When the Energy Security Board was formed at the behest of Australia’s energy ministers in 2019, it was tasked with redesigning the country’s energy systems to transition away from fossil fuels to an infinitely more complicated renewables-based system.

Now, after delivering what it saw as future options back in May, the Energy Security Board’s (ESB) reforms have again hit turbulence because of the proposal of a Physical Retailer Reliability Obligation (PRRO), essentially a capacity market mechanism in which coal generators could be paid to stay in business.

While much of the criticism has been directed at the Board, Dan Cass, the Australia Institute’s energy policy and regulatory lead, says the core problem is not building a capacity market itself, which could be valuable, but rather having the federal government steering the design on behalf of vested interests in coal and gas.

Image: Energy Security Board

Intimately involved

Cass has been “intimately involved” in the ESB’s reform process over the past years and was one of 16 stakeholders appointed to work on a strategy for retiring ageing coal generators. He says scheduling the retirement of coal generators is necessary for an orderly transition, and believes the ESB’s reforms, if they are led by well informed state ministers and stakeholders, could deliver this without prolonging coal’s inevitable departure.

In fact, he believes that the vast majority of people involved in the ESB process, including the board itself, are on the same page, eager to not delay coal’s exist anymore than absolutely necessary.

The federal government, and in particular energy minster Angus Taylor, seem less on board with this planned exit strategy though. Cass, like many others, is concerned the federal government is trying to use the capacity market proposal (entitled the ‘physical retailer reliability obligation’) not as a mechanism to ensure reliability on the path to a clean energy transition, but rather as a way to keep coal in the energy mix in perpetuity – or at least to delay its demise.

“He’s committed to keeping fossil fuels going as long as possible, even if that means propping them up when they are unprofitable,” Cass told pv magazine Australia.

“That’s not a technological reform blueprint reform for the NEM, it’s a political agenda.”

Image: Facebook

Concern around the strategy and how it badly it could shape the reforms led Cass and his colleagues at the Australia Institute to today publish an open letter advertisement in newspapers addressing energy ministers and the ESB, imploring them to not subsidise coal.

The open letter was signed by Tesla’s Australasian Energy Director, Mark Twidell, as well as global inverter manufacturer, Enphase, retailer Flow Power, co-operative Enova Community Power, and more. The strategy behind the move, Cass said, was to ensure ministers know that the companies who are actually building tomorrow’s technology do not support coal.

Secrecy surrounding national meeting

Last Friday, Australia’s energy ministers met to discuss the ESB’s final recommendations on the Post-2025 Market Design, after it delivered its options in May.

Due to the pandemic, the meeting was classed as National Cabinet, meaning it took place in confidence. That is despite the fact, as Cass noted, the ESB’s energy reform advice can in “no way” be counted as national cabinet. This shroud of secrecy, Cass said, has caused high level rifts between state ministers and other stakeholders and the federal government.

Cass pointed to this as a way of sowing confusion and casting doubt around the reforms, a tactic which leads to fracturing and delays and ultimately benefits incumbents.

In his media release on the meeting, Taylor said: “ministers agreed it is important to release the ESB’s final advice documents in relation to its recommendations to inform public discussion of these recommendations.” No information has been released to date.

State minister speaks out

The Australian Capital Territory’s (ACT) energy minister, Shane Rattenbury, has also voiced concerns about the reforms. On August 7, the state minister wrote to ESB Chair Kerry Schott. In the letter, Ratternbury outlined he had received “stakeholder reaction” to the capacity market proposal “and how this may perpetuate operation, and delay the orderly market exit, of thermal electricity generation.”

In the letter, Rattenbury sought assurance from Schott that the recommendation “will not support thermal electricity generation beyond the minimum that is required to maintain the reliability of the electricity system.” Additionally, he asked whether there might be alternative measures which could be taken to mitigate the need for the proposed mechanism.

Firming Australia’s grid

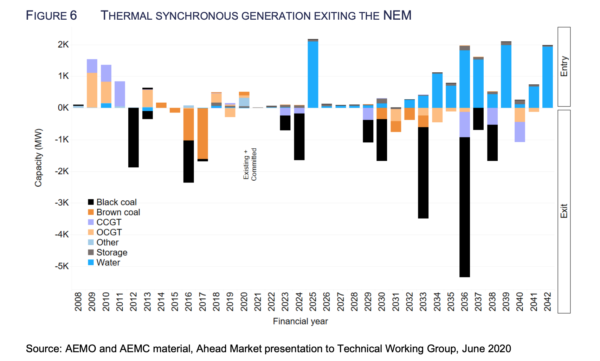

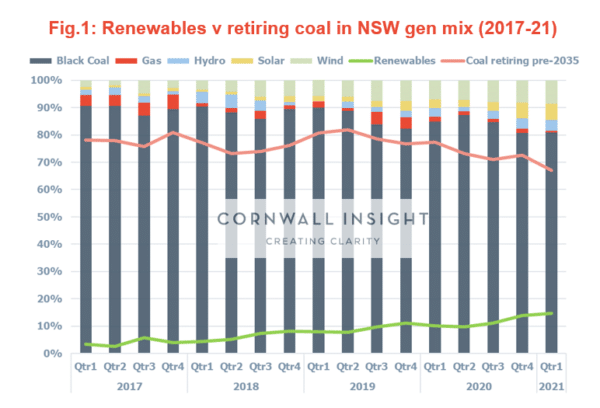

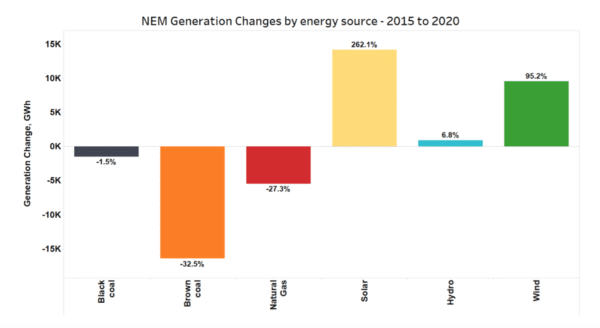

The reason the ESB is recommending Australia develop a capacity market, which would essentially pay power stations to guarantee a certain amount of generation capacity available to the market, is to ensure reliability. The problem is, Cass says, coal generators are not necessarily the dependable generators they are marketed as, nor are they easy to turn on and off – meaning they can’t respond quickly to electricity demand surges and troughs.

Image: AEMO

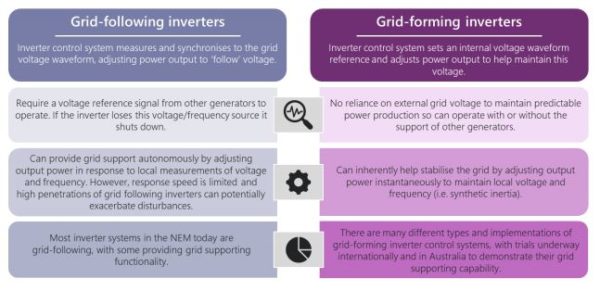

Technology which can better respond, Cass says, is right “on the brink.” For instance, inverter based technologies, he says, are already proving their ‘grid forming’ capabilities in trials in Australia. Likewise, technologies like Virtual Power Plants and battery storage, as well as demand response will play bigger roles into the future.

On principle, Cass doesn’t oppose the idea of a capacity mechanism, such as the existing Reliability and Emergency Reserve Trader (RERT). In fact, he thinks there is a space for a well designed mechanism to smooth the exit of coal, but it needs to be agnostic and not favour thermal generation over newer technologies.

Feds vs states

As a federal minister, minister Taylor does not have constitutional power over electricity, nor has he been a part of the ESB reforms’ inner workings. Moreover, all of the country’s state energy ministers share his position as “bosses” to the ESB, making Taylor one of many. He does, however, have a critical leadership role as the national minister, Cass said.

Nonetheless, Cass is confident that if it comes down to well-informed state ministers facing off with Taylor, the outcome will be good.

The idea that this state by state split will weaken the National Energy Market (NEM), Cass thinks is somewhat beside the point. States are already driving investment in the NEM through their Renewable Energy Zone plans, he said. If states step up with more of a role in firming and security, it would be more of a continuation of things as they are, rather than a split or weakening of the NEM.

“I also don’t think all things are broken,” he added. Rather, he believes real progress has been made with leaders like Daniel Westerman, the new chief of the Australian Energy Market Operator, readying the grid to handle 100% renewable instantaneous generation by 2025.

He also pointed to Kerry Schott and how unequivocal she’s been that coal’s end is nigh, despite it consistently putting her in the federal government’s firing line. “I feel like that’s a really big shift,” he said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

With the price of batteries dropping they forget turns solar into on demand power, beating coal which basically is on or off and takes time, costs, pollution to do either.

A coal plant might take .5-2 hr to start and 30 minutes to shut down.

And those are the times of the most pollution, wear on the plant so coal can’t be said to be load following solar and battery can be.

Which is why Hornsdale made so much money.

RE will end up on demand so should outcompete coal if thy try to pull that.

They tried that in Texas thinking they were smart and FF would be cheaper they did an open market and RE is taking over fairly fast.

So make sure it’s a actual free market and RE will win as cheaper..