The owner and operator of Australia’s two biggest batteries, Neoen, is close to switching on its third – the Capital Battery beside the Queanbeyan substation in Canberra’s southeast.

The Capital Battery will be owned by Neoen, and financed through a combination of company equity and loans from infrastructure fund manager Infradebt as well as the Clean Energy Finance Corporation (CEFC). It is the third investment CEFC has made in Neoen’s Australian big batteries.

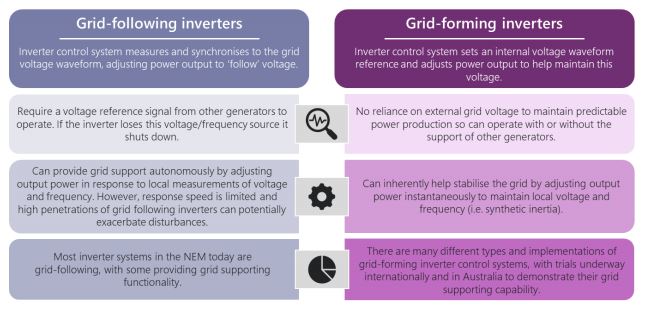

The Capital Battery is also set to deliver grid support services to the network, Neoen says, presumably through what’s known as virtual synchronous machines or grid forming inverters, which gives batteries the capacity to help stabilise the grid by providing inertia.

This is something the company’s 150 MW / 193.5 MWh Hornsdale Power Reserve, AKA the South Australian Big Battery, began doing at scale in July 2022 following two years of trials.

The Capital Battery is Neoen’s first project with South Korean technology partner Doosan. The two big batteries Neoen already operates, the 300 MW / 450 MWh Victorian Big Battery near Geelong, and the Hornsdale Power Reserve in South Australia, have both used Tesla technology. The Doosan partnership was announced shortly after the Victorian Big Battery caught fire during commissioning.

Virtual battery contract with AGL

Also helping underpin the Capital Battery’s finances is a 70 MW “virtual battery contract” Neoen entered with utility giant AGL Energy back in April 2022. Lasting seven years, Neoen described the new type of contract as a financial agreement and a hedging tool.

“The virtual battery [agreement] is an innovative solution designed by Neoen to allow a large electricity user or retailer to mimic a grid-scale battery, without having to build or own one,” Neoen said of the AGL contract. “This highly flexible solution provides AGL Energy with the ability to hedge its customer load by virtually charging and discharging a battery of 70 MW as and when it chooses.”

Neoen has said it hopes the virtual battery concept will become one of its core products in future.

It is likely the AGL agreement is behind the doubling of the Capital Battery’s capacity, which has grown from the initial 50 MW / 100 MWh project outlined by Neoen in its 2020 tender with the Australian Capital Territory (ACT) government.

The Capital Battery was part of Neoen’s winning bid in the Territory’s renewable energy auction that year, where it was awarded a 14-year contract to supply 100 MW of wind energy to the ACT government from Stage 1 of its Goyder Renewables Zone, which included the battery plan.

The Goyder Renewables Zone is another flagship project currently being developed by Neoen – a hybrid wind, solar and storage project located near Burra in South Australia’s mid north.

Construction of the Capital Battery began in late 2022. Once the battery is operational sometime in the first half of 2023, Neoen says it will launch a “Community Co-investment Scheme,” providing local residents an opportunity to become financial stakeholders in the project. This specification was part of Neoen’s winning bid in the ACT Renewable Auction in 2020.

Neoen’s big batteries

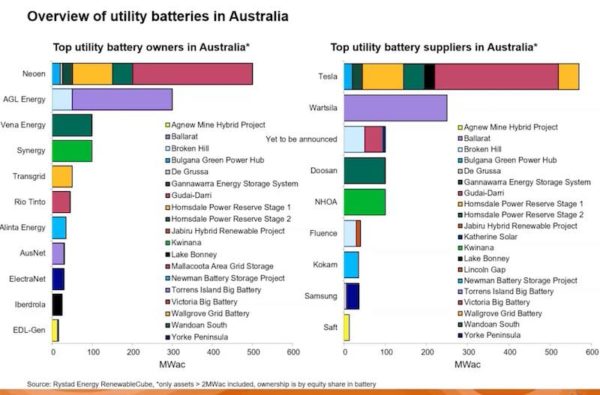

Neoen has the biggest portfolio of operational and planned utility-scale batteries. in Australia today – sitting at 576 MW. In late 2022n the company announced plans for 300MW and 800 MWh battery in Blyth, north of Adelaide.

Image: Neoen

The company is aiming to have a grid-scale battery in each of the five states participating in the National Electricity Market – something it is well on its way to achieving with the Capital Battery making three of five.

The strategy is proving highly profitable for the company. In August 2022, Neoen announced storage revenues had grown by more than one third in the last year thanks to its Australian battery assets – specifically its Victorian Big Battery coming online coupled with Australia’s energy crisis.

Neoen’s first-half 2022 consolidated revenue totalled $328 million (USD 212 million), up 36% compared to the first six months of 2021, according to its most recent earnings report.

Image: Rystad Energy

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.