From pv magazine 05/2022

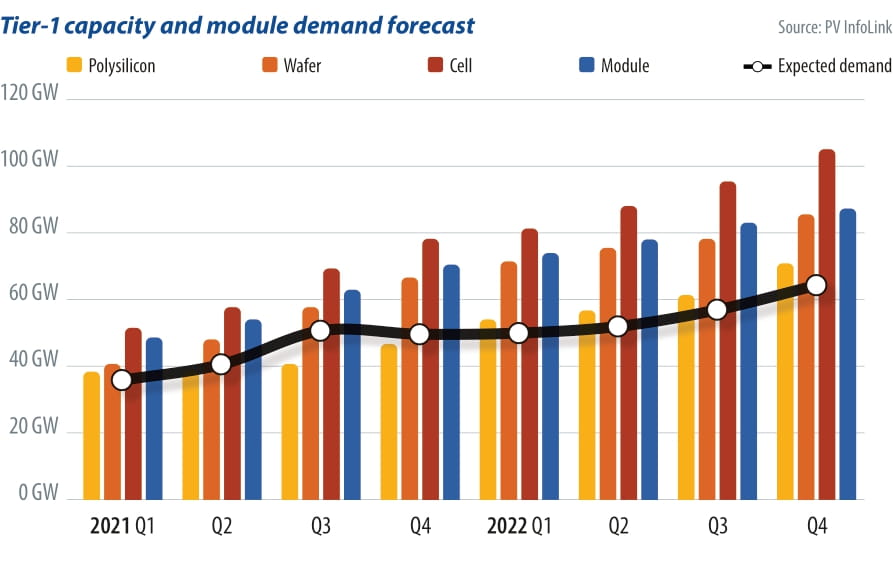

PV InfoLink projects global PV module demand to reach 223 GW this year, with an optimistic forecast of 248 GW. Cumulative installed capacity is expected to reach 1 TW by year’s end.

China still dominates PV demand. The policy-driven 80 GW of module demand will beef up solar market development. In second place is the European market, which is working to accelerate renewables development to wean itself off Russian natural gas. Europe is expected to see 49 GW of module demand this year.

The third-largest market, the United States, has seen diversified supply and demand since last year. Disrupted by the Withhold Release Order (WRO), supply is unable to catch up with demand. Moreover, the investigation into anti-circumvention in Southeast Asia this year causes further uncertainty in cell and module supply for US orders and adds to the low utilization rates in Southeast Asia amid impacts of WRO.

As a result, supply to the US market will fall short of demand throughout this year; module demand will stay at last year’s 26 GW or even lower. The three largest markets together will contribute to around 70% of demand.

Demand in the first quarter of 2022 stayed at around 50 GW, despite persistently high prices. In China, projects deferred from last year were commenced. While ground-mounted projects were postponed due to high module prices over the short term, and demand from distributed-generation projects continued due to lower price sensitivity. In markets outside of China, India witnessed strong inventory draw prior to the introduction of basic custom duty (BCD) on April 1, with 4 GW to 5 GW of demand in the first quarter. Steady demand continued in the US, while Europe saw stronger-than-expected demand with robust order requests and signings. The EU’s market acceptance for higher prices also increased.

Overall, demand in the second quarter may be spurred by distributed generation and some utility-scale projects in China, while Europe’s strong module inventory draws amid the accelerated energy transition, and steady demand from the Asia-Pacific region. The US and India, on the other hand, is expected to see dwindling demad, owing respectively to anti-circumvention investigation and lofty BCD rates. Yet, demand from all regions together amass 52 GW, slightly higher than in the first quarter.

Under current pricing levels, China’s guaranteed installed capacity will drive inventory draws from utility-scale projects in the third and fourth quarter, while distributed generation projects will continue. Against this backdrop, the Chinese market will continue to consume large volumes of modules.

Overall, demand in the second half of the year will surpass that in the first half. PV Infolink predicts a gradual increase over time, reaching a peak in the fourth quarter.

Polysilicon shortage

As shown in the graph (left), polysilicon supply has improved from last year and is likely to meet end-user demand. Yet, InfoLink predicts that polysilicon supply will remain short due to the following factors: Firstly, it will take about six months for new production lines to reach full capacity, meaning production is limited. Secondly, the time taken for new capacity to come online varies among manufacturers, with capacity growing slowly during first and second quarter, and then increasing markedly in the third and fourth quarter. Lastly, despite continued polysilicon production, Covid-19’s resurgence in China has disrupted supply, leaving it unable to meet demand from the wafer segment, which holds huge capacity.

Raw material and BOM price trends decide whether module prices will stay on the rise. Like polysilicon, it seems that EVA particle production volume can satisfy demand from the module sector this year, but equipment maintenance and the pandemic will lead to an imbalanced supply-demand relationship in the short term.

Supply chain prices are expected to stay elevated and will not decline until the end of the year, when new polysilicon production capacities come fully online. Next year, the entire supply chain may hopefully recover to a healthy state, allowing the long-stressed module makers and system suppliers to take a deep breath. Unfortunately, striking a balance between high prices and robust demand continues to be major topic of discussion throughout 2022.

About the author

Alan Tu is a research assistant at PV InfoLink. He focuses on national policies and demand analysis, supporting PV data compilation for each quarter and investigating regional market analysis. He is also involved in the research of prices and production capacity in the cell segment, reporting authentic market information. PV InfoLink is a provider of solar PV market intelligence focusing on the PV supply chain. The company offers accurate quotes, reliable PV market insights, and a global PV market supply/demand database. It also offers professional advice to help companies stay ahead of competition in the market.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.