From

The solar boom in Vietnam surprised many in 2019 and 2020, and though installations in the country are set to drop off this year, there is still plenty happening there and elsewhere in Southeast Asian solar. The following five trends offer a snapshot of current trends in the region.

Vietnam’s timeout

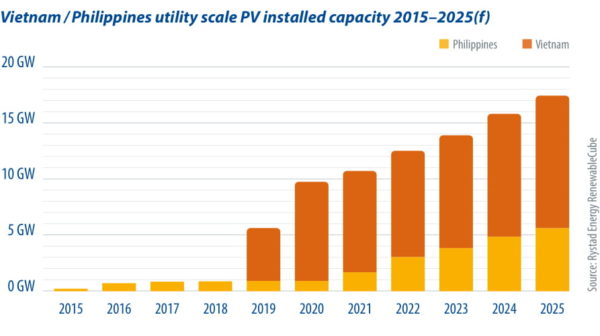

The feed-in-tariff policy for solar PV in Vietnam over the past few years has been extremely successful. From almost no installed PV capacity in the country back in 2017, Vietnam now has 9 GW of utility solar in its power mix. The growth created a new investment market for regional players from Thailand and the Philippines, and helped major local corporations such as Trung Nam Group and TTC Group to enter renewables.

However, the boom comes with drawbacks. Multiple developers have been hit by strong curtailment, as assets have been concentrated into weak areas of the grid. Vietnam is also switching to a reverse auction mechanism for PV this year. As a result, installed capacity in 2021 is expected to drop to below 400 MW, almost a 10-fold decrease year-on-year. Furthermore, the drafted Power Development Plan VIII (PDP VIII) looks to squeeze solar development further and add only a maximum of 4 GW by 2030. The plan instead aims to attribute most of the future renewable energy installations to wind power.

Nevertheless, with a pipeline of 27 GW of utility PV, developers are still showing a lot of interest in the technology. Plans for a corporate power purchase agreement (PPA) segment will also open up further value streams for solar PV development in the country. Vietnam has a history of surpassing its own targets and, amid the results of its reverse auctions, the attractiveness of solar PV could increase compared to coal, which has experienced delays, despite the strong growth planned under PDP VIII.

Philippines revival

After implementing a renewable portfolio standard (RPS) in 2020, the Philippines experienced a revival in its renewables sector. Solar in particular saw a boost, and in 2021 more than 300 MW is expected to be constructed, including large-scale plants from AC Energy at Arayat and Palauig.

To further assist the RPS and ensure the growth of renewable energy, the country will introduce a renewable energy market platform and gigawatt-scale green energy auctions from the second quarter of this year. These mechanisms were due to be implemented in June 2020, but were delayed due to the Covid-19 pandemic.

While initially set at 1%, RPS requirements for utilities are expected to be increased to 2.5%, meaning the share of renewables in companies’ power-generation portfolios will have to increase. This is expected to support the country’s goal of having renewable energy account for 35% of the power mix. The solar PV market in the Philippines reacted accordingly, with the pipeline now sitting at more than 12 GW of projects in early stages of development.

The past year has witnessed multiple gigawatt-size ambitions from Solar Philippines, including a 1.2 GW plan in Batangas, and the 2 GW PV plus 6 GW of storage development nearby, as well as multiple project acquisitions from AC Energy, further establishing the market.

Indonesian hopes

Myanmar’s relatively successful 2020 has been derailed in 2021 by the recent coup. While a successful 1 GW solar PV capacity auction saw projects commence last year, there are serious market doubts in the near term.

Indonesia, meanwhile, despite huge energy demand and population, has not been able to kick-start its solar industry. However, 2021 may be a turning point for renewables with the potential release of a new FIT policy and a new renewable energy law.

The FIT could help renewable energy developments secure a fixed price set by the central government, rather than negotiating one with PLN, the country’s utility company. The fixed price can come in a tiered setup, with a higher price for the first 12 years, before reverting to lower remuneration for the rest of a plant’s life. In tandem, the renewable energy law could help streamline the process for project developers. Currently, the first 50 MW phase of the 145 MW floating PV Cirata project is under development, while Tsingshan Holding is planning a 2 GW wind and solar facility to power its nickel -producing business.

New norm

Last year was a turning point for the scale of renewable energy projects around the world, with most of those commissioned and under construction hitting above 50 MW. Asia also saw this expansion. Starting this year, around 83% of solar PV projects to be commissioned are expected to be above 100 MW, compared to just 68% in 2020 and 32% in 2019. Last year, in Vietnam, Trungnam’s 450 MW solar PV plant and Xuan Thien’s 600 MW development were commissioned. In 2021, anticipated big developments include the 120 MW Alaminos solar PV project in the Philippines and the 145 MW Cirata floating PV in Indonesia.

Southeast Asia can greatly benefit from the global cost reductions associated with bigger developments and improvements in technology, in particular, related to the power and efficiency of solar PV modules. It is important that governments understand this trend and that solar farms are no longer seen as small-scale developments. With lower costs, scale, and better technology, countries will not necessarily have to offer significant incentives for the energy transition.

International majors

As the energy transition ramps up across the world, European energy majors are announcing aggressive green targets. Asia and Southeast Asia, in particular, are important regions, given the huge growth in installed renewable energy expected over the next few years.

We have seen several majors branching into Asian regions looking to expand portfolios. While the headlines were grabbed by large-scale offshore wind developments, solar PV is a key energy source for companies, especially thanks to subsidies.

Total Eren and Quadran, for instance, have established solar projects in the Philippines and Vietnam. Norwegian player Equinor ventured into PV through its stake in Scatec, which has been successful in Malaysia with four large-scale utility PV plants, and is currently working on a gigawatt-scale pipeline in Vietnam. This will be a key trend to watch moving forward, as European utilities and E&P majors continue to explore opportunities in the region.

Minh K Le

About the author: Minh K Le is part of the renewable energy research and analytics team at Rystad Energy. As a senior analyst, he currently leads the company’s green hydrogen research, as well as renewable energy research for APAC. Le completed his PhD research in mechanical engineering at the University of New South Wales and has authored articles and papers in highly regarded, international peer-reviewed journals, covering topics ranging from fundamental scientific research to industrial engineering applications. He spent a few years working in academic and industrial R&D before joining Rystad Energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.