The Value-Added Critical Minerals Bilateral Agreement for Australia and South Korea report urges the Australian government to form a strong international relationship with South Korea, with one eye on the United States’ Inflation Reduction Act (IRA).

The $1.2 trillion (USD 800 billion) economic stimulus created from the IRA and Department of Energy’s (DoE) Loan Program Office funding has been the catalyst for an investment race in global decarbonisation technology. A significant part of the funding is dedicated to energy storage, namely batteries.

The IRA has been responsible for major growth in manufacturing in the U.S., and battery and electric vehicle (EV) industries have been central to the boom, with South Korea already a key player in battery technology and manufacturing.

South Korea is the second-largest battery producer in the world behind China, with three of its majors accounting for over a quarter of the EV battery manufacturer market share in 2022. The country has already made significant investment to supply downstream battery facilities to the US, and is the largest foreign investor into new battery facilities in the country.

The report suggests that allied nations, such as Australia and South Korea, should now look to leverage the stimulus through supply chain investment and capacity.

Australia’s abundance of critical minerals and mining expertise means it is perfectly positioned to capitalise on a bilateral agreement that focuses on battery supply chains.

The need for a stable, long-term lithium supply is central to South Korea’s manufacturing growth. While Australia is the largest lithium producer in the world, South American nations such as Chile, Argentina and Bolivia, as well as Indonesia, are all well-placed to compete and have existing trade relationships with Korean firms.

In 2022 Australia produced nearly half of all extracted lithium, with the majority exported in an unprocessed state to China. Several Western Australia producers have begun producing battery-grade refined lithium hydroxide, the precursor for battery cathodes.

Refining partnerships

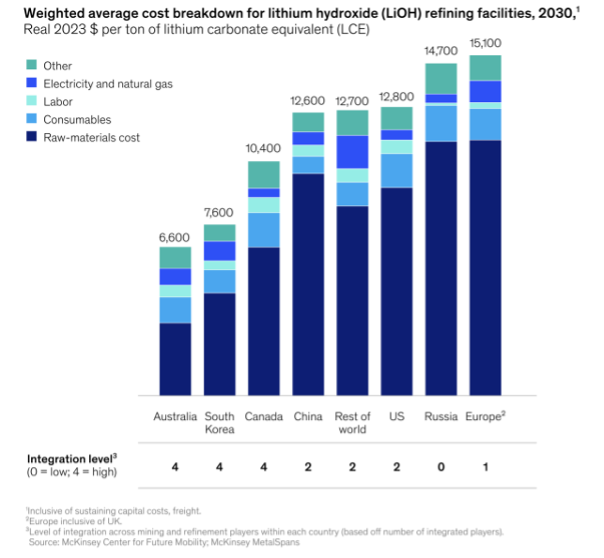

Australia’s refining process, which uses hard-rock mineral supply to produce hydroxide, provides the country’s lithium producers with a significant competitive advantage compared with those in South America. The CPE report quotes economic modelling from a McKinsey study that found Australia could produce lithium hydroxide up to 52% cheaper than the rest of the world by 2030.

“Australia must now, as a key strategic priority, work constructively with South Korea to ensure both economies are dealt into the North American value-added cleantech opportunity, and to leverage our combined world-leading capacity and skill sets,” authors Matt Pollard and Tim Buckley state in the report.

“Harnessing Australia’s world-leading expertise in mining and mineral extraction/processing and renewable energy resources, and leveraging Korea’s world-leading battery IP and technology, there is potential to become a joint powerhouse in the global battery midstream market, capitalising on the generational opportunity of the IRA.”

The report also suggests Australia must commit more resources and industry support to take advantage of its own partnership with the U.S., the Climate, Critical Minerals and Clean Energy Transformation Compact announced in May.

The Central Energy Fund estimates Australia will need $100 billion of public capital to ‘crowd in’ $200 billion of private investment.

The Federal Government’s recently released Critical Minerals Strategy 2023-2030, CEF notes, is a “missed opportunity”, and lacks the necessary ambition and support to leverage Australia’s competitive advantage in critical mineral and renewable energy resources.

The report suggests the $500 million (USD 334.3 million) investment committed by the Albanese government falls well short of the requisite funding to build scope, scale and speed to leverage Australia’s opportunity to become a world leader in value-added critical minerals.

Opportunities beyond South Korea

Within Australia, states are already beginning to look abroad for critical investment opportunities, including with other major lithium-producing nations.

The Western Australian government this week signed a Plan of Action with Indonesia’s Chamber of Commerce, in a move that will promote investment and collaboration in value-adding critical minerals and battery industries.

“We’re committed to growing the State’s participation in global battery and critical mineral supply chains, with a view to further developing our value-adding and manufacturing industries,” WA’s freshly installed premier Roger Cook said in a statement.

“Working with Indonesia, an important trading partner and our closest neighbour to explore partnerships, share information, knowledge and strategies and facilitate business links will fuel our mutual economic growth and green ambitions.”

The agreement encompasses three pillars of co-operation, which are: to develop resilient and sustainable supply chains; support strong environmental and social governance outcomes; and grow a skilled workforce.

Author: Chad Bennett

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.