The Clean Energy Council (CEC) has called for energy market reforms to accelerate the massive investments required for Australia’s renewable energy transition after a new report showed 2022 is the worst on record for new approved generation capacity.

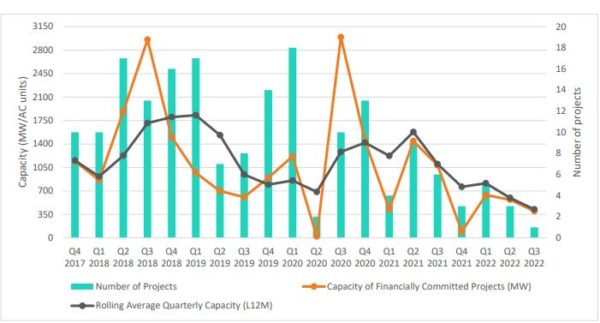

The CEC’s renewable projects quarterly report shows that only one project – ACEN Australia’s 400 MW Stubbo Solar Farm being developed in the New South Wales (NSW) central west tablelands region – reached financial close in the third quarter of this year.

Three new projects commenced construction in the third quarter, totalling 902 MW of capacity, while two projects were commissioned, adding another 127 MW into the network.

This was 169 MW less (-29.7%) than the second quarter of the year and 683 MW down (-63.1%) on the same period 12 months ago. The rolling quarterly average of financially closed new capacity over the past 12 months fell by 28.7% to 426 MW, down from 596 MW in Q2 2022.

The total quarterly investment in financially committed new projects reached $418 million (USD 282 million) in the quarter, down 59.3% on the previous quarter, and 75.8% less than the same quarter in 2021. This is its lowest level since data collection began in Q4 2017.

With modelling by the Australian Energy Market Operator (AEMO) indicating the need to build 45 GW of new wind and solar generation, plus 15 GW of storage by the end of the decade, to achieve the federal government’s target of 82% renewables by 2030, the report is a sobering reminder of the challenges ahead.

Image: CEC

CEC Chief Executive Officer Kane Thornton said the report “makes it abundantly clear that Australia’s clean energy transition has been throttled by years of policy uncertainty.”

“Industry confidence to invest is growing, aided by clearer and more potent policy directions across the country, but the investment trend over the past year shows that we need a sustained focus on the energy transition from all governments,” he said.

“We need to see more projects coming more quickly through state planning systems and policy settings that send consistent signals for ongoing investment.”

Thornton said it is critical the energy market adapts to address concerns with the increasing complexity in connections with grid connection remaining a major challenge for renewable energy projects.

“We need to fix the connection and commissioning process to get projects through all the hurdles and actually start producing power,” he said. “The connection process was designed years ago to account for a few hundred megawatts connecting every few years.

“This highlights the importance of accelerating the reform of the connection process to get projects connected faster.”

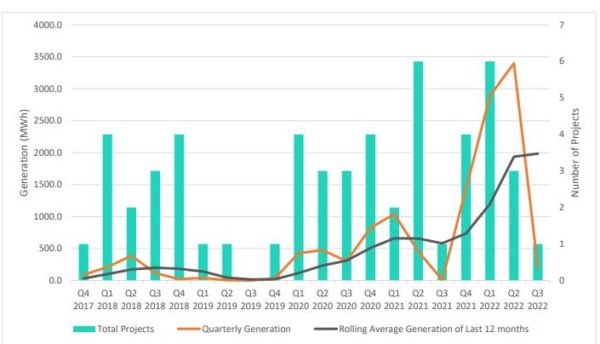

Despite the slowdown in new renewable energy generation projects, the CEC pointed to investment commitments in large-scale storage projects as a bright spot for the sector during the third quarter of 2022.

Image: CEC

While only one energy storage project – the 200 MW/250 MWh battery energy storage facility that will be co-located at the Stubbo Solar Farm – reached financial close in the third quarter, two other storage projects, representing 235 MWh of new capacity, began construction.

In addition, a record 14 new large-scale storage projects worth more than $2 billion were committed in the past year with the 12-month rolling average of energy output from utility-scale storage reaching a record high of 1,984 MWh – almost four times higher than this time last year.

Thornton said that this demonstrated a strong response from investors to the need for energy storage to support the transition to clean energy and manage the energy system but he acknowledged the levels must be accelerated into the future.

“We must provide the firming capacity needed to complement solar and wind generation and supply crucial system services such as system strength and inertia,” he said.

Of the energy generation projects, NSW contributed the most new financially committed projects and capacity over the past year, with its eight projects accounting for more than a third of new developments and 65% of new capacity. Victoria delivered six new projects accounting for 19% of new capacity, followed by Queensland with six projects (6% of capacity) and Western Australia with three (4% of capacity).

Since 2014, there have been 247 financially committed renewable projects in Australia, with 221 under construction and another 169 commissioned.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.