The Western Australian government’s two long-duration big battery projects in Collie and Kwinana, both south of Perth, were first unveiled in May. Today, the government announced it has awarded more than $1 billion (USD 644 million) in battery and inverter supplier contracts for the huge storage projects.

Chinese company Contemporary Amperex Technology Co. Limited, better known as CATL, has been contracted to supply around 950 of its EnerC Plus containerised battery systems for the two batteries.

Of those, around 650 units will be for the 500 MW / 2,000 MWh (or 2 GWh) Collie big battery – which will help replace the district’s two soon-to-be-retiring coal plants.

Image: International Graphite

The other ~300 EnerC Plus battery systems will be used in the stage two extension of the Kwinana big battery. Work on the extension begun in June, and will see a second 200 MW / 800 MWh battery built alongside the existing 100 MW / 200 MWh battery. Stage two of the project is slated for completion at the end of 2024.

In the announcement, WA Energy Minister Bill Johnston noted the first 100 MW Kwinana battery “is now storing energy and discharging into the grid.” CATL also provided the battery systems for that initial project, totalling 600 units, according to Johnston. It would seem those earlier CATL systems had a lower capacity than the newly contracted EnerC Plus units, as the number of units to capacity is inverted between the two stages. That is, 600 units were used in stage one to deliver 100 MW / 200 MWh while just 300 units are set to deliver 200 MW / 800 MWh for stage two.

Both batteries are located at site of the decommissioned Kwinana Power Station about 30 kilometres south of Perth.

Spanish company Power Electronics has been contracted to supply inverters for the big battery projects, with 72 inverters awarded for the Kwinana battery extension and 160 inverters for the Collie battery.

Both projects will be operated and managed by Western Australia’s (WA) government-owned “gentailer,” Synergy. Like Queensland, the state is opting to directly invest in clean energy technologies and retain operating rights.

“These contracts, worth more than $1 billion, represent a major and important investment by our government,” WA Premier Roger Cook said. In total, the projects were allocated $2.3 billion in May’s state budget.

Both batteries have four hours of duration – a longer-duration market Australian big batteries have only recently started moving into.

French renewables giant Neoen is also in the process of building a big battery in Collie – which will eventually have an even greater capacity than the government’s at 1 GW /4 GWh. It will be Neoen’s longest-duration battery project so far.

Image: Neoen

In June, Neoen confirmed it had started construction – around the same time the company was awarded a contract by the Australian Energy Market Operator (AEMO) to provide almost all of the project’s Stage 1 capacity to help smooth the state’s solar duck curve.

Stage one involves less than a quarter of the project’s eventual capacity, at 219 MW / 877 MWh. Of that, 197 MW/ 788 MWh (or four hours of storage) has been contracted to AEMO. Given the contract kicks into effect from October 1, 2024, this would appear to be a hard deadline for the first stage to be delivered.

Neoen’s Collie battery will use Tesla’s battery systems and is to be constructed by UGL, owned by CIMIC Group.

Neoen had previously said it expected the Collie battery to be operational “by or before 2025,″ though it is not clear whether the company meant only stage one or the full scope.

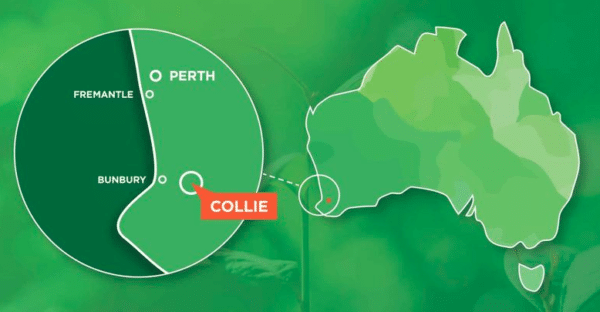

Collie’s transition

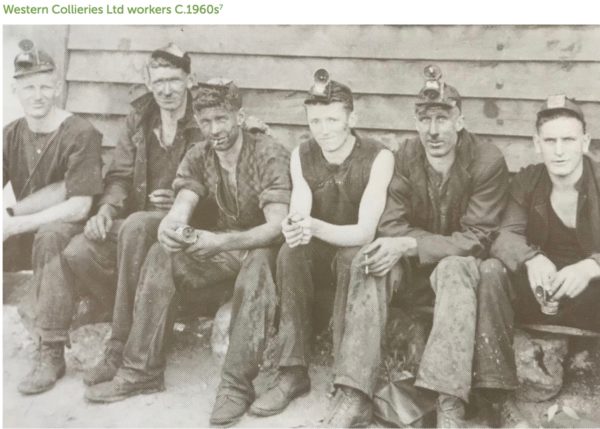

Collie, approximately 200km south of Perth, has been powering WA with its two coal mines and power stations since the 1880s. In 2022, however, the state government announced it would close these two plants before 2030, with the 854 MW Muja plant slated for retirement by October 2029, and the 340 MW Collie plant in October 2027.

Following the closure of these two power stations, the only remaining coal-fired power plant in WA will be the privately owned Bluewaters generator, also near Collie.

Image: Beyond Zero Emissions / Stedman, Catherine. 100 Years of Collie Coal. Curtin

University of Technology

Collie has become a focal point for governments in WA as they seek to provide the historic energy hub with a just transition. Funding has poured into the district, including the state government’s $662 million (USD 450 million) funding boost to entice new and emerging industry into the district. A number of renewable energy and technology companies have taken up the offer.

According to people familiar with the situation, community acceptance for Collie’s energy transition program remains mixed, especially among former coal workers. Jobs in renewables are not permanent, pay less and require greater skillsets than jobs in coal mining and power stations.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.