The unprecedented Tokyo Olympic Games mean the world’s attention is focused on Japan, and The Land of the Rising Sun’s Ministry of Economy, Trade and Industry has taken the opportunity to revise its draft energy plan for 2030. The new plan sees an ambitious doubling of renewables and significant cuts to coal and gas. What is more, the draft plan also proposes the building of a hydrogen supply chain.

The move comes in response to pressure from U.S. President Joe Biden, the upcoming Glasgow climate change conference in November, and the International Energy Agency’s (IEA) “Japan 2021 Energy Policy Review”, published earlier this year, in which IEA Executive Director Fatih Birol described the challenge ahead of Japan as “considerable”, and warned that even if Japan met its 2030 climate goals (pre-revision) “a very significant reduction of greenhouse gas emissions post-2030 will be necessary if Japan is to realise its ambition of achieving carbon-neutrality by 2050.”

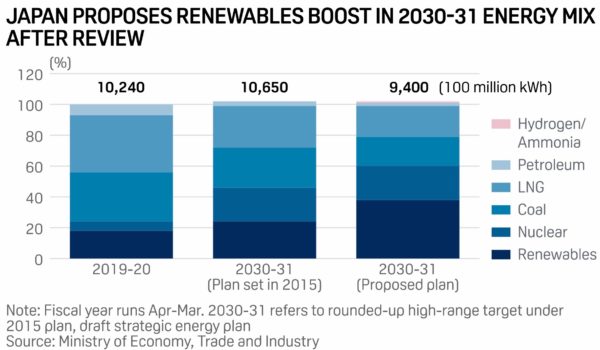

The new draft plan looks to cut Japan’s emissions by 46% (from 2013 levels) up from the original goal of 26%. To achieve that the world’s third largest economy needs renewables to account for 36-38% of its energy generation mix by 2030, a significant increase from the previous target of 22-24%.

On top of that, the coal target has been revised down from 26% to 19%, and gas, upon which Japan relies heavily, is to be reduced from 56% to 41%. Amongst all this change, Japan’s nuclear target has remained unchanged at 20-22%.

Interestingly, Japan has included new fuels like hydrogen and ammonia in its new draft plan, which it says will contribute 1% of the energy mix by 2030. However, the plan did not specify these new fuels had to be green.

Japanese Prime Minister Suga originally announced the revised 46% reduction in emissions at the April Leaders Summit on Climate, hosted by the US President Biden. At the Summit, Suga said the reduction “would mean that Japan will raise our current target by over 70%, and it will certainly not be an easy task. However, by defining a top-level ambitious target befitting to a next growth strategy of the nation which underpins manufacturing in the world, Japan is ready to demonstrate its leadership for world-wide decarbonisation.”

What is not clear is just how Japan can increase its renewable generation so significantly over the course of the decade. The country is already so short on useable land that it is ripping up golf-courses and replacing them with solar farms, utilising floating PV on lakes and reservoirs, and looking to invest strongly in wind. However, much of the waters around Japan are too deep for traditional wind turbines and floating wind turbines are still technologically nascent.

Impact on Australia’s export future

Considering Japan is the largest buyer of Australian coal and thermal coal, and the world’s largest importer of LNG (buying $15 billion worth of Australia’s LNG exports in 2020), there is no doubt that Japan’s revised ambitions will have an impact on Australia, and perhaps particularly on the Morrison’s government’s controversial “gas-led recovery”, toward which it has already committed to funding private industry to the tune of $224 million for the development of onshore gas fields in the Northern Territory’s (NT) Beetaloo Basin.

Indeed, on the same day one of Australia’s biggest export partners demonstrated clear intentions of reducing their dependency on Australia’s fossil fuel exports, Australia’s Minister for Resources and Water, Keith Pitt, reiterated that “the Coalition Government’s Gas-Fired Recovery is the right policy for Australia.”

In a statement about a new seven-year deal signed between QLD gas company Senex Energy and South Australian cement manufacturer Adbri Limited to supply up to 11 petajoules of gas from 2023. “We can’t be following the examples of NSW and Victoria where the answer is to bow to activist pressure and just lock up our gas resources,” said Pitt.

Meanwhile, back in reality, the Climate Council’s Madeline Taylor pointed out that “Japan is one of Australia’s biggest export markets for LNG…This development could undermine the Federal government’s support for new gas earmarked for export…This creates economic risks for Australian LNG exports, which represent up to 82% of Australia’s gas production.”

“The government has allocated tens of millions of dollars into opening up new gas basins like the Beetaloo basin in the NT and the Bowen and Galilee basins in Queensland (QLD), but it’s not clear this spending is necessary, given the growing uncertainty around having buyers for this gas.”

In contrast to Japan, continued Taylor, “Australia has not adopted a binding net zero emissions target, nor has it raised the ambition of its 2030 target, which is well below scientific recommendations…As one of the sunniest and windiest countries on earth, Australia could be generating and exporting renewable energy to meet rising global demand. The government must accelerate progress towards a renewables-powered economy instead.”

The Australian Conservation Foundation’s Elizabeth Sullivan agree, noting that “Australian coal burned in Japan generates roughly as much climate pollution as all Australia’s carbon emissions every year…This revised draft energy plan suggests Japan is moving quickly to replace its fossil fuel energy with renewable energy, including hydrogen and ammonia, which could be made and shipped from here, using Australia’s abundant renewable resources.”

The revised draft plan must first be opened to public comment and then approved by cabinet before it becomes policy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.