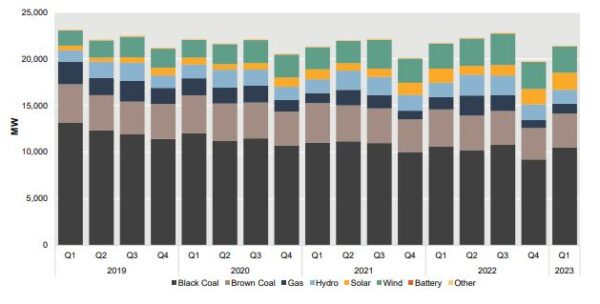

A new report from the Australian Energy Regulator (AER) highlights that both large-scale solar and rooftop PV generation reached record highs in the January to March quarter, helping push down the cost of power across the National Electricity Market (NEM).

“Across the NEM, large-scale solar output achieved an all-time quarterly record and was up 22% on a year earlier, accounting for 9% of the total generation mix in the quarter,” the AER says in its latest Wholesale Markets Quarterly Report. “Rooftop solar output also hit a new record.”

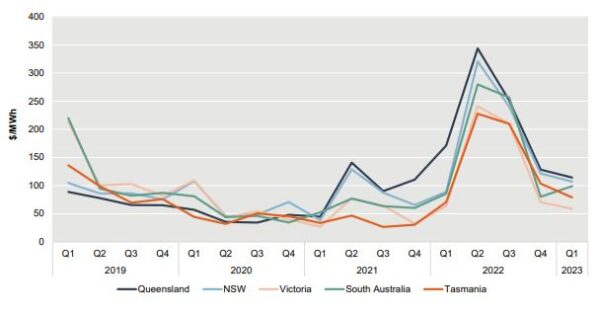

The AER said the increase in both large-scale and rooftop solar output contributed to downward pressure on prices across the market with average quarterly prices ranging from $64 per MWh (USD 43/MWh) in Victoria to $114/MWh in Queensland.

Comparisons to prices at the same time last year vary by region with prices lower in Queensland but higher in New South Wales, South Australia and Tasmania. They were about the same in Victoria.

Image: AER analysis using NEM data

The AER said lower average prices across most regions occurred despite an increase in demand while heatwave conditions experienced across several regions during the quarter produced several acute high-price events that resulted in average prices being higher than they otherwise would have been.

“These high-price events were concentrated in evening periods where solar output was relatively low,” the regulator said.

“This is consistent with a longer-term trend of deepening separation in market dynamics between periods of solar availability and unavailability which are directly associated with specific times of day.”

Image: AER analysis using NEM data

AER Chair Clare Savage said the report, which showed forward prices for electricity stabilised during the early part of 2023, is unlikely to impact the Default Market Offer (DMO) for the coming year.

“Despite an increase in March, (forward base futures prices) remain well below levels observed in 2022,” she said. “It also appears that the coal price cap interventions continue to place downward pressure on electricity prices, together with strong renewable output.”

“At this stage, the late quarter increase in base futures prices does not appear to be having an impact on likely DMO outcomes, but we will continue to monitor contract prices head of releasing our final DMO determination in May.”

The regulator’s DMO for 2023-24 will be released by May 26.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.