From pv magazine ISSUE 11/23

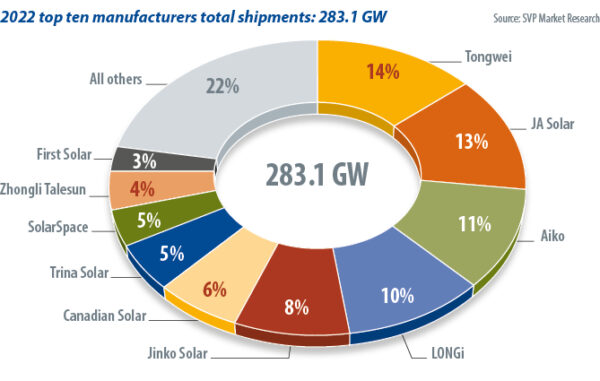

First Solar is not the only cadmium telluride solar manufacturer but it is by far the biggest. It is also the only thin-film company in the list of top 10 solar manufacturers by shipments in the 2022 ranking published by California-based SPV Market Research. First Solar is also in the top 10 in the latest ranking from Taiwan-based InfoLink.

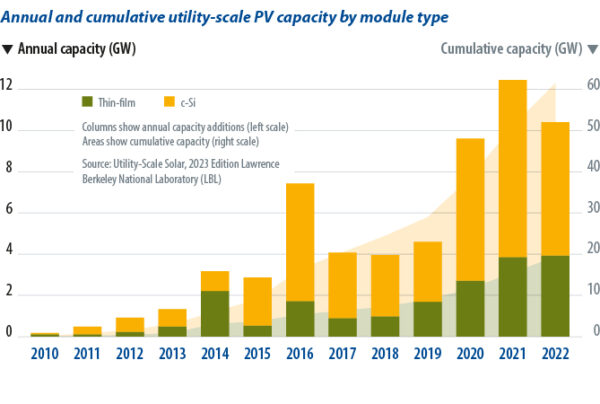

The Arizona-based company is expanding its share of United States utility-scale solar, the world’s second-largest PV market, according to the Lawrence Berkeley National Laboratory (LBL). It says that thin film has been gaining ground since 2018 hitting 19.6 GW of installed generation capacity in 2022. All the thin-film modules in the LBL sample were made by First Solar.

Paula Mints, chief market research analyst at SPV Market Research, said that First Solar had a 36% share of the United States utility-scale solar market in 2022. “I would look at their 2023 share of the US utility-scale market as similar,” she said.

As of September 2023, First Solar had 13 GW of operational capacity. It ended 2022 with 9.8 GW of nameplate manufacturing capacity, up from approximately 6 GW in 2020. Based on its capacity and market share, First Solar is competing in the mainstream PV market.

“First Solar has proven that thin film can perform very well in the field,” said Ayodhya N. Tiwari, head of the thin-film PV lab at the Swiss Federal Laboratories for Materials Science and Technology. “It bridged the gap between research labs and industrialised high-volume manufacturing: focused R&D with a long-term commitment to address industrial needs was key to success.”

First Solar, which has repeatedly produced efficiency-record breaking CdTe research cells since 2013, brought CdTe to a level of maturity, in terms of products, factory productivity, reliability, and environmental performance, to be able to reach scale and to grow under the current United States regulatory environment. Other thin-film technologies, featuring copper, indium, and selenium (CIS) and copper, indium, gallium, and selenide (CIGS) are, in the meantime, still addressing niche or emerging applications.

Tandem dream

To keep its position in the mainstream, First Solar is expanding capacity and investing in its technology roadmap. It is on track to reach 25 GW of global annual nameplate capacity in 2026, with 14 GW of that in the United States.

At its latest investor conference, First Solar presented a technology roadmap with an eye on competing with emerging crystalline silicon technology, such as tunnel oxide passivated contact (TOPCon). The US-based manufacturer listed a bifacial program, a copper replacement (CuRe) plan, an “advanced interconnect” aim, and two unspecified technology drives, aiming for 590 W to 600 W per module without increasing panel sizes.

CuRe is a novel method to embrace alternative materials. “Our CuRe technology replaces copper and creates a path to better bifaciality, lower degradation, improved temperature coefficient, and better utilisation of tellurium,” said First Solar Chief Technology Officer Markus Gloeckler.

The “advanced interconnect” program addresses laser scribing-related resistive losses and unproductive zones in the thin film stack – so-called “dead zones.” That technology has the potential to improve thin-film area utilisation.

“An advanced interconnect can reduce both these losses substantially,” said Gloeckler. “This process requires custom tools which have been deployed on a pilot line in Ohio and we are working towards de-risking the manufacturing aspects of this novel technology by next year.”

A new research and product development facility – the Jim Nolan Innovation Center in Perrysburg, Ohio – is also on the agenda. First Solar said it represents up to $370 million in investment.

The company also recently acquired Sweden’s Evolar, a CIGS and perovskite technology company. First Solar has been involved in CdTe-silicon tandem research in the past and the plan is to continue tandem cell work.

“With respect to configuring tandems, for the top cell there are only two practical known material choices today: CdTe or perovskites,” said Gloeckler.

He noted that perovskites are fundamentally thin-film semiconductors and there are well-documented challenges in commercialising and scaling up their production.

“However, there’s no other solar manufacturer in the world that has mastered commercialising and scaling thin-film photovoltaics to the extent that First Solar has which, we believe, puts us in an advantageous position,” he added.

Future thin film

Could the future be more expansive for thin-film technology innovators? “Thin films are already evident in heterojunction [HJT] solar cells,” said Swiss Federal Laboratories’ Tiwari, referencing the fact amorphous silicon (a-Si) is used with negatively-doped, “n-type” monocrystalline silicon substrates in HJT cells that are being produced by manufacturers from China, Europe, India, and South Korea.

“In any event, the next generation PV will be low-cost, highly efficient, and highly stable, which probably means tandem cells with a wide-band gap perovskite top-cell in combination with CIS, CIGS, silicon, or a compatible perovskite sub-cell,” said Tiwari.

Ulrich W. Paetzold, who leads the next-generation photovoltaics group at the Karlsruhe Institute of Technology (KIT), notes that when it comes to all-thin-film tandem cells, the top cell is “typically a perovskite composition with a wide-band gap absorber while the bottom cell, or sub-cell, is a narrow band gap absorber, typically CIGS or another perovskite composition”. His team is researching a range of tandem technology including bifacial, all-perovskite cells; scalable all-perovskite tandem modules with 19.1% efficiency in a 12.25 cm2 format; and perovskite-CIGS tandem cells certified at 24.1%.

A remarkable amount of research into all-thin-film tandem solar cells is under way. There have been notable breakthroughs in all-perovskite devices at the US-based National Renewable Energy Lab (NREL); the University of Toronto, in Canada; China’s University of Nanjing; and at KIT and the Helmholtz-Zentrum Berlin (HZB), both based in Germany. Participating companies include California-based startup Swift Solar, Chinese business Renshine, and Poland’s Saule.

Looking at this list of all-perovskite research groups, Steve Albrecht, head of the perovskite tandem solar cell department at HZB, said there are “many more around the world working on this fascinating technology.”

HZB recently announced an all-perovskite tandem solar cell with a certified efficiency of 27.2%, developed and manufactured at the institute where the team is also participating in SuperTandem, an EU-funded collaboration led by the Netherlands-based Organisation for Applied Scientific Research. The SuperTandem project website highlights the pursuit of all-perovskite, two-terminal metal-halide tandems in 100 cm2 modules. A low-carbon fabrication method will be used, including closed-loop recycling.

In 2020, the HZB achieved a certified record in perovskite-CIGS tandem technology, with 24.2% efficiency. More recently, Switzerland’s Federal Laboratories demonstrated a bifacial perovskite-CIGS device made in a low-temperature process that hit 19.8% efficiency for front side, and 10.9% rear-side efficiency. The organisation’s Tiwari sees 32% efficiency potential. The bifacial research will continue in Hi-BITS, a European Union project.

Another team working on CIGS-based tandems is Avancis, the German subsidiary of China National Building Materials. While it has been making inroads developing the market for building-integrated PV (BIPV) made with aesthetically finished CIGS modules, Avancis is also researching perovskite and CIGS tandem cells in a variety of band gaps, measured in electron volts (eV).

“We have started tandem development,” said an Avancis spokesperson. “We optimise our CIGS technology both for application as a bottom cell towards band gaps of 1 eV, and for a top cell towards band gaps above 1.5 eV.”

Evidently, there is room for more than one type of all-thin-film tandem technology, with differentiated properties to make an impact.

“Although it is still a research effort with some hurdles to overcome, perovskite-CIGS tandems have some advantages,” said Daniele Braga, head of sales at Fluxim, a Swiss developer of characterisation and modelling tools for emerging PV devices. “They can be produced on flexible substrates and, like all thin film technologies, they could have a significantly lower carbon footprint per kilowatt-hour, compared to perovskite-silicon tandem cells. Both the CIGS and perovskites have high radiation hardness, which is interesting for space applications such as flexible solar cells for satellites.”

Scaling up

Regardless of the material composition of perovskite tandem cells, stability and manufacturability are also on the research agenda. When it comes to industrial-scale processes for large area thin film cells, the choices are slot-die coating, sputtering, chemical vapour deposition, and thermal evaporation.

“There are basically two process routes for perovskite semiconductor material, either solutions or vacuum deposition processing,” said Paetzold, of KIT. The researcher explained that today’s thin-film PV manufacturing industry is “strongly focused” on vacuum-based deposition techniques for the absorber material. “Both routes are interesting. Either one could be a winner.”

Progress will depend on combining knowhow about encapsulation, material device architecture, and composition stability. But as Paetzold pointed out, further innovations from the field of material research are needed, such as new buffer and interlayers, “2D” perovskite heterostructures, and new or improved perovskite compositions. HZB’s Albrecht sees work ahead on material stability and the need to demonstrate scalable deposition at high production volumes.

“We’re around one order of magnitude away from where we need to be but I am still amazed by the progress in stability over the recent years” said Paetzold.

Fortunately, sources of interest in tandem technology are expanding. “There used to be a lot of push from the science and research community but now it’s a pull, not necessarily a market pull, but a pull from tech-oriented PV manufacturers like Longi or First Solar – also the established PV equipment manufacturers,” said Paetzold.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.