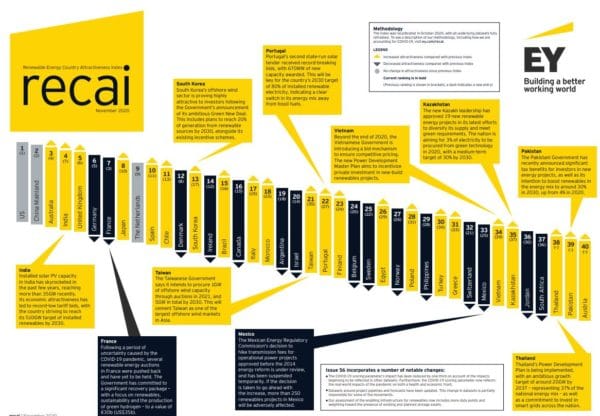

EY has elevated Australia to third place in the latest edition of its biannual Renewable Energy Country Attractiveness Index (RECAI) which ranks the top 40 nations on their renewable energy investment and deployment opportunities.

The United States continues to lead the way with China second but Australia has climbed into third place despite investment in large-scale renewable energy projects earlier this year slumping to its lowest level since 2017 in the wake of the COVID-19 pandemic.

The Clean Energy Council (CEC) said $600m was invested in large-scale renewable projects in the second quarter this year, a drop of almost half from the previous quarter.

EY however said there is a renewed sense of optimism in Australia’s renewable energy sector and it is well positioned to take advantage of what it described as a “global surge of interest” in green hydrogen.

The report identified that green hydrogen presents a sustainable way to create and store zero-emission energy for use throughout the decarbonised economies of the future and is of particular interest for countries with limited potential for their own renewable generation capacity.

EY’s infrastructure advisory director, Jomo Owusu, said Australia has already made moves to exploit the predicted demand with developers and investors driving growth in the renewables sector while the market has ambitious green energy export plans.

Screenshot by DC ion 27.11.2020 from https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/power-and-utilities/ey-recai-56-country-index.pdf

The Council of Australian Governments (COAG) Energy Council has estimated the potential value of the nation’s hydrogen export industry could reach $26 billion by 2050, transforming the nation into a major force in renewable energy.

Owusu said while Australia has long been a net exporter of energy, coal and gas have historically dominated production but the country is now looking to transform its energy exports as it transitions to a low-carbon future.

Owusu said federal and state governments have demonstrated their intent at a policy level by backing renewable hydrogen pilot programs and trials and helping to fast-track projects like the 15 GW Asian Renewable Energy Hub (AERH).

The ambitious project in Western Australia’s Pilbara region is on track to be the world’s largest wind-solar hybrid project, with the renewable energy generated used to produce green hydrogen and ammonia for export to Asian markets.

The AERH is one of two “mega-projects” highlighted by Owusu in an article written in conjunction with the RECAI.

He also singled out Sun Cable’s 10 GW solar/battery project which aims to send renewable electricity to Singapore via a 4,500km cable. While the project is still to be signed off by Singapore’s government, plans include the world’s largest solar array, biggest battery and longest power cable, providing 3 GW of dispatchable electricity. Just as importantly, the high-voltage, direct-current cable would connect Australia to the planned 16-nation ASEAN power grid.

“The two mega-projects would elevate Australia to a renewable energy export superpower,” Owusu said.

Betting on big battery storage

The report also highlighted Australia’s energy storage market, describing it as a “promising” sign with regulators and grid operators recognising the important role storage needs to play to allow the smooth shift to renewable energy.

“This year, Australia is set to add 1.2 GW of energy storage, more than double last year’s total … as developers look to maximise returns from their wind and solar projects,” Owusu said.

Owusu predicted the expansion of battery storage would had flow-on effects with power prices likely to drop.

“The costs of energy storage systems are expected to decline by 27% over the next five years,” he said.

“By 2025, the levelised cost of electricity of solar-plus-storage and solar-and-wind-plus-storage are expected to be lower than that of gas plants, which should mark a tipping point for Australia’s renewables sector.”

Grid stability still an issue

The report did however warn that problems around price volatility and grid stability could “cloud the picture” for renewables.

CEC chief executive Kane Thornton earlier this year said investments in the electricity transmission network had not kept pace with the rapid deployment of wind and solar farms. He said underinvestment in the energy network was creating congestion and causing delays in projects being connected.

Owusu agreed, saying while developers and investors are driving renewed growth, the sector is “facing headwinds on grid stability and price volatility”.

“Renewables projects have been held back by grid bottlenecks and have faced the risk of radical curtailment because of insufficient network capacity and system strength.”

Despite the concerns, Owusu said “the future should shine bright for Australia’s renewables sector”.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.