From Jake Dunstan, analyst at Cornwall Insight Australia.

As a reminder, the current settlement price (SP) is determined by averaging six dispatch interval prices within a half-hour period. From October 2021, the dispatch price (DP) will be the settlement price. While the NEM already dispatches on a 5-minute basis, there is no certainty as to how (if at all) price outcomes and the operation of NEM participants will change under the new rules.

Under 5MS, one-off price spikes (and floors) which could have been averaged out in 30 min settlement would now be fully costed. Put differently, there is no opportunity to use the power of averaging to alter settlement in the 5MS world – bids will need to more accurately reflect a participant’s willingness to supply.

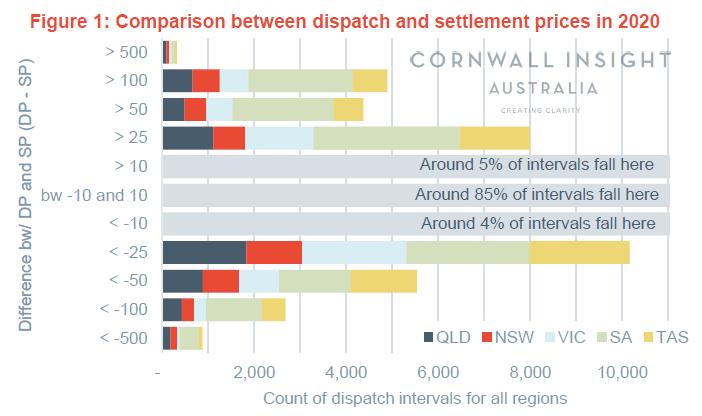

History may not be the best predictor of 5MS impacts, since current behaviours align with the current settlement process, however it does highlight edge cases and scenarios which may results in a material difference in outcomes post October 2021 (Figure 1, above).

It’s important to note that in ~85% of dispatch intervals in 2020, the two pricing methodologies are similar. However, in 15% of intervals there is a difference of at least $10/MWh between the two prices (3% where diff. > $50). While small in proportion, this still accounts for ~5,000 dispatch intervals where DP is at least $100 higher than SP. The opposite is also true where ~3,500 dispatch intervals had DP is at least $100 less than SP.

Some of these discrepancies may be legacy artefacts of the current settlement methodology, however it is likely that the current dynamics observed in dispatch continue which could be material given the potential for significant financial impacts when the price deviates in either extreme – note that as the generation mix increases in intermittency so too does the potential for significant swings in price outcomes in the 5MS world. Therefore, there is an increasing importance for effective hedging tools/ strategies/ products to avoid significant financial impacts of unforeseen price events – however time will tell which methods, strategies or technologies will rise to the top in mitigating the risk.

One product is the 5-minute cap product which the ASX recently listed. After the first month there has been some decent volume traded. Open interest is over 1,200 at time of writing with most volumes traded in QLD and VIC. Focusing on Q122, while a long way away, early trading would suggest an expectation of increased volatility with cap products trading between $15.15 (in QLD) and $22.50 (in VIC). For context, under 5MS a single period at the Market Price Cap (MPC) will contribute ~50c to cap product value. which would indicate expectations of around 30-40 intervals at the MPC. As we approach go-live, the potential impacts of 5MS will become clearer however, it’s very likely that the first year of 5MS will see conservative operations while participants adjust their strategies to the new paradigm.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.