On Saturday, a consortium made up of Mike Cannon-Brookes’ Grok Ventures and fund manager Brookfield put in a bid to acquire 100% of AGL Energy, Australia’s largest electricity generator and the nation’s largest carbon emitter, for approximately $8 billion.

This morning, AGL rejected the “unsolicited” offer, saying it “materially undervalues the company” and was “not in the best interests” of shareholders.

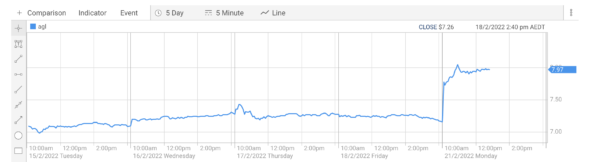

The consortium remains undeterred. It will continue to work with AGL’s board to reach an acquisition agreement, Cannon-Brookes said. The news pushed AGL’s share price up more than 12%.

ASX

Consortium claims it has $20 billion to invest in Australia’s green energy transition

Driven by what he sees as one of the country’s greatest economic opportunities, as well as a climate imperative, Cannon-Brookes told ABC’s RN Breakfast this morning that the consortium’s shock takeover bid was a “sensible play” it is committed to pursuing.

On top of its acquisition budget, he said the consortium has access to $20 billion to invest in decarbonising AGL, and more broadly Australia. With this capital it plans to invest in new renewable assets, contracting external renewable developments, as well as storage, firming and “the infrastructure required to make [the transition] happen.”

cooking with angus @FinancialReview #agl pic.twitter.com/E9BcSfSMtP

— david rowe (@roweafr) February 20, 2022

“We have $20 billion to fund the transition ourselves, and obviously as a private company we can fund the transition faster than as a public company,” Cannon-Brookes said.

The consortium plans to replace AGL’s 7GW of fossil-fuel capacity through a “build-out of at least 8GW of clean energy and storage,” it said.

Cannon-Brookes added that he believes one unified AGL is the best way to bring this plan to fruition, describing the consortium’s takeover as a “far better option than the demerger which is on the table.”

Cannon-Brookes is among Australia’s richest people having made billions from co-founding software company Atlassian, where he remains CEO. He is an ardent advocator for climate action and has invested significantly in the renewables sector.

Image: Atlassian Facebook

Retiring coal by 2030

With the bid, Cannon-Brookes and Brookfield are seeking to accelerate the retirement of AGL’s extensive coal-fired power plants in New South Wales and Victoria.

The consortium has flagged it plans to retire all three of AGL’s sizeable coal plants by 2030 – far more ambitious than AGL’s schedule to have its Loy Yang A plant in Victoria remain open until 2045 and its New South Wales Bayswater plant until 2033. The Liddell coal power plant is already on track to close next year.

Cannon-Brookes said the consortium plans to cut 15 years from AGL’s net zero target, which would be crucial for aligning it with Paris targets keeping global warming below 1.5°C, he told ABC Radio.

Image: AGL

AGL accounts for over 8% of Australia’s emissions, with Cannon-Brookes pointing out the company is responsible for more carbon pollution than the entirety of Sweden, Ireland or New Zealand.

“If successful, this will be one of the biggest decarbonisation projects in the world today and show Australia is capable of globally significant projects,” Cannon-Brookes said.

Brookfield setting itself up for decarbonisation opportunity

The Toronto-headquartered fund management company Brookfield would invest in AGL via its Brookfield Global Transition Fund.

The fund in the “final stages” of raising US$15 billion (AU$21 billion), Brookfield said, claiming the title of world’s largest fund focused on transition investments. “The investment in AGL would be the largest investment from the fund to date, not only in terms of capital invested but also in terms of the expected renewables build out and carbon reduction,” Brookfield added.

Image: AusNet

Brookfield recently acquired Victorian network utility AusNet Services, which owns and operates the majority of the state’s transmission network infrastructure, as well as a large proportion of its electricity and gas distribution network.

It has been flagged that any takeover of AGL by Brookfield would likely be closely examined by the Australian Competition & Consumer Commission (ACCC).

AGL’s position

As a company, AGL has been struggling. AGL stocks are currently at a 20-year low with its demerger plans failing to excite enthusiasm on the stock market. At the end of 2021, AGL’s share price was less than one-fifth of its 2017 peak.

In September, 55% of AGL shareholders voted for the company to adopt Paris-aligned climate targets in both of its demerged businesses. The vote was hailed as the largest ever contested resolution in Australian corporate history.

This is an incredibly momentous event in the history of climate in Australia. Wow. Wow.

👏🏻 @brynnobrien and @AustCCR team on their @AGLAustralia resolution.

You put a dent in the future timeline of the world today. https://t.co/0HH6WeslLp

— Mike Cannon-Brookes 👨🏼💻🧢🇦🇺 (@mcannonbrookes) September 22, 2021

Cannon-Brookes and the consortium look to be leaning into this shareholder upset, with the billionaire saying of its takeover plan: “ultimately, I believe the decision is up to the shareholders, so we are putting our case forward.”

The Brookfield & Grok Venture consortium offered AGL $7.50 a share, a 4.7% premium on Friday’s closing price of $7.16. The consortium said its offer represented a circa 20% premium to the three-month volume-weighted average price (VWAP) of AGL’s $6.28 per share.

After meeting to discuss the offer on Sunday, AGL’s board deemed the bid short.

Demerger ‘dis-synergies’

Yet the consortium insists the offer, and presumably the future offers it is alluding to, would be far more valuable to shareholders than AGL’s current demerger plan, which would see the company separate into AGL Australia, the forward-facing ‘green’ business and Accel Energy, which would retain the company’s fossil fuel generation assets.

The consortium sees this plan as highly unattractive, saying it would “significantly dis-synergies” AGL in a letter to the company’s management. “The pressure to fund decommissioning and energy transition with reduced balance sheet capacity will undermine investor appetite and the financial viability of Accel Energy and, when added to significant one-off costs, diminish the potential benefits of any prospective demerger,” it said.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.