Just 24 hours after Canadian asset management group Brookfield put in a bid for AusNet valuing the company at $9.6 billion, Australian gas giant APA Group jumped in with an almost $10 billion offer.

It wasn’t enough though, with AusNet announcing yesterday that it deemed APA’s offer “inferior in respect of price, form of consideration, structure and certainty” to the Brookfield offer.

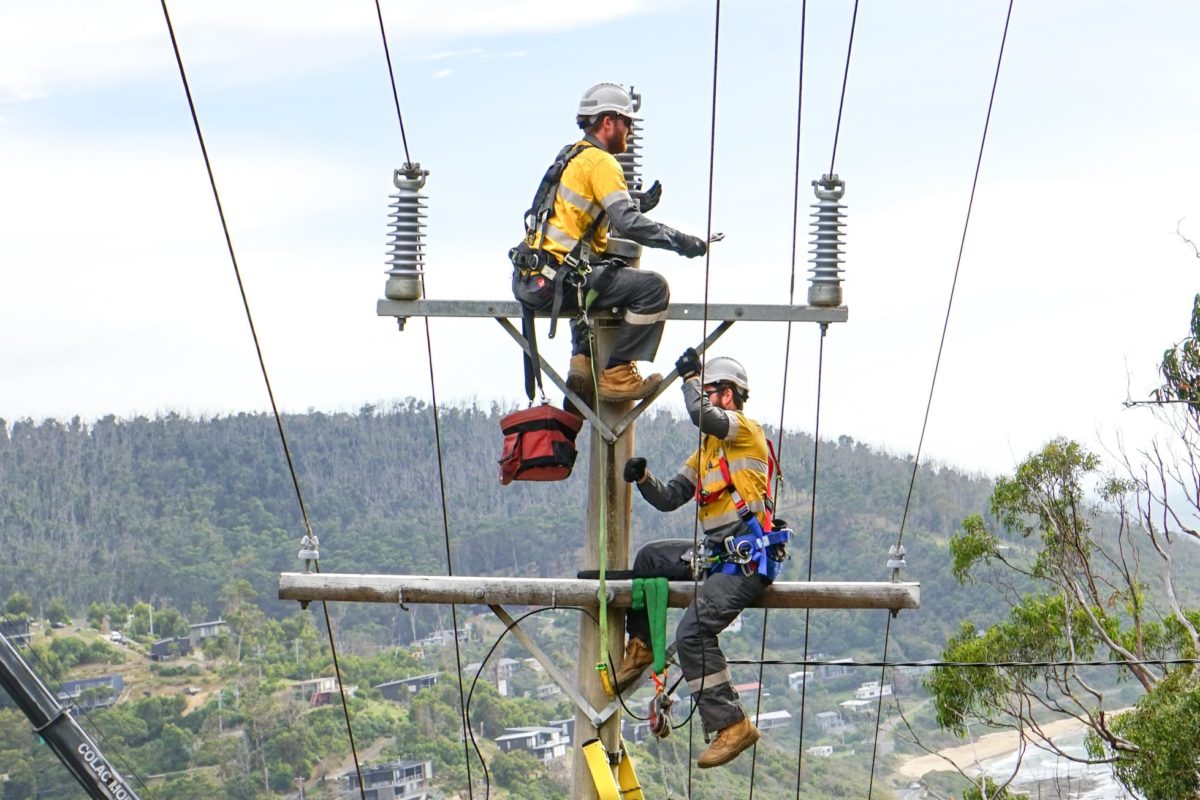

AusNet owns and operates Victoria’s electricity transmission network, which is of course connected to the national electricity market (NEM). It also owns a Victorian electricity distribution network and gas distribution network. The company is currently 32% owned by Singapore’s state investment arm Temasek and 19.9% owned by the China’s State Grid Corporation.

AusNet’s takeover battle

Brookfield now has eight weeks of exclusive due diligence to asses AusNet’s books. APA Group had hoped to undercut this exclusive arrangement with its offer, but it seems to have failed with AusNet saying it will “consider the APA [proposal] and has the ability to engage with APA following completion of the exclusivity period”.

APA Group, which already own or operate a $22 billion portfolio of gas and electricity assets in Australia, sought to rally support for its takeover on the promise of preventing Victoria’s power grid becoming completely foreign-owned.

“Unlike many OECD countries, Australia lacks a locally owned and controlled energy utility with capabilities across critical energy infrastructure and with the size and strength to partner with government and the community to deliver the energy transition,” APA’s managing director Rob Wheals said in a statement.

AusNet’s takeover comes less than a month after the bid for Australian power network group Spark Infrastructure was finalised at $5.2 billion from a North American consortium comprised of Kohlberg Kravis Roberts & Co, Ontario Teachers’ Pension Plan Board, and the Public Sector Pension Investment Board.

Evidently, Australia’s transmission assets are seen as increasingly attractive investments with electricity usage expected to grow over the coming decades as the country decarbonises, embracing electric vehicles and producing hydrogen.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.