Researchers at Melbourne’s Monash University have unveiled a new open-source economic modelling tool which has projected continuing cost declines and deployment of solar PV will by the end of the decade allow for the production of green hydrogen by electrolysis for $2p/kg.

The Hydrogen Economic Fairways Tool (HEFT), developed by researchers from Monash University in collaboration with government agency Geoscience Australia, is a free online tool that assesses the economic viability of potential hydrogen operations across Australia.

Stuart Walsh, senior lecturer in Resources Engineering at Monash University, said the tool has the ability to conduct detailed geospatial-financial analysis of future large-scale hydrogen projects.

It assesses the quality of energy resources including wind, solar PV, concentrated solar power, steam methane reformation (SMR) with carbon capture and storage (CCS), and coal gasification with CCS, and also considers other associated costs including transportation, infrastructure and storage.

“It’s a tool we’ve developed in collaboration with Geoscience Australia to identify regions of potential development of new hydrogen projects,” Walsh told pv magazine.

“In particular we’re looking at those areas which are best suited for developing hydrogen projects from an economic perspective.”

The Australian government has committed to green hydrogen – generated by electrolysis powered by solar PV and wind energy – as a fuel for the future, formally recognising it as a ‘priority technology’ in the Technology Investment Roadmap announced late last year.

The government has set an economic ‘stretch goal’ to produce green hydrogen for $2p/kg. At that price green hydrogen is expected to be cost competitive with gas produced using fossil fuels.

Walsh said that modelling completed using the HEFT, using technology cost reduction forecasts provided by financial research company BloombergNEF, indicated that the goal is achievable.

“It’s definitely possible, especially over that 10-year timeframe,” he said.

“A lot can change over that period but if the Bloomberg numbers hold up, keeping in mind they are a bit optimistic, then our model predicts you can get to that $2 farm gate production target.”

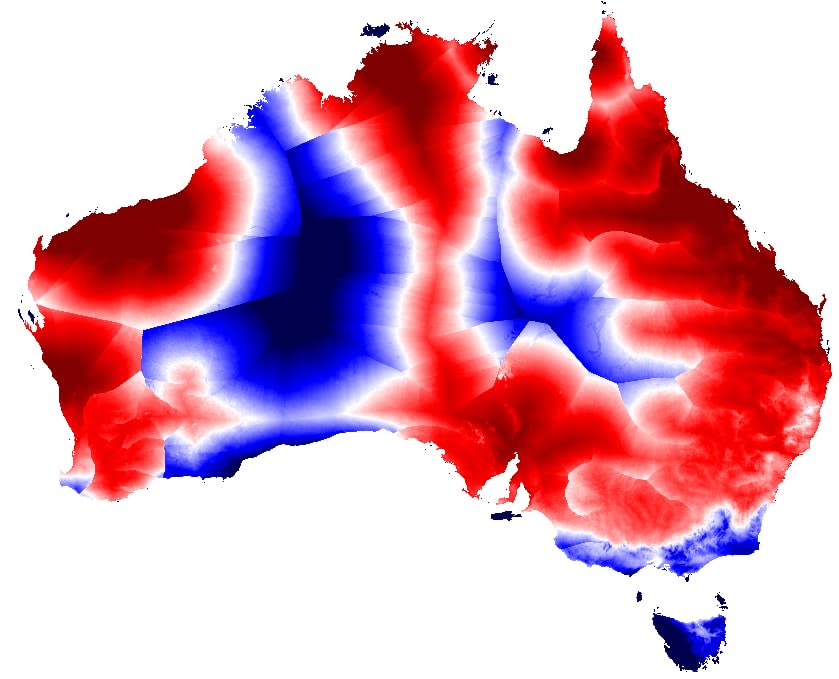

Image: Monash University

The HEFT modelling indicates off-grid hydrogen production using solar PV could be as low as $2p/kg by 2030. Adding water and delivery costs would lead to a hydrogen cost just below $3p/kg before shipping.

“The Bloomberg figures are generally accepted as being fairly optimistic estimates, but nevertheless they provide one baseline against which you can judge what the potential future cost will be to produce hydrogen in different places,” Walsh said, adding the speed of achieving the $2p/kg goal depends on many factors, including the momentum of technology adoption, costs of renewable generation facilities, the utilisation factor of the electrolyser, configurations of the hydrogen supply chain, and delivery of supporting infrastructure.

“We’ve seen even over the last couple of years the estimated price of what it costs to produce hydrogen has fallen quite dramatically and people are also predicting that it will continue to fall which is in line with those predictions,” he said.

“It’s just very hard to say at this point what those curves will look like into the future.

“The fact that there is uncertainty, I don’t want to give the impression that that necessarily is a bad thing it’s just that we don’t know. The prices are changing rapidly. They are changing for the better but what that will mean in the future is something that we will be waiting to see.”

The federal government is keen to capture a significant share of the growing global export demand for green hydrogen and state governments have also embraced the vision, announcing their goals and actions in support of the development of a hydrogen industry.

Walsh, who teamed with postdoctoral research associate Chanlong Wang and Geoscience Australia’s Laura Easton and Andrew Feitz on the HEFT project, said the tool could support decision making by policymakers and investors on the location of new infrastructure and development of hydrogen hubs in Australia.

“The Hydrogen Economic Fairways Tool is an online website and it allows anyone to jump on and work out different areas around Australia which are well suited for different types of hydrogen production,” he said.

“Originally it stemmed from a project we had with Geoscience Australia that was looking at economic potential of developing new mining projects and mineral developments.

“From that we developed a code called Bluecap and we realised quite early on that we could extend the codes we were running in Bluecap into other areas and one of the areas that we were particularly keen on looking at was hydrogen production and renewable resources.”

Image: Geoscience Australia

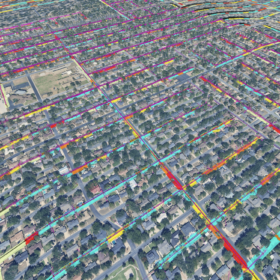

The HEFT is an open-source modelling tool, freely available via Geoscience Australia’s AusH2 portal. The software has been designed to be as flexible as possible and the modular design allows users to input their own assumptions and cost curves and run an analysis on those.

“In addition to that, we’ve also got the Bluecap code itself which is open-source software,” Walsh said.

“We recognise there are some calculations that are perhaps better done on your own machines, whether that be because of the size of the data involved or the type of calculations that you want to run so we’re making the engine that underlies the Hydrogen Economic Fairways Tool available for people download and play with themselves and try their own assumptions and own analyses as well.”

There are also plans to expand the tool’s capabilities with the aim to optimise the development of shared infrastructure to facilitate large-scale hydrogen production and delivery, attracting investment into Australia’s hydrogen industry.

Further inclusions of battery, hydro, pumped hydro energy storage, and delivery infrastructures will be added to the tool. Large-scale hydrogen storage will also be incorporated in future works.

While large-scale hydrogen production has not yet been implemented in Australia, there’s an increasing number of pilot, demonstration and small-scale projects in various development stages around the country.

Walsh expects the rollout of small-scale projects will provide a more concrete base on which to judge green hydrogen production costs and said the early signs are promising.

“We’ve seen some early data that is at least in line with some of the more optimistic estimates so once we see how the projects pan out, it will provide a lot more certainty around the cost estimates,” he said.

Project team member Chanlong Wang is due to present the Hydrogen Economic Fairways Tool at the Energy Next Exhibition in Sydney next month.

Originally scheduled to be staged at the International Convention Centre next week, the event has been pushed back to August 25-26 o Covid-19 restrictions.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I am surprised that any investor is thinking about this because the risk of not achieving the AUD or USD2/kg appears to be quite high and makes it look like this is not the most probable outcome but a best possible case if everything goes well. This is a bit frightening because I think I have seen a few projects saying they will start with fossil fuelled hydrogen and then convert to electrolysis as soon as electrolysis reaches $2 per kg. This might be never but they will have so much money invested in dirty hydrogen they will have to continue running their H2 plant. They would also be making so much money producing dirty hydrogen why would they bother switching? Coz they are good guys of course.

Of course this is planning on CCUS bringing the CO2 pollution down a lot and doing it very cheaply. How much of the generated hydrogen will have to be used for the CCUS part of the project? Its probably similar to CCUS with coal which is projected to add 40% to the running cost. CCUS has had billions thrown at it over a very long period of time. I think it could be considered a mature technology by now and very unlikely to get much cheaper.

This looks like it could result in many companies making dirty hydrogen as a pathway to a clean future.

We have to understand that the object of all the development is not to make CHEAP fuel but to make fuel that doesn’t pollute with any GHGs. If it comes to pass that the price of green hydrogen in 2030 is still USD6/kg then the producers and the users have to live with this. There has to be a final date after which you either stop making any hydrogen or you make green hydrogen and sell it at the market price. Its like allowing tobacco companies to sell nicotine cigarettes because they can’t make a profit selling healthy cigarettes. Or soft drink companies to add 120mg of caffeine per can because no-one would ever pay so much profit margin if they sold healthy drinks. Perhaps the best analogy is asbestos if you think about it.

The health of the world depends on making many people use green hydrogen and if green hydrogen is too dear then they have to use something else that’s pollution free like batteries. NOT dirty hydrogen.

No one should be allowed to build a new dirty hydrogen plant under any circumstances.

Solar and wind cost reductions have been consistently underestimated for the past 20 years, as too have battery costs in the last 5. Most likely, (and hopefully), the same will happen with green hydrogen costs…

Solar and batteries are different in that they can be trialed and demonstrated in prototypes at low relatively low cost. Hydrogen producers want to charge into dirty hydrogen at a profitable $2 per kilogram on a promise that they will bring the cost of green hydrogen down over the next year? or 30 years? or just perhaps?

“Likely” and “hopefully” are not a good basis for progression when billions of dollars are to be spent on dirty hydrogen. If likely and hopefully dont work then what is the likelihood of any government saying “too bad mate you lost the bet and now have a billion dollars worth of scrap metal”? I would bet that $M10 in a brown paper bag under the table would get a 30 year extension on your “development pilot plant” with success forever just 5 or 10 years away. Look at the extreme optimism of fusion power or CCUS. A producer of hydrogen should be required to prove he can do it for $2 a kilogram before he is allowed to build an unstoppable dirty hydrogen plant.

There is no justification for regarding our politicians as guardians of the future.