Perth-based mining companies Australian Vanadium Limited (AVL) and Technology Metals Australia (TMA) have announced they will merge via a proposed $217 million (USD 139 million) scheme of arrangement under which AVL will acquire all shares in TMA.

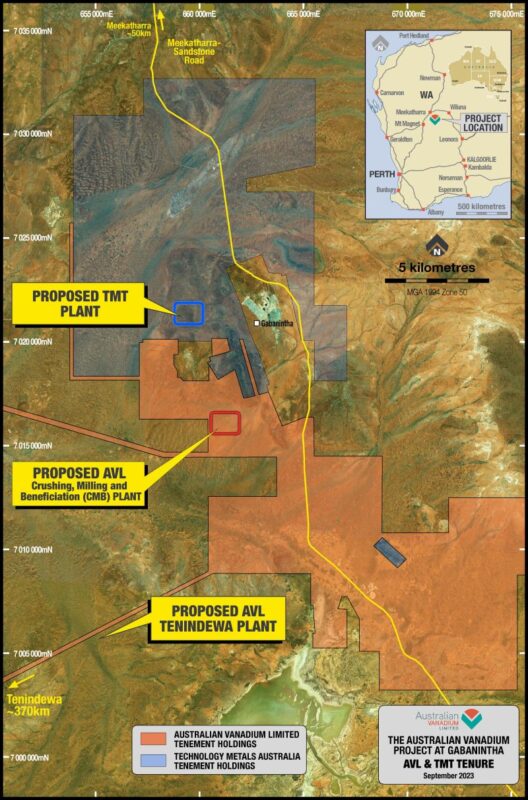

In a joint statement, the companies said the consolidation of the two adjoining projects across the Gabanintha orebody near Meekatharra provides a “unique” opportunity to realise operational and corporate synergies by creating a single integrated project.

AVL Chief Executive Officer Graham Arvidson said if successful, the transaction will “create a world-class asset of scale located in a tier-one mining jurisdiction.”

“The combination of Australian Vanadium and Technology Metals Australia is transformational for both companies and marks a significant milestone in both management teams’ efforts to develop their respective projects,” he said.

“The logical consolidation of two adjoining projects on the same orebody will unlock material synergies for both sets of shareholders.”

Arvidson said the transaction will “leverage the best of both organisations, including best-in-class technical work, assets and people, and will result in AVL becoming the leading force in the Australian vanadium sector.”

AVL said both of the mining projects are “significantly advanced” and will form part of its “pit to battery” strategy with the company aiming to turn the mined product into commercial vanadium battery electrolyte, catering to the rapidly expanding flow battery market.

The merger comes just weeks after AVL signed a new option agreement to purchase land for vanadium processing plant being developed at Tenindewa, near the port city of Geraldton.

TMA Managing Director Ian Prentice said the merger provides increased scale and scalability, with significant opportunities for expansion with the Gabanintha vanadium ore body “arguably one of the best undeveloped vanadium resources in the world.”

“This all comes at a pivotal time for the global vanadium industry as vanadium flow batteries are established as a critical player in the long-duration energy storage market, a key requirement for the world’s transition to net zero,” he said.

The scheme has been unanimously recommended by the Technology Metals board and the largest shareholder, Resource Capital Fund, has confirmed its intention to vote in favour.

AVL said it would also raise $15 million from a placement of new shares to support integration, ongoing project and corporate initiatives and general working capital and transaction costs.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Good knowledge