From pv magazine 10/2020

A Renewable Energy Zone (REZ), as envisaged in the Australian Energy Market Operator’s (AEMO) Integrated System Plan (ISP), is a geographical area combining solar and wind resources, backed by a strong grid connection, or the potential for strategic network augmentation. A REZ would be co-located with energy-intensive industries, on land to host energy generation and storage. Critically, it would invite manufacturers to tap into its supply of low-cost electricity. REZs represent a golden opportunity for renewable generation to become central to regional economies, creating ongoing skilled jobs beyond initial infrastructure build, while providing renewables developers with guaranteed connection, the stabilising influence of energy storage, and long-term offtakers.

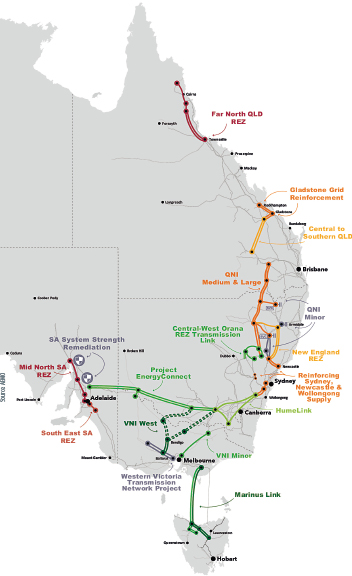

AEMO’s 2020 ISP confirmed 35 such zones throughout the five states served by the National Electricity Market (NEM). Recognising that REZs need to integrate with the new or upgraded transmission, it proposed phasing their development. The Central-West Orana REZ in New South Wales (NSW), for example, would coordinate with the development of the Central-West Orana Transmission Link and reach completion in 2024-25.

In May of this year, the NSW government became the first state to get the REZ ball rolling by urging developers to register their interest in the proposed 3 GW Central-West Orana REZ. It was bowled over by the response, as it received 27 GW of bids, or AUD 38 billion ($27 billion) in proposed investments. It quadrupled its original funding target to aid development of the REZ. Shortly afterward, it sought to soak up investor enthusiasm by announcing the 8 GW New England REZ in the northern part of the state.

“Renewable Energy Zones are modern-day power stations which will provide the state with the clean, cheap electricity needed to take advantage of green-powered opportunities identified by the state’s chief scientist,” said NSW Energy and Environment Minister Matt Kean in September, shortly after earmarking almost AUD 110 million to smooth the path to development of the two zones.

The devil is in the smoothing, said Simon Corbell, former Australian Capital Territory deputy chief minister and energy minister. He was appointed on Sept. 3 as the chair of the 25-member Clean Energy Investor Group (CEIG), which has a combined Australian development pipeline in excess of 10 GW. The chairperson’s role was made permanent to establish a central role for investors in shaping energy market reforms.

Corbell told pv magazine that it depends on how REZs are built, and particularly on how transmission infrastructure is delivered, or whether the zones can boost the confidence of renewable energy investors. “Without a clear mechanism to drive timely transmission capacity augmentation and distribution augmentation in REZs, they will really make no difference at all. We’ll continue to see piecemeal, almost ad hoc build-out of capacity on a project by project basis,” he said.

Market design

The real problems with transmission in Australia have not necessarily been that it’s built for a centralised, fossil-fuel-generator era, but that the rules governing augmentation and access have rigidly stood in the way of timely change that could keep pace with renewables development in regional areas.

The real problems with transmission in Australia have not necessarily been that it’s built for a centralised, fossil-fuel-generator era, but that the rules governing augmentation and access have rigidly stood in the way of timely change that could keep pace with renewables development in regional areas.

“We need a clear market-design process,” said Corbell. Proposed rule-changes to the Regulatory Investment Test for Transmission (RIT-T) and Distribution (RIT-D) “are very welcome,” he added. But proposals for grid-access reform “present significant challenges for investors, as they “don’t necessarily increase certainty in terms of the development of REZs and the opportunity that REZs would otherwise present.”

The changes proposed via the Australian Energy Market Commission after modelling carried out by NERA Economic Consulting would see generators paid for the value of supplying electricity from their location, rather than a common price for each region. During times of high solar or wind output to the grid, it would result in lower payments, thereby discouraging generators from congregating in high-resource areas, but potentially incentivising the co-location of energy storage technologies. It is proposed that such locational marginal pricing (LMP) would be offset by enabling power generators to buy financial transmission rights in advance.

The CEIG made submissions after the announcement of the two proposed changes, saying that they were overly complex and “would not address long-term investment uncertainty,” that they would “increase the cost of capital for future generation and storage investment, and reduce competition through increased barriers to entry.” Moreover, it said, the reforms would also potentially increase the volatility of marginal loss factors (MLFs) that already present a significant challenge to realising investment returns on large-scale solar and wind developments in Australia.

Kean said that in its plan for REZ development, “the New South Wales government will offer generation and storage projects via a competitive process, with the ability to buy access rights to a shared transmission network.” He added that this would “streamline planning approvals” to attract investment in new or upgraded transmission infrastructure.

Although NSW has led with its REZ proposals, Queensland upped the ante on potential investability in August when it announced three proposed QREZs (expansions or groups of AEMO-identified zones), along with AUD 145 million of funding to create the zones. It also set aside a AUD 500 million Renewable Energy Fund, or half of Queensland’s billion dollar Covid-19 recovery boost, which will allow state-owned energy corporations to invest in commercial renewable energy projects and infrastructure.

Queensland has been lagging on infrastructure that would meet its admirable commitment to become 50% powered by renewables by 2030. The Queensland Department of Natural Resources, Mines and Energy says that the state needs to attract between 3.5 GW and 5 GW of renewable generation to meet the 2030 target. It claims it is on the path to net-zero emissions by 2050, when a lot of renewables are expected to enter the system.

The Northern QREZ encompasses five AEMO-identified REZs, adding up to a combined potential output of 7.9 GW. It is intended to supply regional industries, from new-economy minerals extraction to food processing and hydrogen production. The Southern QREZ incorporates the AEMO-identified Darling Downs REZ, and has the potential to accommodate almost 4 GW of renewables. It will supply the existing agricultural, resource, and mining sectors. The 4.2 GW Central QREZ incorporates AEMO’s Fitzroy and Wide Bay REZs. Corbell said it has the potential to meet the port of Gladstone’s heavy industrial load, which includes an aluminum smelter and cement manufacturing, when the 1.68 GW Gladstone Power Station finally reaches retirement age in 2035.

As yet, there is no timeline attached to Queensland’s REZ development, and Corbell said that the state has taken a “very strong leadership position” around REZs. However, he added that it needs “meat on the bones of how they’re going to deliver.”

The conceptual commitment to accelerating REZ development is welcome. “We have a commitment for some grant funding to assist with what would appear to largely be bringing forward detailed design of transmission upgrades that are required for certain REZ developments,” Corbell said. “There is no relative priority between different REZ areas.” He added that there’s little clarity around whether there will be streamlining of statutory approvals to drive outcomes. Investors should ask what the vehicle will be to drive REZ development in Queensland, and whether the coordinator-general will be appointed to the task, or whether it will come under the state’s priority projects.

In NSW, where the government has promised that the Central-West Orana REZ will be shovel-ready by 2022, Kean told pv magazine that the state “will repurpose the Energy Corporation of NSW to coordinate REZ delivery.” Corbell agrees that could be an effective progress-driving mechanism, but the CEIG “strongly suggests” that the Energy Corporation needs to become a permanent statutory entity, with an ongoing statutory mandate to pursue REZ development. “It can’t just be a policy setting inside a government department because that’s too easy to change,” he said.

Baringa Partners, meanwhile, is conducting an ARENA-sponsored study on the technical, commercial, and regulatory challenges of developing REZs in the NEM. “Network augmentations are the most effective standalone solution to developing the REZs,” it concluded. However, it found that in the near term, unlocking the new connection headroom for 3 GW of renewable development planned for the Central-West Orana REZ, could require a number of other technology solutions. “Coordinated synchronous condensers, synchronous static series compensators and coordinated batteries with grid-following inverters were found to be cost-competitive in terms of dollars per additional kW of capacity unlocked,” the study said.

It is unclear which parties will bear the cost of such solutions. “We really don’t know,” said Corbell. “The key is to design REZs with a clear market and regulatory framework, which is understood in advance. We’re always interested in a discussion about the best technical solutions – investors support a reliable system – but it’s most important to understand what the technical requirements are before the investment is made.”

Otherwise, he says, developers will face the same grid challenges they’ve had to contend with in recent years, with net impact on revenues caused by issues such as marginal loss factors, and additional capital requirements required to achieve connection. “We are very optimistic about the long-term opportunity,” said Corbell. “But let’s get on with the detailed process of REZ design and make sure that the concerns of people who are going to deliver the capital are understood.”

| Planned REZ projects 2020-40 | ||

| Classification | Project | Indicative timing |

| Committed | SA System Strength Remediation | 2021-22 |

| QNI Minor | 2021-22 | |

| Western Victoria Transmission Network | ||

| Actionable1 | VNI Minor | 2022-23 |

| Project EnergyConnect | 2024-25 | |

| HumeLink | 2025-26 | |

| Central-West Orana REZ Transmission Link | Mid-2020s | |

| VNI West² | 2027-28 | |

| Marinus Link²: | ||

| Cable 1 | 2028-29 to 2031-32 | |

| Cable 2 | 2031-32 to 2035-36 | |

| Preparatory activities required | QNI Medium & Large | 2030s |

| Central to Southern QLD | Early 2030s | |

| Reinforcing Sydney, Newcastle and Wollongong supply |

2026-27 to 2032-33 | |

| Gladstone grid reinforcement | 2030s | |

| New England REZ Network Expansion³ | 2030s | |

| North West NSW Network Expansion4 | 2030s | |

| Future ISP projects |

Far North QLD REZ | 2030s |

| South East SA REZ | 2030s | |

| Mid North SA REZ | 2030s | |

| Notes: 1. Estimated practical completion including any subsequent testing – projects may be delivered earlier; 2. Decision rules may affect timing; 3. May be accelerated by government initiatives; 4. Not shown on map. AEMO requires that preliminary engineering designs be completed by June 30, 2021.Source: AEMO | ||

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.