Now called Gaw Maoneng Renewables, or GMR Energy, following a majority buyout from private Hong Kong firm Gaw Capital Partners in late 2022, the company is progressing its 1.3 GW portfolio of storage projects across Australia’s east coast, albeit on a delayed timeline.

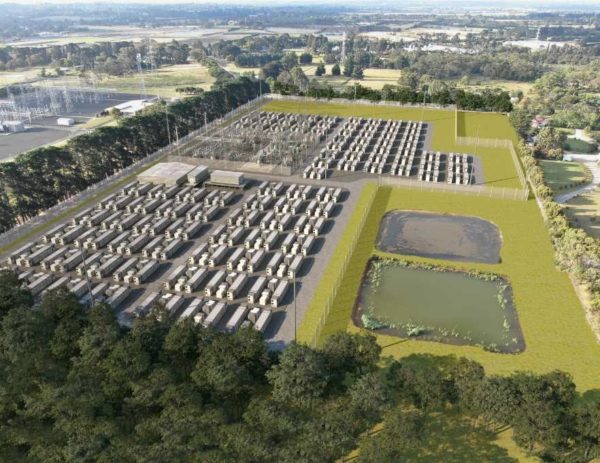

The standalone 240 MW / 480 MWh Mornington Battery Energy Storage System (BESS) south of Melbourne will be the first cab off the proverbial rank, following the company’s pivot from solar to storage around 2021.

The Mornington project has secured both development and connection approvals, and GMR Energy’s CEO Morris Zhou says its partner, Victorian network AusNet, has now begun early works and is procuring long-lead items. To this end, Zhou noted supply chain disruptions have led to a “significant bottleneck in the availability of transformers and other materials required.”

Image: Maoneng

AusNet will build the transmission infrastructure required for the Mornington project, which sits adjacent to AusNet’s existing Tyabb substation.

GMR Energy says it is also in “final negotiations” with the engineering, procurement, and construction contractor to build the Mornington battery, though which company has won the contact has not been revealed.

The Mornington project will rely on energy arbitrage and supplying frequency and grid control services to generate revenue.

GMR Energy’s project pipeline

GMR Energy has another five projects in its pipeline, including the 225 MW/450 MWh Gould Creek BESS near Adelaide in South Australia, which also has development application (DA) approval. Alongside this, the company has lodged DAs for three battery projects in New South Wales, including a 150 MW project in Armidale, a 200 MW project in Tamworth and a 100 MW project in Lismore – all of which will have two hours storage duration.

All of these projects will miss their originally forecast completion dates, which then-named Maoneng had slated for either this year or last. It is worth noting the company did seem rather ambitious in its initial timelines, frequently forecasting just a year between public announcements and completion.

Image: Maoneng

In May 2022, the company also publicly announced its biggest project to date, the $1.6 billion Merriwa Energy Hub, which comprises of a 550 MW solar farm and a 400 MW/1,600 MWh battery energy storage system in the NSW Hunter region, about 180 kilometres north-west of Newcastle.

Maoneng to GMR

In October last year, Hong Kong real estate firm Gaw Capital Partners took a majority stake in the company, leading to its name change. Maoneng co-founder-cum-GMR CEO, Morris Zhou, said the investment would help the company realise its storage project pipeline, estimated to require upwards of $2 billion.

Finance has long been an issue for storage and battery projects since revenues, while often lucrative, cannot be guaranteed in the same way they can with other renewable projects, leading to hesitation from banks and other traditional lenders.

Zhou told the Australian Financial Review in October: “As a developer, once a project is done it’s out the door because we need to get cash flow, we were at the mercy of the market.”

“Being a renewable developer backed by institutional shareholder [Gaw Capital Partners] means that not only will be able to fast track these projects, but also have holding power.”

In terms of the Mornington project, GMR Energy says the battery will be funded with equity and debt through the support of Gaw Capital Partners and its existing stable of institutional investors.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.