Wood Mackenzie (WoodMac) has called on the Australian Government to implement a much more ambitious Renewable Energy Target (RET), arguing Australia needs a revised RET to unlock US$40 billion in opportunities in the energy sector.

Rishab Shrestha, a senior analyst at WoodMac, said “Australia does not have a federal long-term national power mix target like many other countries. The RET scheme, alongside government funding, have led to the renewables boom over the last few years. Hardware cost declines have continued to be a precursor for growth. But the grid has been pushed to its limit making future renewable cash flows difficult to ascertain and stifling growth.”

According to the Clean Energy Council (CEC), the RET is a Federal policy to “designed to ensure that at least 33,000 GWh of Australia’s electricity comes from renewable sources by 2020. It is composed of two components, the large-scale Renewable Energy Target (LRET), and the small-scale Renewable Energy Scheme (SRES).

The LRET’s 2020 targets were met as early as September 2019, though the Government is still issuing large-scale generation certificates (LGCs) created by large-scale generators and sold to large-scale users. Meanwhile, the SRES, which expires in 2030, continues to provide financial incentives (thought subsidy is continuously decreasing) for individuals, households and businesses to install small-scale systems such as rooftop solar. According to the CEC: “As more renewable energy is produced beyond the 33,000 GWh target, the number of LGCs generated will continue to increase, leading to an oversupply in the market that will significantly reduce their value.”

Shrestha is similarly concerned, and believes the key to unlocking the enormous investment opportunity an expanded RET would attract is to invest strongly in grid flexibility now. “There is definitely room to achieve more renewables penetration with a more ambitious target for the RET scheme, but the potential needs to be unlocked through grid flexibility investments. A coordinated federal push would be effective.”

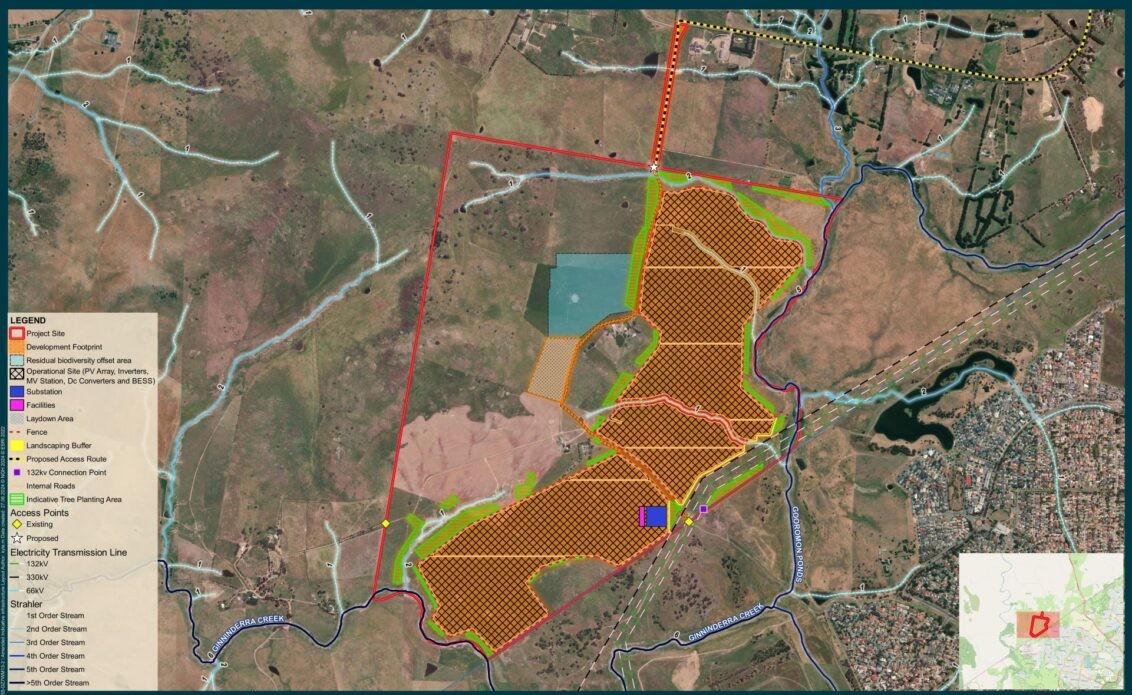

Image: Wood Mackenzie

WoodMac thus argues that we are at a pivotal juncture in the energy transition. Either we invest ambitiously in grid flexibility to all more renewables to come online, or tomorrow when the coal-fired power stations retire we’ll be left with a whole lot of stranded assets.

“Coal retirements will be challenging due to its important role in providing low-cost baseload power,” continued Shrestha, “Over 40% or around 10 GW of the existing coal fleet in the National Electricity Market (NEM) is expected to retire over the next two decades. But realistically, we think significant retirement of coal capacity will only start from the early 2030s.”

By 2030, WoodMac predicts coal’s primacy in the generation mix will fall from 55% to 47%, with gas contributing 10%. The Australian Energy Market Operator (AEMO) disagrees with this expectation of gas, saying that it is all hot air and that gas will only contribute a 1% share of the generation mix in 2030.

Shrestha suggests AEMO’s Integrated System Plan (ISP), which sets out gas’s 1% stake, would “remove critical balancing capacity from the grid system and make renewables integration more challenging.”

However, is big battery storage projects come online throughout the next decade at the same rate at which they are being announced, the utility of gas would be significantly diminished. Nevertheless, gas would remain in the NEM “to provide multi-day or even multi-month backup. In the event of a large plant or transmission line outage, a system relying heavily on renewables and storage looks fragile. More storage is needed, but it will not solve all the problems which are causing a slow-down in wind and solar investments in Australia.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I can understand the desire to incentivise more renewable development – however, as explored in the GSD2018, the form of incentive in the RET (and more recently in state-based renewable targets) seems to be having unintended, and adverse, consequences.

Some discussion at:

https://wattclarity.com.au/articles/2020/03/villainno7-is-killing-with-kindness/