Geelong, Victoria – formerly a major Australian auto manufacturing hub – will apparently soon host “one of the world’s largest gigafactories,” according to owner Recharge Industries. At full capacity, the lithium-ion battery cell production facility will generate up to 30 GWh of storage capacity per year.

The aim is to cater to both the electric vehicle (EV) and stationary energy storage markets. But as big as the EV market is set to become, Australia currently doesn’t have any EV manufacturers. It does, however, have a sizeable big battery project pipeline which will soon to be underpinned by a major federal underwriting policy, the Capacity Investment Scheme.

Recharge Industries, founded by New York-based David A. Collard, is part of the portfolio of another of Collard’s ventures, a fund called Scale Facilitation.

Scale Facilitation describes itself as neither private equity fund nor hedge fund, but rather says it is a “hybrid fund focused on scaling technology.” In an interview with Bloomberg, Collard said he raised funding for Recharge via Scale Facilitation and backers include Australian superannuation funds, asset managers and strategic investors. Recharge has had a base in Geelong, Victoria since 2021.

Image: Recharge Industries/LinkedIn

Accenture has been hired to design and engineer the Geelong gigafactory. Alongside Recharge, Accenture will now move the project into the detailed engineering phase, laying the foundations for construction.

During this period, Accenture will advise on the facility layout, assist in procuring and shipping the required equipment, conduct final tests of all line equipment, and provide ongoing process and product engineering support to improve battery production.

Equipment for the first 2 GWh production line has already been secured with binding off-take contracts and secured funding, Recharge said, noting the equipment is scheduled to arrive in Australia in May 2023.

Deepening trend towards shoring up new energy supply chains

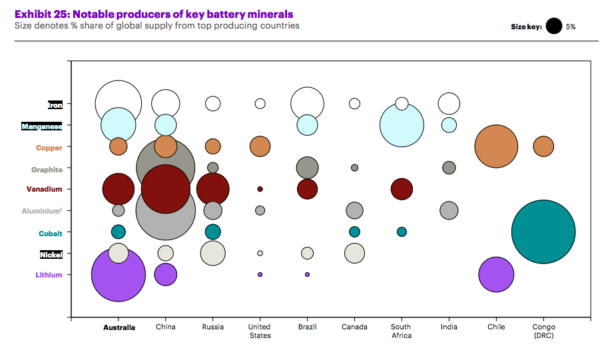

Today, China accounts for a vast majority of lithium-ion battery manufacturing. Australia, on the other hand, is the globe’s leading lithium supplier, and tops that list for a range of other commodities vital for making batteries and other renewable equipment.

Image: US Embassy Australia/Twitter

Speaking to pv magazine Australia recently, SunWiz founder Warwick Johnston said he has seen a real trend developing in the last year around building local ‘value adding’ capacity for battery markets, which includes things like refining, processing, and manufacturing from Australian-sourced material.

Australia currently does not have much ‘value add’ capacity, but it is surely growing with a number of lithium and other commodity refining and processing plants coming online in West Australia in 2022.

In terms of onshore lithium-ion battery manufacturing capability – a decidedly more complicated play than processing – there are a number of projects in the works.

Image: Supplied

For one, Australian company Energy Renaissance is preparing to transfer its lithium-ion battery manufacturing operations into a new $28 million purpose-built facility in the New South Wales Hunter region. Its plant has an initial battery production capacity of up to 300 MWh per annum, with plans to scale the operation up to 5.3 GWh.

In West Australia, developer InfraNomics Technologies and UK battery manufacturer Amte Power have set up a joint venture, Bardan Cells, with the vision of building production facilities in Australia’s “Lithium Valley” around Kwinana, south of Perth. InfraNomics and Amte announced their partnership plans back in 2020, and while there has been some formal movement since then, the project looks to be moving fairly slowly.

The Imperium3 Townsville (iM3TSV) Battery plant in Queensland, of which Magnis Energy Technologies owned a one third stake, had until recently also been on the cards. The Queensland government funded a feasibility study for the 18 GWh battery plant – but it has since been abandoned by Magnis Energy, who quietly announced in early January 2023 that it would no longer be proceeding with the plant.

Moving into other battery storage technologies, Queensland company Energy Storage Industries Asia Pacific is currently constructing a $70 million iron-flow battery manufacturing plant in Maryborough, Queensland, as part of a “deep tech partnership” with US company ESS Inc.

Image: ESS Inc.

There are a number of other projects seeking to produce downstream materials for the flow battery market, including vertically integrated plays from companies like Australian Vanadium and TNG, though these are more nascent.

While these projects have surely been in the works for more than a year, the push to localise and “friendshore” new energy supply chains has taken on a new sense of urgency with the shifting geopolitics of 2022, including Russia’s invasion of Ukraine. The move has also been propelled by President Biden’s Inflation Reduction Act, which includes massive funding support to build clean energy manufacturing capability in the US and, seemingly, partner countries like Australia.

Image: Future Battery Industries Cooperative Research Centre

While this path defies the logic of securing the cheapest possible products, it helps answer the growing problem of reliability – apparently a priority for the US.

Coming back to Recharge Industries and its manufacturing plans, founder Collard described Australia as the “Saudi Arabia of the new energy age,” to Bloomberg, noting it has all the key critical minerals to power the next 100 years.

With its headquarters in the US, Recharge is reportedly looking to manufacture its batteries in Geelong without sourcing materials from either China or Russia.

Recharge’s technology partner for battery manufacturing is another US company, Charge CCCV, better known as C4V. (C4V is also the technology partner on the Imperium3 Townsville battery plant project.)

C4V will provide Intellectual Property (IP), a qualified supply chain, blueprints and technology concepts for battery manufacturing, Recharge said. It will work closely with Accenture to adapt C4V’s IP to the conditions and requirements of the Geelong manufacturing plant, it added.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.