Capping off a big month for ReNu Energy Limited, the company closed its capital raise oversubscribed, collecting $4.5 million before costs through the issue of 75 million new shares.

The newly raised capital, the ASX-listed ReNu said, will go towards its Tasmanian and Indonesian green hydrogen projects – which it is primarily pursuing through its wholly owned subsidiary Countrywide Hydrogen, which it acquired in February.

In Tasmania, ReNu is moving to build a modest 5 MW facility at Brighton near Hobart. It also recently announced its plan to work with Australian Pacific Airports to develop another 5 MW facility at Launceston Airport, where the design is set to deploy a solar array on vacant airport land to provide behind-the-meter electricity.

Also in November, ReNu announced its memorandum of understanding (MoU) with Anantara Energy, a partnership between Singapore-based independent power producer Quantum Power Asia and German PV developer ib vogt, to investigate the feasibility of developing a large-scale green hydrogen production facility in Indonesia’s Riau archipelago. The plan features a 10 MW electrolyser supported by at least 100 MW of solar.

“This capital raise improves our balance sheet and strengthens our financial position to progress our various green hydrogen projects to the next stage of development and co-invest alongside HESTA who recently signed a term sheet for up to $100 million investment in our green hydrogen projects,” ReNu Energy CEO Greg Watson said.

“The raise also allows us to boost our internal team to increase our ability to deliver on our project plans and build our portfolio of strategic renewable & clean energy investments,” Watson added.

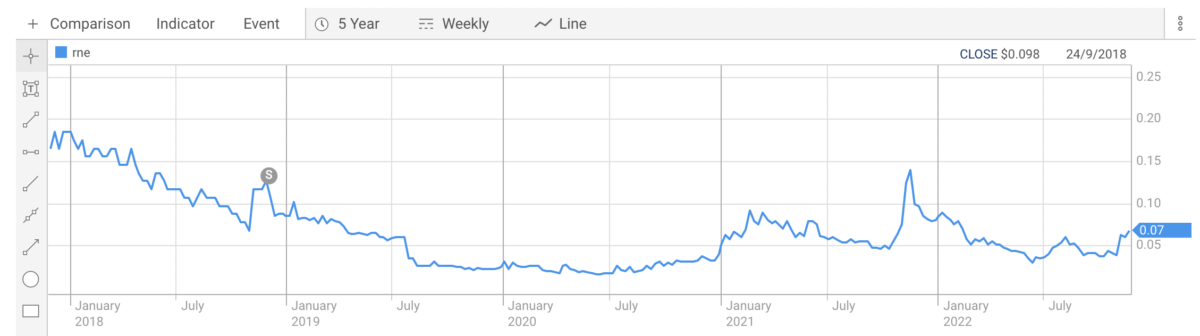

The company’s busy November has seen its share price climb 50%, clawing back some of the value it has lost in the past years.

Image: ASX

Melbourne firm Peak Asset Management acted as corporate advisor and lead manager to ReNu’s capital raising.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.