From pv magazine 07/2022

Shortages and broken supply chains are colliding with sharply rising demand. This is not only coming from the big players such as utilities and major developers, who are building, or at least announcing, one multi-megawatt plant after another. The small plant sector is also booming. All you have to do is casually mention in your own neighbourhood that you are in the solar business and you’ll be besieged by interested parties looking to set up their own PV system or find a good installer. And that’s where the problem begins.

Anyone, like me, who has been in the solar business for a while remembers all too well the days of the distributor’s market. Even in the 2010s, there was often a scramble for stock of inverters and panels available at short notice. Back then, however, you could still be reasonably sure that goods ordered and confirmed by the manufacturer would arrive in the foreseeable future. Installation dates could also be predicted with some degree of reliability since materials and personnel were usually available when needed. Now, however, it seems as if we are not dealing with a distributor’s market – nothing fits together anymore.

Blocker’s market

As a wholesaler, you must seriously consider whether it still makes sense to accept orders, or whether you should close your online shop, your customer hotline, and your email inbox. The sheer volume of requests is too gruelling, and it has become nearly impossible to process them to the customer’s satisfaction. The high volume of inquiries significantly increases response and processing times. If every customer nervously asks for information within a very short period of time, tying up additional employee hours, it takes even longer for everyone. Most manufacturers, on the other hand, rarely provide timely and reliable information on availability and delivery times, so that even their own customers are unable to get any meaningful information. The customer then moves on to the next potential supplier, and the game starts all over again. Suppliers may then be faced with over-ordering, and the likelihood of getting a reliable delivery estimate drops even further – a vicious cycle.

For these reasons, I urgently appeal to all buyers to please understand that your suppliers cannot work magic and that everything will take a bit longer. Every company is facing the same desperate situation, and turning up the pressure with constant inquiries does not make the situation any better. As soon as reliable information is available, you will be contacted!

The more wholesalers refuse to take orders, the worse it automatically gets for the remaining suppliers. This will continue until the last supplier has closed its channels to prevent employee burnout. This is not meant as finger-pointing at installers because they are under the same pressure from their customers. For them, it is hard enough to get even a non-binding offer. If they get as far as placing an order, they understandably also want to know when installation of the PV system can begin.

This is where the process screeches to a halt again, as it is now virtually impossible to install modules in one go and without interruptions. Even if the modules are still available, parts of the substructure may not be. If these components are not available at a minimum, then installation on the roof cannot begin, of course. And even if the roof is ready to go, just getting on with the job is still a long way off. First of all, the inverter and the storage system, if needed, along with sensors would have to be available. But these components are often out of stock indefinitely, which leads to further delays in completing the system. Last but not least is the crap-shoot of when the grid operator will get around to connecting the system or installing the new meter.

Speedy, smooth installations are a thing of the past – they rarely happen anymore, even for small systems. These days, it is a stop-and-go process and a nerve wracking ride for everyone involved.

The only upshot is that already tight installation capacities cannot be used with any efficiency. Installers would have to have large quantities of all the various individual components they need delivered and stored, well in advance and on spec, to be in a position to install small systems successively and on schedule. Only a few big players would be able to play this game properly because it ties up liquidity and storage capacity. There is also always a risk that there will be a change in the rules (political or technical) in the interim and that the wrong components will be in the warehouse.

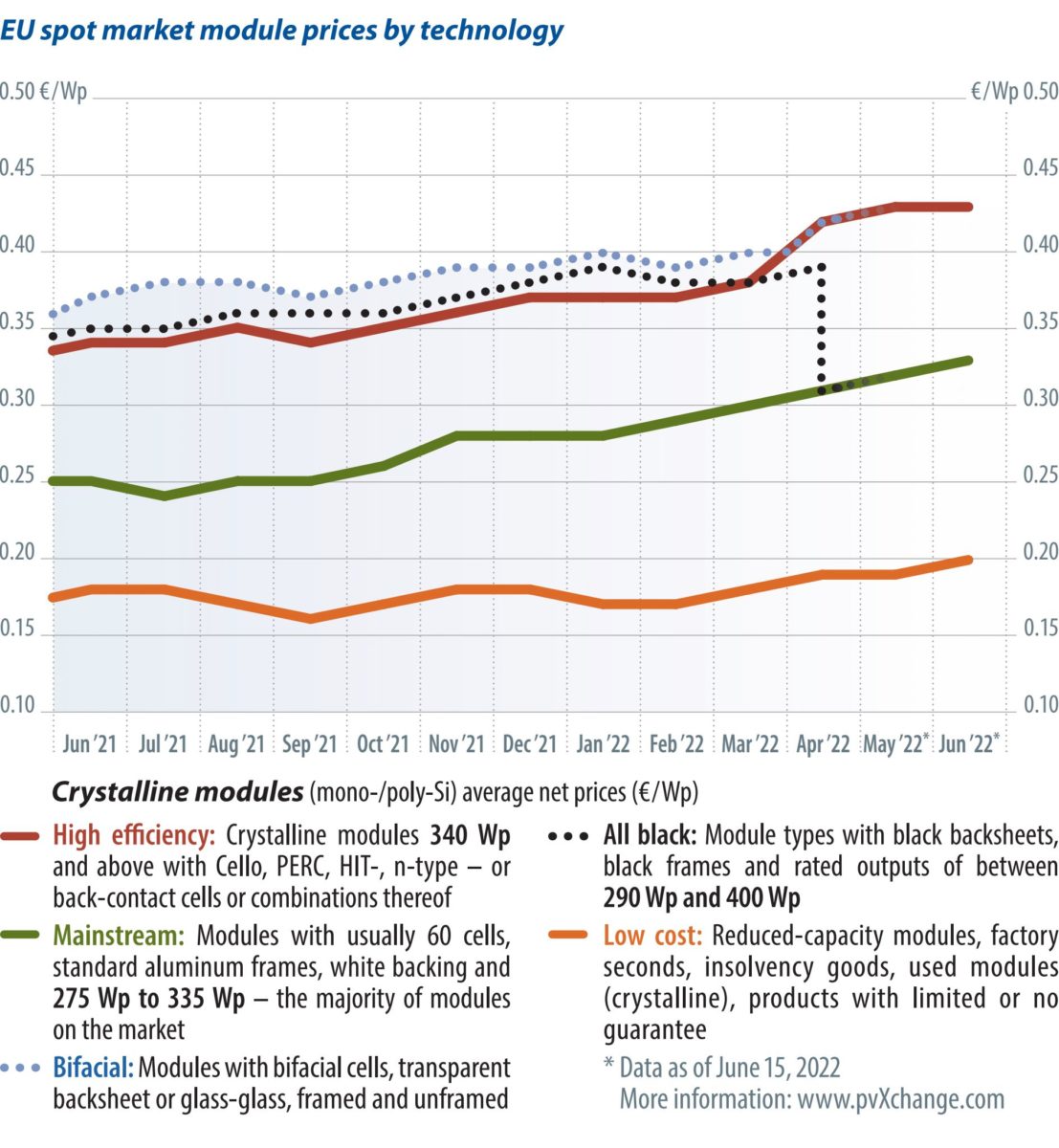

The rise in module prices has also slowed in recent weeks and is expected to come to a complete standstill in the coming months. This is due mainly to the likelihood that installations will be delayed and planned projects postponed. Can the small plant installer really ask a homeowner to wait for months for the completion of a rooftop system due to a lack of inverters or power storage units? this rarely happens on large projects. Unless the other components are safely at hand, no modules will be purchased. This is why special items and overproduced stock are increasingly ending up on the open market at present, which is putting pressure on the high module prices. Whether this trend will continue over the long haul is currently hard to predict, as is the case with so many other things.

About the author

Martin Schachinger has a degree in electrical engineering and has been active in the field of photovoltaics and renewables for more than 20 years. In 2004, he started his own business and founded the internationally known online trading platform pvXchange.com, where wholesalers, installers and service companies can purchase solar panels, standard components and inverters that are no longer manufactured but are urgently needed to repair defective PV plants.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.