In April, the newly formed Western Australian company HyTerra announced it would be acquiring 100% of Neutralysis Industries. Neutralysis, also Australian, holds a stake in an established Nebraska project alongside Natural Hydrogen Energy, a company with one of the field’s preeminent researchers, Viacheslav Zgonnik, at its helm. The move would effectively be HyTerra’s ‘in,’ giving it access to expertise, room to demonstrate and, probably, a wellspring of naturally occurring hydrogen.

While the world has known for many decades about hydrogen accumulating under the earth’s surface, the phenomenon has largely been ignored. The main reason for that, HyTerra’s business development manager Luke Velterop tells pv magazine Australia, is simply because there’s previously been no market for it. Hydrogen is finicky to handle and in the past oil and gas have been considered just fine.

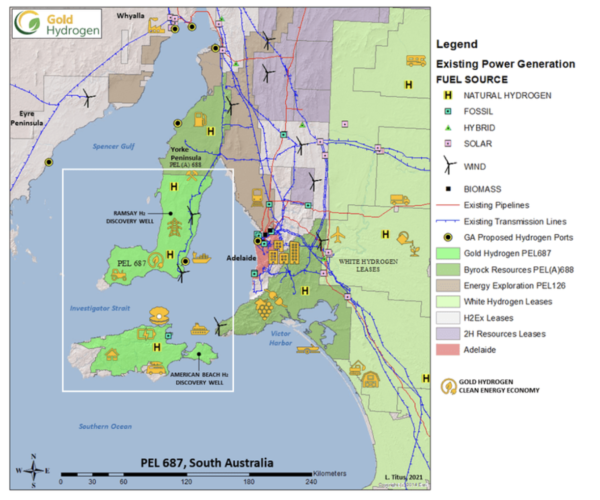

Now the urgent need to decarbonise has changed that, and with it opened up new avenues of interest. In February, pv magazine reported that in the past year exploration licenses amounting to one third of South Australia’s total landmass have been either granted or applied for by companies in search of natural hydrogen.

Image: Guilhem Vellut, flickr

As HyTerra executive director and chief technical officer Avon McIntyre explains, it isn’t that South Australia is particularly bountiful in natural hydrogen accumulations, but simply that the state leads the country in terms of exploration regulations for the nascent industry. Accumulations, he says, may well be found all across Australia. And HyTerra and a handful of other companies are vying to secure them first.

So what is natural hydrogen

While there remains some debate natural hydrogen, which has until now rarely been a focal point, there is consensus around the two main ways underground accumulations of the molecule develop.

The first, called ‘serpentinisation,’ is an underground reaction between iron and water. As McIntyre, who spent 13 years at Shell as an exploration geologist explains, the reaction occurs when water comes into contact with iron rich rocks in the subsurface, deep enough to be unaffected atmospheric oxygen. “Then those iron-rich rocks, they effectively want to rust, they want to turn into iron oxides… so they will strip the oxygen atom off the H2O and that releases the hydrogen,” McIntyre tells pv magazine Australia.

“This is a well understood process and people have known about it for many, many years. It’s just that nobody’s really considered if this could be an economically viable process.”

The second mechanism is radiolysis of water, in which radioactive rocks split the H20 molecules into its component atoms. The hydrogen then migrates away from the radioactive rocks to accumulate or possibly get stuck in a fracture flux system underground.

Gold Hydrogen

One of the major points of excitement here is that because these reactions happen naturally without human intervention, they are regenerative – and considered a ‘inexhaustible’ supply. While McIntyre says that’s not technically true, he believes exhausting an accumulation would take a very, very long time.

Accessing natural hydrogen

Here is where scientific opinions begin to diverge. Since natural hydrogen shares similar attributes to oil and gas, it has drawn attention from this industry, with a number of smaller companies and some bigger ones, looking into the world as a potential pivot point or subsidiary stream. These companies, McIntyre says, tend to think of natural hydrogen extraction in terms of trapping an accumulation and drilling it like one would with fossil fuels.

Other companies, however, are looking for fracture systems within rocks which could be intercepted. “Maybe both are right, maybe both wrong,” McIntyre says. “We’re still learning here.”

HyTerra

What is solid is that exploration companies, of which McIntyre estimates there is between four and seven in Australia (some differently named companies ultimately being owned by the same parent), are looking for certain rock types and water conditions.

How natural hydrogen can be used

Again, the question of how to handle the hydrogen which has been released from its underground hideout is far from sorted. The most convenient thing, McIntyre says, would be to burn the hydrogen at the source and generate electricity – but, he adds, that’s probably the least effective way to use resource.

Instead, HyTerra, in partnership with Natural Hydrogen Energy, hopes to blend the natural hydrogen from its Nebraska well into a nearby natural gas pipeline. The company, however, is far from wedded to the notion of pipeline blending, with its executives saying it chose that route in this case because an ammonia plant servicing the fertiliser industry is just down the road and already connected to the pipeline. Currently the ammonia there is produced from gas, and the project is hoping to switch that input to a cleaner alternative.

But the issue of how to handle the natural hydrogen in other project sites remains. “One of the real challenges with hydrogen is being able to store and transport it,” Velterop notes. He also works in this space consulting for Global Energy Ventures, a West Australian company developing hydrogen powered and carrying ships.

H2EX/LinkedIn

In Velterop’s view, it’s likely there are sites where wells could be established either close to market or near infrastructure which could take it to market since, he says, it appears that reservoirs can be accessed from multiple points. “If you can perhaps drill somewhere that’s on the fringes or slightly closer to market so you can minimise the amount of infrastructure needed to take that product to a customer, that’s a real opportunity.”

Carbon footprints and the unwelcome aesthetic of well drilling

Velterop acknowledges that people might recoil from the fact the natural hydrogen industry is using essentially the same equipment as fossil fuel industries. The notion of ‘exploiting’ underground natural resources sounds all too familiar for many, and hardly fits into collective visions of green energy futures.

Be that as it may, proponents insist natural hydrogen projects would not only have a smaller footprint than most of the hydrogen rainbow, but that it in fact it would have a smaller footprint than even green, renewable hydrogen.

This, they say, is because unlike the green hydrogen produced via electrolysis powered by renewable energy, natural hydrogen projects need minimal infrastructure (think, no sweeping solar farms or wind turbines) nor does it need a water source. “We’re clearing a very small footprint drilling a very shallow wellbore versus using tens of thousands of hectares with installations of PV and wind,” Velterop says.

“We would be zero or effectively zero CO2,” McIntyre adds.

Image: SA Labor

Not a fan of the hydrogen colour classification system, Velterop says “we’re kind of scrapping all that and just saying natural hydrogen.

“We’re confident that the carbon intensity of [natural hydrogen projects] will be the same as that of green hydrogen products, so we’ll be able to sell that at that premium as well.”

The price of natural hydrogen

Which brings us to the important point of pricing, yet another source of excitement for the burgeoning industry. While HyTerra, which is currently going through the process of relisting on the Australian Stock Exchange (ASX), is unwilling to make hard price forecasts, Velterop says “the target is certainly to be cheaper than grey hydrogen today.”

At the world’s first ever natural hydrogen conference last year, H-Nat 2021, which was held online and attracted 500 participants, presenters floated pricing ballparks of between US$1 to US$0.5 per kilogram, roughly between $1.35 to $0.70 in Australian dollars.

Given our federal government’s hydrogen stretch goal is “H2 under $2,” if natural hydrogen projects were demonstrated and proven viable, they could be extremely competitive. For comparison, in 2019 the International Energy Agency’s ‘The Future of Hydrogen’ report calculated grey hydrogen costs ~US$0.9-$3.2 per kg, blue is around US$1.5-$2.9 per kg, and green sits significantly higher at US$3.0-$7.5 per kg.

The cheapness of natural hydrogen rests on its lower upfront and ongoing project costs. McIntyre estimates to develop a natural hydrogen well would cost between AU$1 to $5 million, roughly the same as an oil and gas well since it uses the same equipment and should be (though it remains to be proven) technically straight forward.

Unlike green hydrogen projects, Velterop says, it appears natural hydrogen won’t require the same level of engineering and feasibility studies, meaning the projects should be far quicker to get off the ground. “It’s a lot more accelerated,” he says.

Companies on the prowl

As mentioned, McIntyre estimates there are just a handful of Australian companies in the natural hydrogen game at the moment. Brisbane-based firm Gold Hydrogen is one pv magazine Australia has previously reported on after it secured exploration rights to areas in South Australia where high purity hydrogen was detected back in the 1930s.

As for HyTerra, it recently changed its name from Triple Energy and is hoping to be relisted on the ASX by mid-June. In terms the company’s partnership with Natural Hydrogen Energy, HyTerra will continue to invest in the Nebraska project it is codeveloping with them to earn additional stakes. How the joint venture works is that the more HyTerra invests, the more equity it earns, with the possibility of going all the way up to 51%.

The companies are hoping to complete a longterm well test for the US project later this year, which will inform them of the project’s commercial prospects.

Following this, McIntyre says HyTerra is “evaluating [its] path to Australian operations.” While the regulatory framework for natural hydrogen is still just being considered everywhere except South Australia, the company is hopeful it won’t take too long for the scaffolding to go up. West Australia, for instance, is already making strong headway in this direction.

Given the momentum growing around the vision of Australia becoming a ‘hydrogen superpower,’ the technical ease coupled with the commercial potential of natural hydrogen means we’ll likely be hearing more about this ‘gold’ rush in future.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Interesting. A friend forwarded this article to me. I’m a long standing substantial shareholder in graphite through Syrah Resources… some 11 years. Still waiting accurately but getting closer.

I’ve never heard of Natural Hydrogen. I’d like to know more including your new company. Sounds too good and I like the US connection and their ongoing experience that you can share. You also mentioned benefits or dividends coming form US association.

We are not in any associated area. We, my family business of 47 years in manufacturers and Retailers of Kitchens in Melbourne.