From pv magazine 06/2021

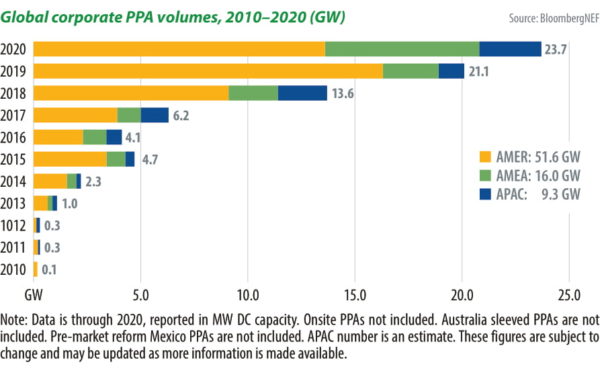

The market for corporate clean energy purchases – primarily solar and wind – skyrocketed to a record 23.7 GW in 2020, according to BloombergNEF (BNEF). Development over the past year has been particularly impressive, given the effects of the Covid-19 pandemic and ensuing recessions. This underlines the increased appetite for sustainability in the business, consumer, and political realms with the falling costs of renewable electricity.

According to Kyle Harrison, BNEF senior associate, this upward trajectory continues in 2021. “Through April, companies have announced 7.2 GW of clean energy PPAs, ahead of the 4.2 GW signed in 2020,” he told pv magazine.

He said policy conditions in several markets are easing, providing companies with easy access to clean energy. “European markets like Spain, Italy, France, and Poland, which historically had no activity, have all become hot spots for clean energy buying for various reasons,” he explained. “In Asia, Taiwan officially liberalised its power market in 2020, opening up the option for PPAs and other procurement mechanisms. South Korea enacted similar changes at the end of 2020, and Japan is expected to be next. These changes will drive a significant amount of activity that previously has not existed.”

Tech goliaths

Since 2008, Apple, Google, Amazon, and others have led the charge in corporate procurement of renewables. Their action has meant the U.S. has been the world’s largest market since 2008, with 11.9 GW of corporate power purchase agreements (cPPAs) announced in 2020.

However, other markets are beginning to pick up the pace. In Brazil, corporations signed more than 1 GW of PPAs last year, while cPPA volumes in the Europe, Middle East, and Africa (EMEA) nearly tripled, from 2.6 GW in 2019 to a record 7.2 GW in 2020. The Asia-Pacific region also saw record volumes.

“More than ever before, corporations have access to affordable clean energy at a global scale,” said Jonas Rooze, lead sustainability analyst at BNEF, in their January 1H 2021 Corporate Energy Market Outlook. “Companies no longer have an excuse for falling behind on setting and working towards a clean energy target.”

Changing landscape

While the tech world is light years ahead in corporate renewable energy purchases, newcomers from industries like steel and heavy machinery are beginning to ramp up their clean energy commitments. This shift is noticeable in the recent uptick in global RE100 membership. Via the global initiative launched in 2014, 300 companies from more than 175 markets have now committed to buying 100% renewable electricity to power their operations.

In January, BNEF forecast that the 285 RE100 members (its figures were published before the 300-member milestone in April) will collectively need an additional 269 TWh of clean electricity by 2030 to meet their goals. If met with offsite PPAs alone, it would catalyse an estimated 93 GW of new solar and wind build.

“Investor interest in sustainability is sky high, with inflows to sustainability-focused funds growing 300% between 2019 and 2020,” said Harrison. “Companies in all sectors are feeling the pressure to purchase clean energy and decarbonise. This group is only scratching the surface of clean energy build it can catalyse.”

Critical role

RE-Source – an alliance of stakeholders representing clean energy buyers and suppliers established by the SolarPower Europe association, among others – notes that corporate procurement can play a critical role in the energy transition.

However, the key is removing regulatory and administrative barriers, providing clarity and certainty of long-term Guarantees of Origin (GOs) from contracted supplies, encouraging cross-border transactions, and enabling a variety of procurement models and products.

Another trend is the recognition of workers’ rights – a topic pv magazine’s UP Initiative addressed in the second quarter of this year. A new survey this May by LevelTen Energy, an online marketplace for PPAs, found that demand from corporate renewable energy buyers for improved environmental and social justice measures is growing – a development likely to have wide ranging consequences.

“According to the 2021 survey of 77 project developers on the LevelTen Marketplace, nearly seven out of 10 said they are working to improve organisational environmental and social justice practices as a direct result of buyer demand for additional measures.”

Meanwhile, SalesForce, a U.S. cloud-based tech company, published a white paper, “More Than a Megawatt: Embedding Social and Environmental Impact in the Renewable Energy Procurement Process,” last October. The aim was to highlight the need for a fast energy transition, and also one that is socially just.

In it, the authors state that buyers of renewable energy should align their request for proposals, bid review processes, and PPAs with worker expectations of Responsible Contractor Policies, as well as best practices of regulators and policymakers “who seek to ensure good local economic and workforce development for renewables projects.” They also note that “buyers, with their developer partners, can look for appropriate opportunities to make other business investments and create local jobs in communities disproportionately impacted by energy transition and environmental injustice.”

Business models

Historically, the leading business model for the corporate purchase of renewables were physical PPAs, although the virtual PPA market is now said to be the “fastest-growing” transaction structure, according to the Rocky Mountain Institute.

It defines a physical PPA as one where buyers own the electrons produced by a renewable energy project. “This transaction places responsibility on the buyer for monetising/selling the electrons, which is typically achieved by selling them into the wholesale electricity market. Depending on the contract structure, the buyer could also pay for transmission charges.” In comparison, for VPPAs, buyers don’t own and are not responsible for the physical electrons. Instead, it is “a financial transaction, exchanging a fixed-price cash flow for a variable-priced cash flow and renewable energy certificates.”

Those with enough capital and access to the wholesale power market can build renewable power plants for themselves. Amazon is a prime example. Not only is it the world’s largest clean energy buyer, having signed cPPAs for over 7.5 GW, it has also announced 206 renewable energy projects globally. They include 71 utility-scale wind and solar projects and 135 solar rooftop arrays on facilities worldwide.

Green energy can also be purchased via green certificates. Due to low costs, however – in Europe, a certificate costs less than €0.01/kW – they have little actual effect on the deployment of new capacity and thus, amount to greenwashing.

The growing storage industry is helping to create new business and investment models, and is starting to address the issue of residual energy. Due to their fluctuating nature, renewables cannot supply electricity 100% of the time. Thus, it is crucial to factor in overcapacity, which is currently expensive and not scalable, leading to the question of how they’re compensated.

In the third quarter, pv magazine’s UP Initiative will investigate the world of corporate renewable energy purchases, the evolving business model landscape, how issues like residual energy are being addressed, what political measures are still needed to grow the industry, and how greenwashing can be avoided.

Regarding the latter issue, EnergyTag, a non-profit initiative, said in May that it is working on a framework to improve transparency for clean energy purchases. “Current Energy Attribute Certificates – known as Guarantees of Origin (GOs) in Europe, Renewable Energy Certificates (RECs) in the U.S. and Renewable Energy Guarantees of Origin (REGOs) in the U.K. – are issued for each unit (MWh) of renewable electricity. Companies then purchase certificates to meet their annual demand. These schemes, designed over a decade ago, were developed to encourage the growth of renewables from a very low starting point and do not provide the temporal granularity necessary for reaching 24/7 carbon-free energy,” it said.

The idea is to add hourly timestamps to electricity when it is generated, so users will know where their power comes from. Currently six demonstration projects are underway in the U.S., Denmark, the Netherlands, Sweden, Norway, and Australia, while over 100 organisations are said to be backing the initiative, including Google, Microsoft, Vattenfall, Statkraft, and Engie.

We will be speaking to the main actors in the market, including experts at BNEF, RE-Source, the Renewable Energy Buyers Alliance, EnergyTag, and Energy Brainpool, a European energy market analyst focusing on energy trading. For more information or to get involved, contact up@pv-magazine.com.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.