In December 2019, the University of Queensland (UQ) flipped the switch on one of the state’s largest behind-the-meter battery storage systems, a 1.1 MW/ 2.15 MWh Tesla Powerpack. It is now time to check in on the Powerpack, part of UQ’s Engineering Precinct Battery system.

This week, UQ released “The business case for behind-the-meter energy storage,” a report on the first-quarter (Q1 2020) performance of its Tesla battery.

It was the hope of UQ, which funded the Powerpack through the sale of renewable energy certificates created by its existing 6.3 MW behind-the-meter solar PV portfolio, that the energy storage system would reduce the university’s monthly peak demand charges.

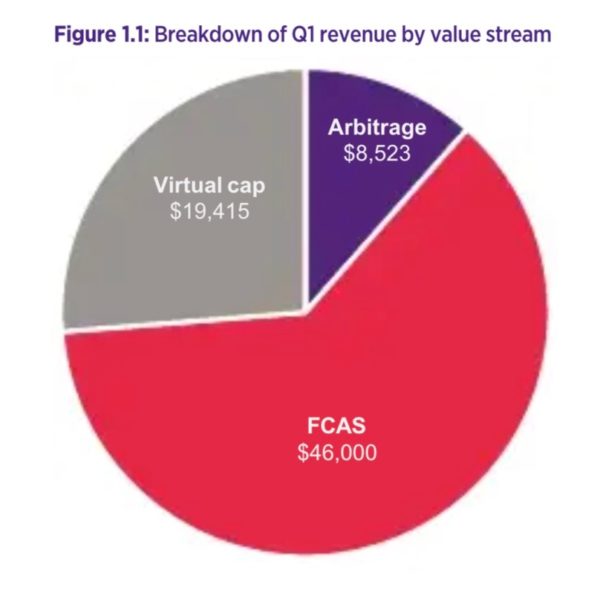

It is fair to say UQ’s hopes have been realised. Not only has the Powerpack reduced the university’s peak demand charges, but in the three months of Q1 2020 the Powerpack has actually delivered $74,000 in revenue.

Revenue

UQ’s Powerpack has delivered revenue across four/three main services.

FCAS

UQ partnered its Powerpack with Enel X, whereby the university is paid to keep its battery on standby, ready to respond rapidly to sudden issues in grid frequency. The NEM’s Frequency Control Ancillary Services (FCAS) then pays UQ for the capability of its storage.

And the Powerpack is certainly capable, its value provided by the ability of energy storage to muster incredibly fast response times. UQ has measured its Powerpack during commissioning tests to have a response time of 200 milliseconds between zero to full discharge, and 400 milliseconds from full charge to discharge. This capability makes it incredibly useful to the NEM when it is under unprecedented and oft immediate pressures.

FCAS outperformed UQ’s forecast by a staggering 54%, a performance that is being put down to unprecedented pressure on the NEM brought on by the Black Summer bushfires, storm events, and other growing pressures on the outdated grid.

Arbitrage

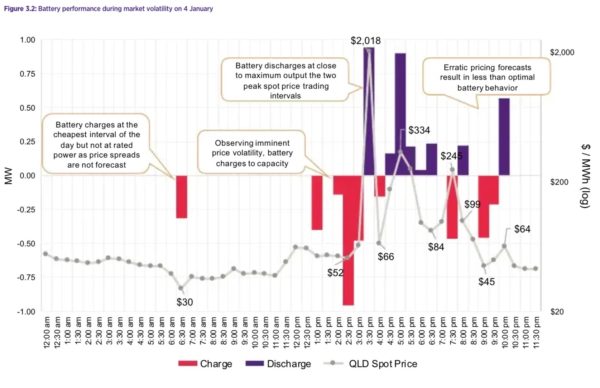

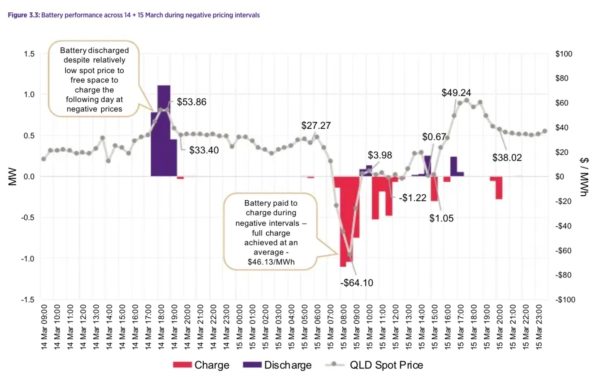

Another key revenue-raiser is Arbitrage, the charging of the battery when prices are low and discharging when prices are high, maximising cost disparity.

Throughout Q1 2020 UQ’s DRE supervisory control system traded in the NEM 24/7.

As can be seen, Q1s arbitrage revenue was made predominantly in January, and in January those revenue gains were largely secluded to a “a handful of days” which saw “large jumps.”

Virtual Cap Contract

A Virtual Cap Contract (VCC) is a kind of financial insurance on the wholesale electricity spot market. To manage risk in a volatile market ‘cap’ contracts are offered for a ‘premium’, and a payout is provided if the market’s prices exceed that cap. Typically, in the NEM, the threshold is $300/MWh. UQ’s Powerpack is able to discharge energy when the price exceeds the threshold.

Paying For Itself

Considering Q1 was the first real outing for the Powerpack it has performed extraordinarily well. However, UQ belives performance can only improve. First, the institution wants to develop an effective control strategy to maximise arbitrage revenue. Although, this depends on AEMO producing better pre-dispatch price forecasts.

UQ also believes it can improve on its FCAS and Virtual Cap revenue. Indeed, UQ’s financial modelling estimates that the battery could provide a financial return of $245,000 annually in a short period, and pay for itself within eight years. The expected life of the battery is 15 years.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.