French renewables giant Neoen has reported a bumper first-half 2020 revenue of €157m (AU$258m), up 33% on the first half of 2019, a good portion of which came from a tripling of storage revenue thanks to South Australia’s (SA) Hornsdale Power Reserve, also known as the Tesla Big Battery.

Neoen’s storage revenue jumped from €8.4m in the first half of 2019 to €24.6m (AU$40m) in the first half 2020 due to “an exceptional non-recurring event in Australia…the key factor behind this very hefty increase.” The exceptional non-recurring event was in fact a tornado in late January which pulled down the Heywood interconnector between SA and Victoria. SA was effectively isolated from the rest of the National Energy Market (NEM) for 18 days.

The Australian Energy Market Operator (AEMO) utilised Neoen’s Hornsdale and two other smaller batteries – Dalrymple ESCRI and Lake Bonney – to maintain grid reliability and keep electricity prices down.

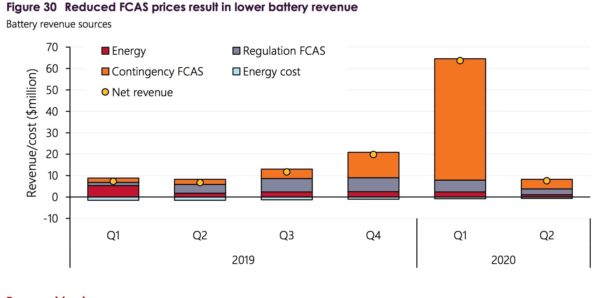

However, since Hornsdale heroics in the first quarter 2020, “less favourable market conditions in Australia or sales of network services (Frequency Control Ancillary Service [FCAS]), meant Neoen reported storage revenue down on comparative 2019 figures.

According to AEMO’s Q2 Energy Dynamics Report, the decline in FCAS was caused by a lack of network volatility, although FCAS markets still contributed 88% of total battery revenue.

The 100MW/129MWh Tesla big battery, located in Jamestown in SA and adjacent to the 315 MW Hornsdale Wind Farm, has already demonstrated its immense value for the grid in a number of ways, largely through grid stabilisation services and savings. But the project, which is being expanded by 50%, through the addition of 50MW/64.5 MWh of Tesla batteries, is set to become an even more valuable asset to the National Electricity Market (NEM) through the addition of digital inertia services.

Solar revenues

Neoen already has six solar farms in operation around Australia and enjoys the status of being Australia’s leading independent producer of renewable energy.

However, despite reporting strong revenue growth of 34% compared to the first half of 2019, the contribution of projects in Australia stalled slightly in the first half of 2020 due to “less favourable irradiation conditions in Australia as well as lower availability of an Australian facility due to renovation works on the grid, which are now complete.”

The mentioned facility remains unspecified, but the less favourable irradiation conditions could be explained by the soiling, smoke plumes, and poor forecasting resultant from the Black Summer Bushfires. AEMO’s NEM Operations Review of the 2019-2020 Summer found that both large-scale and rooftop solar suffered from the effects of the widespread bushfires.

Some positive Q2 news for Neoen’s solar interests in Australia was however the confirmation that the French developer could begin building Australia’s largest solar farm. The 460 MW array in Queensland’s Western Downs is nearing the green light after securing a contract to sell most of its solar energy to the state government-owned renewable energy generator, CleanCo.

Throw in other massive pending projects such as the proposed Goyder South Project featuring 1200 MW of wind, 600 MW of solar, and 900 MW of battery storage. As well as Neoen’s partnership with Mondo Power already resulting in a planning application for a massive 600 MW battery storage project near Geelong in Victoria, and Neoen’s future in Australia, and Australia’s future with Neoen, looks bright indeed.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

5 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.