Is the traditional sales approach working for solar and battery installers, or could there be a better way?

In this article, I will explore the concept of ‘Feasibility First Value Selling’ and how it can be adopted to transform your sales process. If you’re not currently closing at least 80% of the proposals you send to businesses buying solar and batteries, this method could be a game changer for your company.

You’re probably thinking, “not possible,” right? I challenge you that it is possible and that some leading solar sellers already claim this. With the right tools and approach, it is absolutely possible to achieve sales that are less lumpy and with net profit margins increased from a typical industry average of around 2% to well over 5%.

In this article, we will explore:

- Traditional solar sales approaches and its flaws

- The new approach: feasibility-first and value selling

- How businesses can implement feasibility-first and value selling

- The impact to solar business profitability

Traditional solar sales – a race to the bottom on price

Solar companies commonly start as a couple of people with a truck, operating from their kitchen table and selling residential and small business solar systems as fast as they can screw them to a roof. Some of the biggest and best solar companies started like this including Gippsland Solar (acquired by RACV) and GEM Energy (acquired by RACQ).

As solar companies grow, they develop business processes and implement systems to streamline their operations. Solar sales software is commonly implemented to enable a solar business to efficiently and quickly design and price residential solar solutions. Unfortunately though, this has had the effect of locking in a “traditional sales” approach applied to all project sizes.

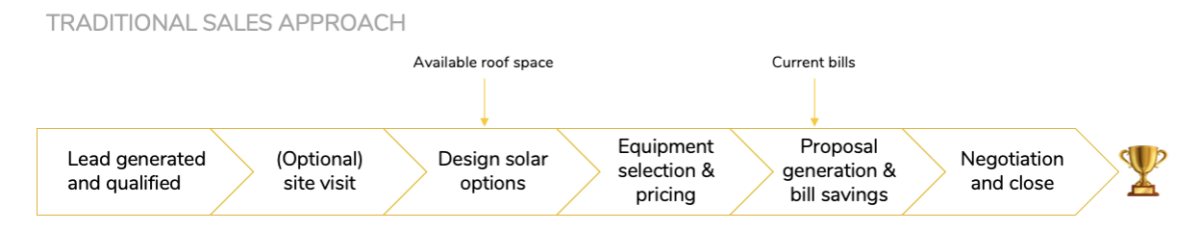

The traditional sales approach typically involves the following steps:

- Generating leads and qualifying them through phone calls.

- Conducting a site visit, if necessary, to assess various factors – roof, switchboard etc.

- Using the solar sales software, mapping panels to determine the system size.

- Selecting equipment and pricing options.

- Generating proposals and presenting basic bill savings.

- Presenting a single option to their customer to negotiate and close.

Figure 1 – Traditional sales approach used by solar installers

There are several problems with this approach:

- It’s a volume game – with literally thousands of registered installers in Australia, installers are likely sending out eight proposals for every ten leads generated and only converting one qualified lead (or less).

- It’s often a race to the bottom on price – some installers will consult with the customer, building rapport and ultimately converting at a slightly higher conversion rate and potentially gross margin, but the trade-off is a higher cost of sale. Generally, if the customer hasn’t selected their installer based on a recommendation or reputation, most customers will select on lowest price.

- There is lots of wasted effort – even with the early call to qualify leads, it’s hard to weed out the tyre kickers because how can you qualify the lead during an initial phone call or site visit? Prevalence of shading? Budget? These questions are hardly going to qualify the most important question – does the customer have willingness to spend? Therefore there’s lots of wasted effort designing and pricing a system and preparing a proposal, more if a site visit occurs.

- The value of the installation and “the why” is commonly unclear – perhaps some bill savings are presented to the customer, but “the why” for the sale and the technology choice are commonly vague or intangible with the value. In the last 10 years, the average residential system size has increased from 3.2 kW to 8.7 kW (Source: APVI) with little economic justification other than the price of installations coming down (on a $/kWp basis) so residential and small business customers could afford bigger systems for the same capital outlay.

As they grow, many solar installers take on more ambitious opportunities, selling increasingly larger systems to business customers. Many solar installers continue to employ these traditional sales approaches. These problems don’t go away, they get worse. The bigger the systems and the larger the clients, the more opportunity risk there is and therefore more time is needed to develop a proposal and the more wasted effort if the opportunity is not won.

When selling to businesses, solar installers also run into a new challenge – they start selling to individuals that are looking for a return on their investment.

A new approach: feasibility-first value selling

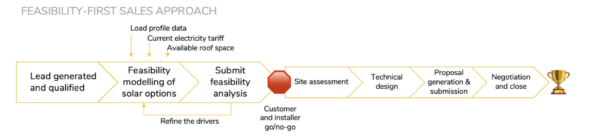

Feasibility-first is intended to flip the typical sales process, bringing forward the financial feasibility of projects that ultimately determine whether the project proceeds, and reserving more expensive engineering resources until the deal has a much higher chance of being closed.

The key principles behind this approach are as follows:

- It recognises that the customer will commonly be a “financial decision maker” – i.e. an individual making the purchase will make an investment decision based on a return on investment or payback.

- It recognises that, from the customer’s perspective, solar and battery solutions are largely commodified and homogenous regardless of the technology selection. A financial decision maker is unlikely to care whether it is panel option A versus panel option B.

- It brings feasibility to the start if the discussion and creates “the why” for the investment and the technology choices, and pushes back the deployment of engineering resources.

In summary, this consultative selling approach builds trust with the customer and identifies the solution that best meets the customers drivers, importantly without wasting any engineering effort.

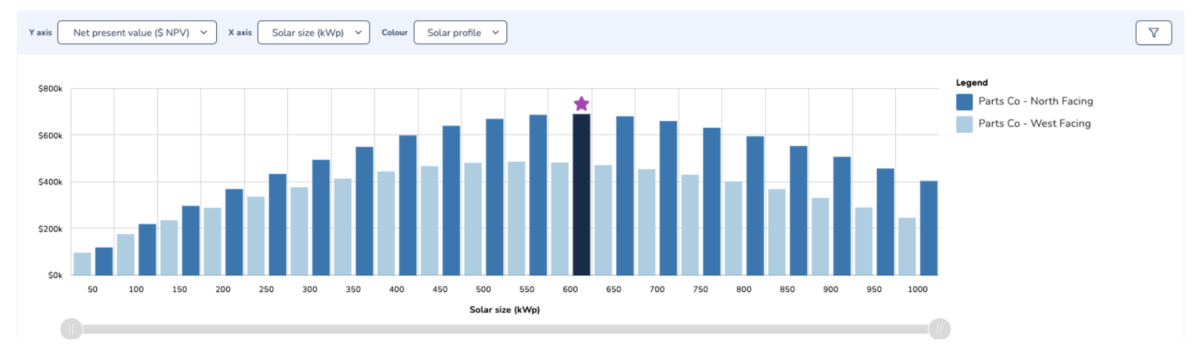

Figure 2 – An example of creating the “the why” in technology selection using Orkestra. Here we determined that a 600kW north-facing solar solution is optimal for this a manufacturing site as it generates the best Net Present Value (determined on a 15-year pre-tax basis).

The feasibility first sales approach is as follows:

- Like the traditional approach, start with qualifying the lead. When speaking with a customer start off by confirming the customer’s drivers and why they want solar and batteries. Are their drivers environmental, financial or something else? Also, confirm the customer’s budget and investment return expectations. In this call, also request a current electricity bill and, ideally (but optionally obtained later), one year of electricity load profile data.

(Side note – requesting data from the customer will provide you with the information needed to create a tangible baseline and makes them work a little for your service. If a customer isn’t willing to do even this amount of work, do you really want them as a customer?!) - Conduct a feasibility study that considers different size solar panels and batteries, and different battery value stacks. Using the load profile and electricity tariff details as the starting point for your analysis, evaluate the technology options based on estimated costs rather than precise figures. Your goal is to find the most suitable solutions that align with the customer’s priorities and emphasise the value they can provide, rather than just focusing on the project expenses. This is the stage where you put in the effort to explain “why” a specific technology solution is being recommended. You’ll have strong justifications for your selection when a customer asks about the reasoning behind your recommendation.

- Present the feasibility analysis to the customer and talk to them about the solutions modelled, capital outlay, the return on investment determined and consult with the customer on how the solution will meet their drivers. You may find that through this process you refine the drivers or identify new ones meaning you need to repeat the feasibility modelling.

This is where you need to stop. This is where we recommend forcing a go/no-go decision by the customer. Here we’d suggest trying to obtain a period of exclusivity or go as far as signing a contract where the customer pays for the engineering and design of a solution if they don’t proceed with your solution. This is easier said than done, but should definitely be the aspiration of all solar companies. It does not make sense that customers force the detailed design of a solar system by multiple installers.

Steps 4 – 7 for the feasibility-first sales approach then follow the same steps as the traditional sales – site assessment, technical design, proposal generation, negotiation and close. The difference is that the engineers have clear direction on what solution will meet the customers drivers and that the high cost resources are only deployed with confirmed/higher likelihood of sale.

Figure 3 – The feasibility-first sales approach

Sounds great – but is it possible to implement?

Yes, because technology is changing the game.

Feasibility value selling is not a new concept, but for a long time it has been just out of reach for most solar installers as it generally requires expensive engineering and analytical resources. The top solar companies in the country developed their own tools, typically built on Excel Spreadsheets. The problem with these solutions is that they are fragile and difficult for anyone but the original developer to use, making these tools unscalable.

Excel also suffers from a few other issues you may have experienced yourself:

- It is generally not user friendly, so often only analysts or other high cost resources can actually undertake the analysis, causing roadblocks and time delays.

- It can take hours or days to conduct the modelling as it’s not able to leverage cloud computing, and from there can take even longer to identify the optimal solutions that meet a customers drivers.

- It is very inefficient at solving multi-variate problems (read: lots of manual trial-and-error) that are created when you have more than one technology or site adjustment like a tariff change that you are trying to solve for.

- It’s incredibly difficult to have an accurate while flexible tariff model that doesn’t involve lots of manual changes to the tariff calculations.

- It can’t be used to mimic battery control systems that deploy linear optimisation algorithms common in today’s best-in-class control systems. (The alternative to optimisation in Excel is rules-based control [i.e. if-this-then-that logic] that inevitability under values the potential battery revenue or blunt addition of value stacks that over values revenue.)

This is where technology comes in, as a critical enabler for supporting faster, more accurate analysis and reporting. Feasibility modelling software solutions like Orkestra are solving all these problems (and more), finally enabling feasibility-first value selling to be undertaken by all solar installers, not just the “big guys” that can afford the best analysts.

Using feasibility modelling software, a solar and battery sales person or analyst can whip through hundreds of technology combinations and site adjustments like tariff changes in minutes. This process not only identifies the solution that best meets a customer’s drivers, but creates the rationale (i.e “the why”) for why it is the best solution and other options are not.

Feasibility-first value selling can be used to increase net margins

Organisations that embrace feasibility modelling software and feasibility-first value selling will discover they can:

- Reduce time for equipment sizing & feasibility modelling from hours down to minutes

- Reduce engineering time for more productive proposal generation

- Increase gross margin through value selling

- Higher conversion from faster speed-to-lead (i.e. sales responsiveness)

- Higher conversion from high-quality analysis

Most solar installers run on wafer thin margins, typically taking home a net profit margin of just 2% – 3%. We estimated all the benefits of feasibility-first selling and value selling, determining that it is possible to increase net profit margins to over 5%.

How do I start?

Your primary task is to empower your sales team to do easy, fast and accurate feasibility analysis. This requires you to:

- Implement a software solution (Orkestra provides a free trial here) to conduct project feasibility on new opportunities.

- Empower your sales team with basic training on commercial electricity tariffs, battery value stacks and equipment sizing.

- Support your sales team to speak the language of their customers and get them talking comfortably to metrics like net present value, internal rate of return and payback periods.

If you invest in your sales teams like this, you’ll be enabling a game changing new sales strategy for your business.

In summary

Feasibility-first value sales can be a powerful growth and profit enabler for any solar and battery installer selling to business customers. Through this strategy, solar installers can increase their net margins by up to 177%.

All together, data-driven, feasibility-first value sales will lead to lower cost of sales, greater sales conversions, higher capacity, faster processing times, better project scoping and ultimately greater business success.

About the author:

James Allston is the co-founder and co-CEO of Orkestra, a technology platform for feasibility analysis and sales of C&I energy projects. James has been working in the Energy industry since 2012 when he started in energy efficiency at Siemens.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.