market.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.