From pv magazine 06/2021

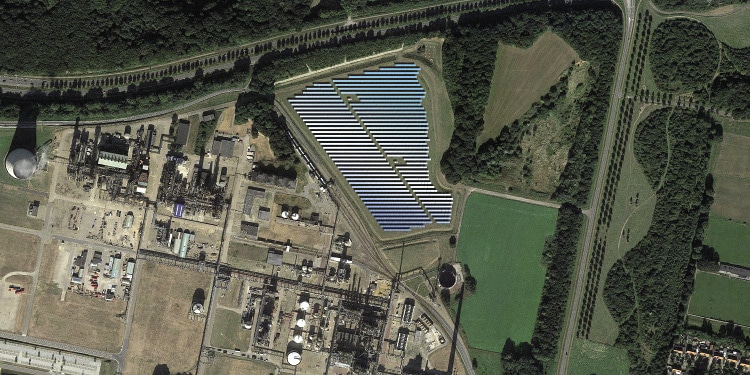

As with many industrial transitions, the emergence of solar PV was aided by government investment. This occurred first through R&D, and then the creation of a stable investment climate, as Germany did with the creation of the Energiewende (energy transition) over the last 15 years.

This gave manufacturers the chance to create scale, which is crucial for decreasing costs and increasing global accessibility and growth. When the engine of scale starts to run, a point of no return is created as acceptance and adoption grows.

Transitions are often exponential, both in price drops and in growth and acceptance. Remember the transition from horse and carriage to combustion engines, from landline phones to mobiles, from LP records to cassettes to CDs to online streaming, and so on.

From that perspective, it is fascinating to see how the International Energy Agency (IEA) has predicted, for over 10 years, a flat line of solar PV year after year. And although it has since updated its models, it still underestimates growth.

350 GW in 2030?

Last year, the EU presented goals for all member states and a forecast for installed PV capacity to 2030. EU countries were asked to share their expectations and ambitions for the growth of PV (and other renewable energy sources). When these expectations are met, the European solar market will triple. One year down the road, political goals are already underperforming when compared to the market.

The political ambitions and the policies in place per country are presented in the Dutch New Energy Research 2021 EU White Paper, which includes a foreword by Diederik Samsom, head of cabinet for European Commissioner Frans Timmermans, who leads the EU Green Deal.

“The Green Deal in December 2019 represents our vision for a just and sustainable future for everyone. Not just another environmental policy, but an overarching comprehensive investment plan to decarbonise our economy and become fully climate neutral in 2050,” said Samsom. “It is clear that solar PV will play a huge role in this transition. The commission’s own assessment shows an installed capacity of approximately 350 GW in 2030 and more than 1,000 GW in 2050. And I do not exclude the possibility that, yet again, reality will beat predictions.”

I fear, but mostly cheer, that Samsom is right about the possibility that reality will beat predictions. The EU predictions start in 2020, and for many countries we can already validate the political underestimation.

Underestimated growth

The Netherlands has been performing exceptionally well for a small country, showing annual double-digit growth numbers for a decade, except for 2014. The Netherlands has a successful residential, C&I, and utility market of more than 10 GW. In the Dutch government’s national climate and energy plan, the market was estimated to grow by 1.8 GW per year over the next decade. However, closer to 3 GW of new capacity was already installed in 2020, off by 67%. This shows the difficulty in assessing the enormous potential of the PV market, and not just in the Netherlands.

Other countries are struggling to value PV development for its true potential as well. For example, this has been the case in two other large markets in the EU, where ambitions for 2020 were outpaced by actual developments: Germany and Spain.

In Spain, the national tally was almost 4 GW installed in 2019, and then 3.2 GW in 2020. The market, in reality, shrunk by 19% compared to the year before. Yet the government estimated a decrease of the market by 47%, making the miss smaller than what was realised.

Similarly, Germany installed 4.88 GW in 2020, a growth rate of 24% compared to 2019, when 3.9 GW was installed. Meanwhile, the German federal government forecast a conservative 2.7 GW, which would have been a decrease of 29% from the previous year. In total, German estimates were off by 74%.

Fearless PV predictions

As shown by these three countries, market statistics and forecasts based on climate ambitions by governments remain a challenge. Especially in the midst of a tremendous energy transition, when markets are still, for the short term, influenced by changing policies. Having governments speak out for a stable long-term investment climate is crucial. A highly ambitious Green Deal on one side and unrealistic conservative estimates on the other lay bare the poor connection of politics with the market. And this unnecessarily undermines the transition.

Within two years of submission, the 10-year EU estimates have already proven to be outdated. Underestimation is central in transitions. Even with the urgency of the energy transition, seeing such estimates this far off remains astounding.

The EU projected a threefold increase for the PV market over the next 10 years. Taking both the context of Covid-19 and the historical gross underestimation of transitions, I predict tenfold growth of the EU PV market to be more realistic.

About the author

Rolf Heynen is the CEO of Dutch New Energy Research and the CTO of Solar Solutions International. The figures in this article were derived from DNE Research’s EU white paper and its upcoming European Solar Quarterly report, which contains quarterly installed capacity, distribution data, and forecasts per country. Heynen holds university degrees in electrical engineering and political science.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.