The Australian Energy Market Operator (AEMO) has today published the final version of its 2022 Integrated System Plan (ISP), outlining a 30-year roadmap of investments for what it said is “a true transformation” of the National Electricity Market (NEM), from fossil fuels to firmed renewables.

AEMO said the 104-page document, developed with involvement from more than 1,500 NEM stakeholders, calls for levels of investment in generation, storage, transmission and system services that exceed all previous efforts combined.

“Australia is experiencing a complex, rapid and irreversible energy transformation,” AEMO chief executive officer Daniel Westerman said in a statement.

“The 2022 ISP informs Australia’s energy transformation, based on an optimal development path (ODP) of essential transmission investments that will efficiently enable low-cost, firmed renewable energy to replace exiting coal generation.”

Australia’s traditional fossil-fuel fired generators are being replaced by consumer-led distributed energy resources (DER), utility-scale renewable energy, and new forms of dispatchable resources to firm those renewables but AEMO said it is critical the NEM provide the power system assets and services to ensure these resources are efficient, safe, reliable and secure.

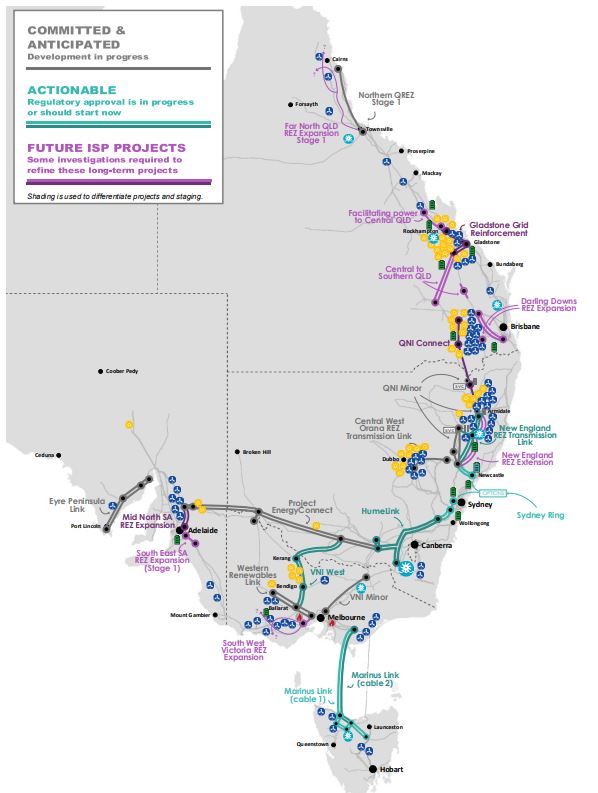

The market operator estimates at least 10,000 kilometres of new transmission is required to connect a nine-fold expansion of wind and solar farm capacity and a near five-fold increase in distributed solar by 2050 and to treble the firming capacity from alternative sources to coal, including utility-scale batteries, hydro storage, gas-fired generation, and smart behind-the-meter virtual power plants (VPPs).

Five transmission projects across New South Wales, Victoria and Tasmania have been highlighted as top priorities with AEMO saying they should progress as urgently as possible. The five projects – HumeLink, VNI West, Marinus Link, Sydney Ring and New England REZ Transmission Link – are all currently being assessed for regulatory approval or should begin that process soon.

The five priority projects are in addition to another seven transmission links, including Project EnergyConnect and the Victoria-NSW Interconnector Minor upgrade, already under development.

Image: AEMO

Westerman said the five priority projects would optimise benefits for all who produce, consume and transport electricity in the market; and provide investment certainty.

“These transmission projects are forecast to deliver $28 billion in net market benefits, returning 2.2 times their cost of $12.7 billion, which represents just 7% of the total generation, storage and network investment in the NEM,” he said.

As part of developing the ISP, AEMO and stakeholders identified the most likely future for the NEM, having considered ageing generation plants, technical innovation, economics, government policies, energy security and consumer choice.

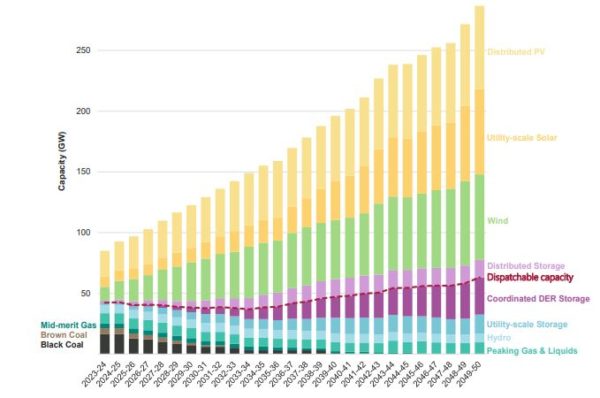

The ISP indicates the NEM must triple its overall generation and storage capacity by 2050 if it is to meet the economy’s electricity needs in the ‘step change’ scenario.

“The step change scenario forecasts annual electricity consumption from the grid will double by 2050, as transport, heating, cooking and industrial processes are electrified and 60% of current coal generation exiting by 2030,” Westerman said.

“To maintain a secure, reliable and affordable electricity supply for consumers through this transition to 2050, investment is required for a nine-fold increase in grid-scale wind and solar capacity, triple the firming capacity (dispatchable storage, hydro and gas-fired generation) and a near five-fold increase in distributed solar.”

Today the NEM installed capacity of nearly 60 GW delivers approximately 180 TWh of electricity to industry and homes per year. In Step Change, utility-scale generation and storage capacity would need to grow to 173 GW and deliver 320 TWh per year to customers by 2050 to serve the electrification of our transport, industry, office and homes.

The ISP forecasts that variable renewable energy (VRE) capacity will increase from 16 GW currently to 141 GW by 2050. Additionally, distributed PV is forecast to increase from 15 GW to 69 GW over the same period. To firm that VRE and distributed PV, 63 GW of firm dispatchable capacity and additional power system security services will be needed by 2050.

Image: AEMO

AEMO also expects that coal-fired generation will continue to withdraw faster than announced, with 60% of the eastern seaboard’s coal fleet to expire by 2030.

“Competition, climate change and operational pressures will intensify with the ever-increasing penetration of firmed renewable generation,” it said. “Current announcements by thermal plant owners suggest that about 8 GW of the current 23 GW of coal-fired generation capacity will withdraw by 2030. In the step change scenario, ISP modelling suggests that 14 GW would withdraw by 2030.”

Westerman said the need to cost-effectively deliver the investment in firmed renewables has gathered momentum in recent months.

“We’ve recently seen market dynamics exhibiting the step change scenario, including accelerated coal-fired power station closures. In addition, generation unavailability and high commodity prices further highlight the need to invest in the transmission plan outlined in the ISP to support firmed renewables,” he said.

“The ISP will help industry participants, investors, governments and communities plan for the decarbonisation of the power system to deliver low-cost, firmed renewable electricity with reliability and security.

“Importantly, the ISP will help meet state and national climate targets, and contribute to economic growth through low-cost, reliable energy.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.