Sterling and Wilson has continued its rapid expansion in Australia. Having announced two new project wins, the company now boasts a 1.1 GW pipeline in the country.

The deals announced this week are for two projects are being developed by “global independent power producer[s] (IPPs)” the company revealed in a statement – although precisely which projects was not specified.

The two PV power plants have a combined capacity of 300 MW, with EPC contracts themselves worth $300 million.

“Our total order book in Australia now stands at about $1.2 billion with five projects and a portfolio of more than 1.1 GW,” said Bikesh Ogra, the global CEO of Sterling and Wilson’s solar business. He noted, in a statement, that high electricity tariffs in the country were driving large scale solar’s competitiveness in the country.

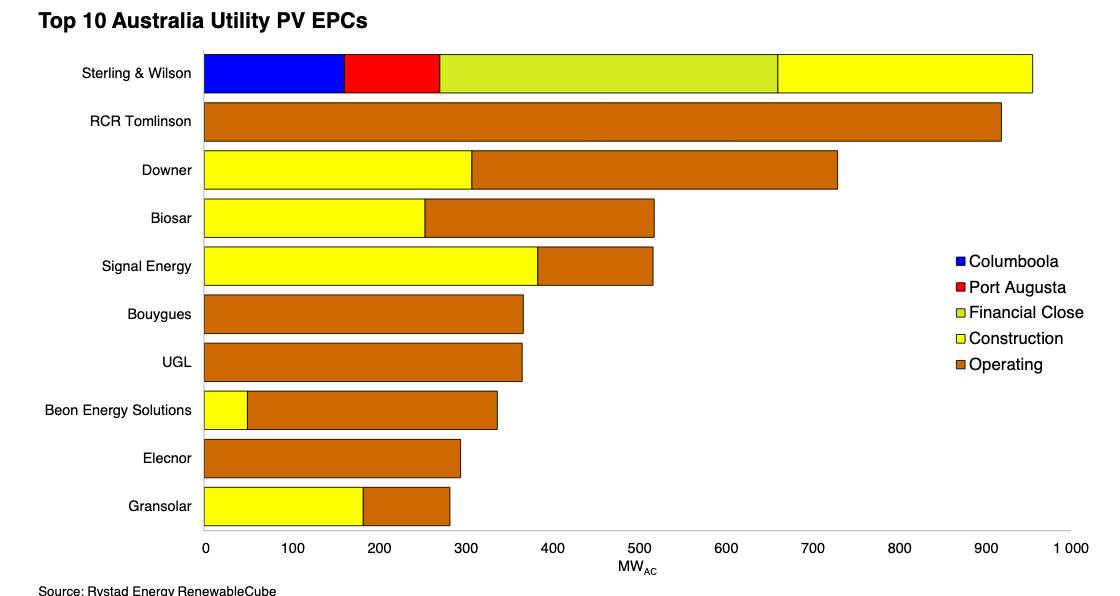

“Sterling and Wilson is now Australia’s largest utility PV EPC with the announcement of the two new projects totaling 300 MW – which are presumably MWdc,“ said Rystad Energy analyst Dave Dixon. “I can’t confirm it, but I assume that these projects are Columboola and Port Augusta, which takes Sterling and Wilson’s total Australia pipeline to 956 MWac, ahead of former number one RCR Tomlinson, which had a pipeline of 920 MWac when they went bankrupt in 2018.”

Graphic: Rystad Energy

The collapse of RCR in late 2018 appears to have rung in a period in which both local construction companies and internationally active solar EPCs have been attracted to Australia’s solar market only to find regulations, federal policy setting and grid constraints difficult.

Sydney-based Downer Group announced in February that it was exiting solar, citing declining investment volumes and network constraints making the solar EPC business in Australia unattractive in the short to mid-term. And it is far from alone, given that EPCs can end up bearing the costs of grid connection delays, as projects take months and even years to achieve full commissioning, obtaining Generator Performance Standards.

Despite the challenges, Sterling and Wilson appears ready and willing to fill the void left by others. “Our vision for the market is to maintain our leadership position in the EPC segment and contribute to the country’s mission of clean energy,” added Ogra.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.