From pv magazine ISSUE 04 – 2021.

InterContinental Energy (ICE) is one of the four consortium partners looking to develop the Asian Renewable Energy Hub in Western Australia. The plans are to produce 1.75 million tons of green hydrogen a year from mega-scale wind and solar projects. Your plan is to transport the energy as green ammonia to offtaker markets in North Asia – is that right?

This is a fascinating topic: If you imagine in your mind a Venn diagram of hydrogen and ammonia, you have the circle where the end-user wants ammonia, a circle where the end-user wants hydrogen, and a middle circle where the end-user is indifferent – they want whatever they can get at the cheapest price. When it comes to price of course transportation is a real factor, as is the conversion of hydrogen into ammonia and its reconversion.

Let’s start with the easiest bit, which is people who need ammonia. There is no question that the producer, ourselves, is going to take their green electricity, turn it into hydrogen and then turn the hydrogen into green ammonia. Then it is going to ship the green ammonia by standard ammonia shipping methods to the end user.

Then there is the middle part of the Venn diagram which, in simple terms, is people who want heat. Whether you burn ammonia or hydrogen, in both cases you get heat. One of the first applications then could be co-firing in coal-fired power stations.

Is this Japan’s long-term strategy?

Yes, exactly. This is the unequivocal roadmap of the Japanese power sector that has been very publicly committed to. So, let’s take Japan as an example. Say they start at 20% green ammonia, right off the bat that’s 20% less pollution. As this percentage grows steadily, it buys a lot of time to transition the energy system because if you got rid of the coal-fired power stations immediately you would have to replace them with something else. You would have to physically build whatever that is, and of course there is no appetite for nuclear. Green ammonia is a good transition for Japan and will be 100% green ammonia in time.

And the people who just want hydrogen?

These are by and large the fuel-cell people. If you’re trying to run a heavy-goods vehicle, you definitely want hydrogen, and you will then decide whether you get hydrogen directly or import ammonia and crack it back. The difference is solely cost. The way all the technology works now, if you have to import by ship ammonia is cheaper.

The cost of converting hydrogen to ammonia and then reconverting it is still cheaper than shipping liquid hydrogen, because that is just so energy-intensive and expensive. Hydrogen is also much harder to store than ammonia and so it is just easier to use ammonia as a vector. Now, if your hydrogen is domestic, terrestrial, and within reasonable distance, pipelines are probably the cheapest option, but it’s highly dependent [on geography].

So, at the moment, the ammonia people are getting ammonia, the indifferent people are also mostly getting ammonia, and the people who want hydrogen will first look for the cheapest domestic hydrogen sources and once they run out, which they will, their next move is to buy the cheapest ammonia that they can and crack it back. The main reason being that the major demand centres of Europe and north Asia don’t have the domestic resources.

ICE’s approach to the Asian Renewable Energy Hub (AREH) and all its planned megaprojects is basically a modular approach, correct? You can roll out your template wherever the suit fits?

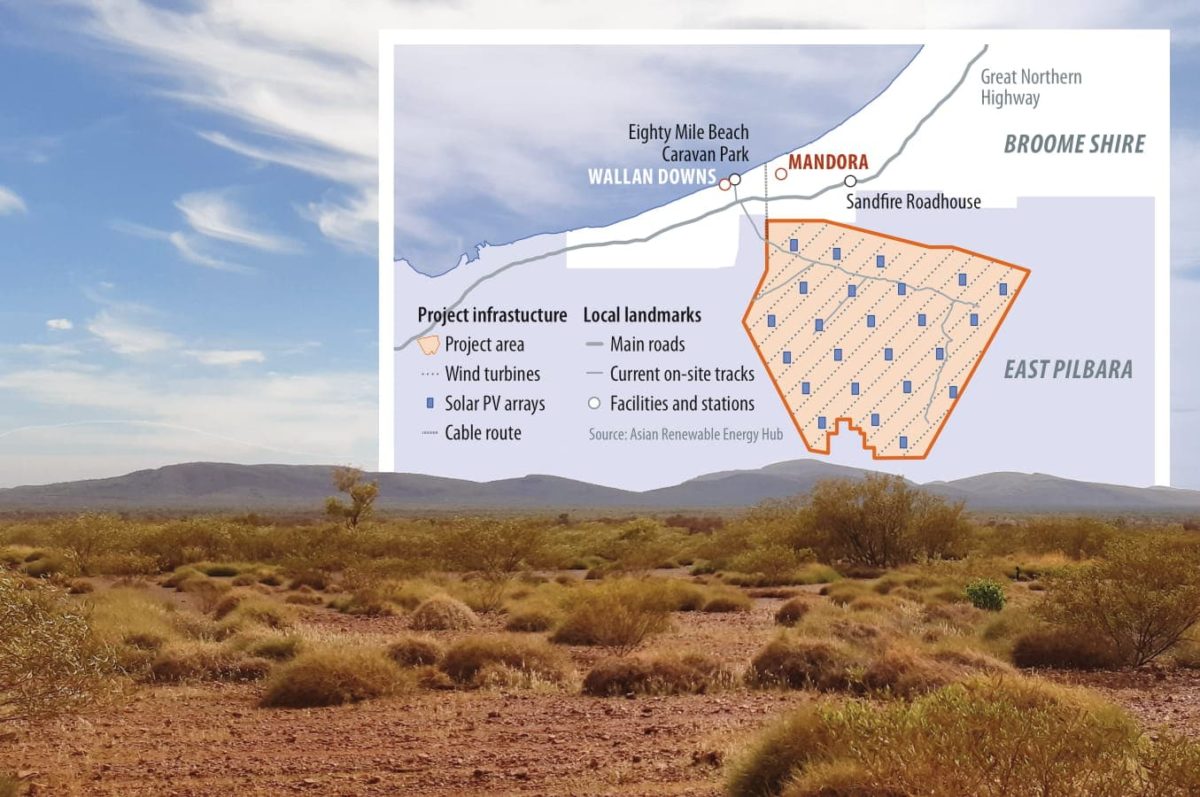

Yes, our projects are templates, but within the project it is modular and that is how all the rollout works. One of the things that seems intimidating about, say, AREH, is how you are going to build 26 GW with all the potential delays and contingencies of a mega-project.

Of course, in some ways it is a megaproject, but it is really a dozen large-scale projects on the same site. For example, on the solar side, it’s not really a 10 GW solar park, it is ten to twenty 500 MW-1 GW projects that happen to be on the same site and leverage some of the same infrastructure and planning.

It’s interesting that you’re also planning a project in the Middle East, considering that countries such as Saudi Arabia are already planning to compete with Australia for green ammonia exports to Asia. Is there a possibility that your projects will be competing against each other?

Yes, that’s a very good question. But look, there is so much demand. If you look at the shipping sector alone, our estimates via third-party consultants are that the shipping sector will require 660 million tons a year of green ammonia if it uses green ammonia to serve all of its decarbonisation needs.

That’s an enormous number for one sector, considering that the worldwide market for ammonia as fertiliser is currently around 200 million tons annually. I guess that allows you to be really ambitious in terms of the number of projects, right?

Exactly. So that is demand of 66 AREH projects. And given how long it takes to build a project, permit a project, fund a project, the amount of money you need to invest etc., we’re not worried about excess supply. This is partly because the world needs these solutions and the whole world needs them at the same time.

Often when you have these types of transitions there is a lead country that takes up all the supply and other nations sort of hold back, but that is not what is happening this time. Everyone has agreed something needs to be done. So, there is a lot of demand and not that many choices, and even fewer choices that can be produced at scale.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.