From pv magazine Global

CATL is reportedly offering sharp discounts on battery purchases to its strategic clients, including major Chinese automotive manufacturers such as NIO, Li Auto, Huawei, and ZEEKR. The Chinese battery manufacturer, which produced 37% of the world’s electric-vehicle batteries in 2022, will not offer such discounts to its largest customer, Tesla, which operates a gigafactory in Shanghai.

Based on the proposal, which has yet to be confirmed, OEMs will be able to produce 50% of batteries in their contracts with CATL with battery-grade lithium carbonate, at costs of CNY 200,000/mt ($43/kg) per metric tonne, provided they agree to source 80% of the battery demand from CATL in the first three years. The remaining 50% of the batteries will be priced at spot market prices.

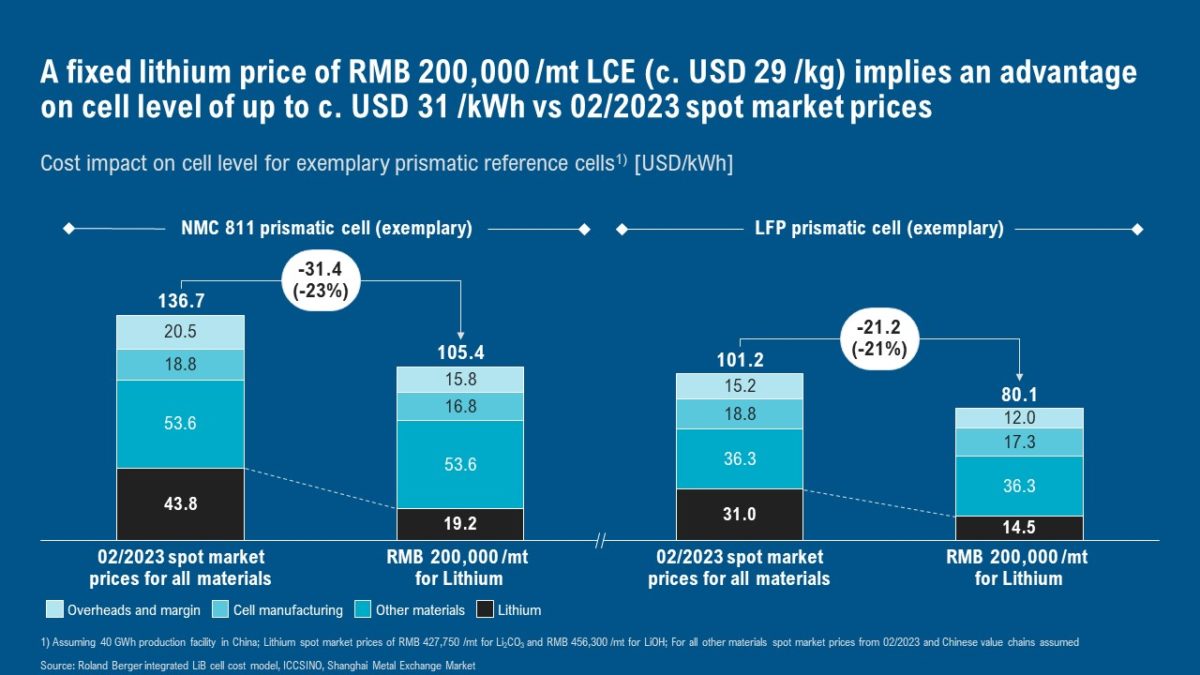

Comparing to spot market prices of currently around RMB 456,300/mt for lithium hydroxide and RMB 427,750/mt for lithium carbonate, the impact for NMC811 only based on the lithium is around USD 24.6/kWh ($36.6/kWh), Munich-based consultancy Roland Berger calculates.

“Considering a lower value of scrap in the production and lower markups based on fixed percentage values, we end up at USD 31.4/kWh. For LFP cells, the respective numbers are USD 16.5/kWh and USD 21.2/kWh,” Wolfgang Bernhart, partner at Munich-based consultancy Roland Berger, tells pv magazine “This represents a potential cost advantage of more than 20% compared to spot market prices.”

CATL is able to offer such prices because it secured significant amounts of lithium through direct investments. The list includes CATL’s own mining subsidy, Guizhou Shidai Mining, 8.5% stakes in Pilbara Minerals in Australia, and a 24% stake in AVZ Minerals in the Democratic Republic of Congo. It also includes the acquisition of Sinuowei with access to a 24.9 mt reserve and the joint development of the world’s greatest lithium reserves – the Uyuni and Oruro salt flats in Bolivia – with China Molybdenum (CMOC).

“Once again it becomes clear,” said Bernhart. “Competitiveness of battery cell manufacturers will be decided on the playground of raw material access.”

Price war

Cell manufacturers have been increasingly focused on securing raw materials through either long-term agreements (LTAs) or direct investments. Most of the currently observed LTAs offer price advantages of 5% to 25% compared to spot market prices. Prices are reassessed quarterly based on an agreed formula, but also a few contracts with fixed lithium prices can be observed, according to Roland Berger.

In addition, major cell manufacturers start to vertically integrate into mining and refining projects through direct investments, which gives them the opportunity to source material to a cost basis.

While some industry analysts see CATL’s move as an industry response to the US Inflation Reduction Act, others say that the battery manufacturer is simply passing on the benefits of its longer-term lithium offtake contracts. Either way, this will likely help CATL to retain some of its key customers in China as electric vehicle sales dip and market sentiment for battery materials and EVs turns bearish.

Bearish lithium outlook

Norwegian-based consultancy Rystad Energy says this proposed discount on lithium in the pricing mechanism reflects the oversupplied battery markets in China, with domestic cell production hitting a 60% surplus in 2022. It says the domestic Chinese battery-grade lithium carbonate price was CNY 486,000/t in January 2023, down 18% from the record high of CNY 593,000/t in November 2022. However, the current price is still 40% higher than it was in the same period last year.

It is estimated that the lithium carbonate prices in China will drop by 40% in the fourth quarter from current spot levels. Rystad Energy’s battery cell cost model shows that if the condition for prices of other materials remains unchanged, and battery-grade lithium carbonate price drops to CNY 200,000/MT, then battery cell costs will decline 22.6% and 24.1% for LFP and NMC523 cells. respectively.

By mixing the proposed lithium carbonate price and market price with a 50-50% ratio, battery cell costs will decline 11.3% and 12.2% for LFP and NMC523 cells respectively, Rystad calculates.

“It is probable that CATL’s proposal could cause other cell manufacturers in China to take similar actions in order to secure existing clients,” says Susan Zou, vice president of Rystad Energy.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.