From pv magazine ISSUE 12- 2023 / 01 – 2024 | WINTER EDITION – GOLD STANDARD

Falling module prices have spurred demand in 2023. Projects postponed or canceled in 2022 have resumed construction and new projects have taken shape smoothly. Module demand in 2023 is expected to hit 412 GW to 455 GW, up 53% year on year.

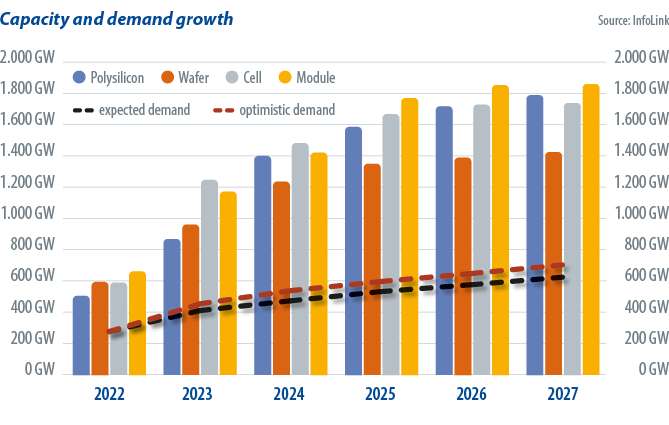

While module shipments increased, Europe and Brazil were hit by inventory pileups in 2023. Falling prices benefit project internal rates of return but labor shortages, policy changes, and project scheduling drove a mismatch between production and installation. With excessive inventory, some manufacturers are cutting prices or moving modules elsewhere, causing huge losses. Installation demand is likely to grow further in 2024 but will still lag production capacity. Oversupply will continue and will limit new production capacity. Overstocked manufacturers will be more cautious about production, shipping, and sales in 2024.

Solar growth is also subject to grid capacity. The solar boom has seen Brazil and some European countries delay or cancel small-scale projects due to grid constraints. Rapid rooftop installation growth in China has prompted local governments to address grid capacity but suspending small array connections and mandating energy storage is a stopgap measure. Upgrading grids requires investment and regulation.

Although solar growth will slow from 2023 onwards, due to a higher baseline, grid issues, and localization trends, the market outlook remains positive as module prices have plummeted, with module demand projected to see an increase of 15% to 20% in 2024.

Profit squeeze

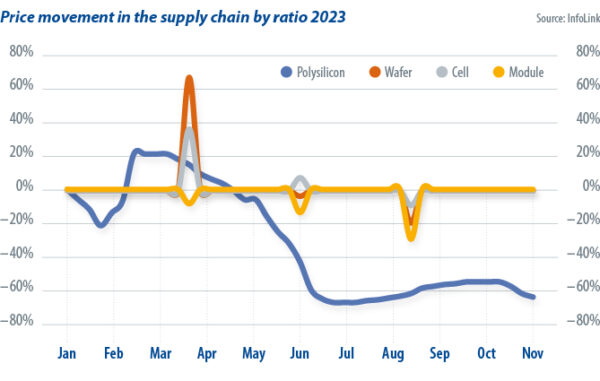

With solar production capacity expansion plans across the supply chain materializing in 2023, the polysilicon supply bottleneck eased, but rapidly expanded solar production facilities led to a serious surplus. Prices across the supply chain plunged in 2023. Polysilicon prices retreated from CNY 300 ($41.40)/kg year’s end 2022, to around CNY 69/kg currently, while module prices fell from last year’s $0.245/W to $0.135/W. Short-term price movements may occur in the future, when supply and demand changes, but as supply will still outstrip installation demand, prices are not likely to bounce back significantly, leaving more bargaining power to end users.

Rising solar production capacity helps industry development but it also leads to increasingly fierce competition between manufacturers. Having observed rapid market growth, better profits, and high prices across the supply chain in 2022, existing and new PV players announced expansion plans one after another, escalating competition and driving down prices.

Now that prices have plummeted, many manufacturers have little room left for profits, forcing them to adjust utilization rates in accordance with demand. Consequently, some older production lines were phased out at a faster pace and some new capacity plans have been cancelled as they are no longer profitable. More expansion plans are expected to be cancelled in 2024. Companies with poor cost control and insufficient sales channels may be forced out of the market.

Supply chain reshoring

Some countries have recently introduced protectionist measures for solar products and tried to build domestic capacity in pursuit of energy independence. Existing policies include the US Inflation Reduction Act (IRA) and an anti-circumvention investigation into Southeast Asian solar products. Other schemes include India’s basic customs duty on imported modules, its approved list of models and manufacturers, and the production-linked incentive scheme. Europe is evaluating the necessity of limiting solar imports as the market grapples with an influx of low-priced Chinese modules.

The solar supply chain remains concentrated in China, with Chinese polysilicon, wafer, cell, and module production capacity amounting to 93%, 97%, 90%, and 82%, respectively, of the global totals. Capacity outside China is unable to fulfil demand. If the European Union restricts solar imports before securing supply, installation volumes will fall. The United States experienced a 16% fall last year after the Uyghur Forced Labor Prevention Act restricted the import of modules featuring Xinjiang polysilicon.

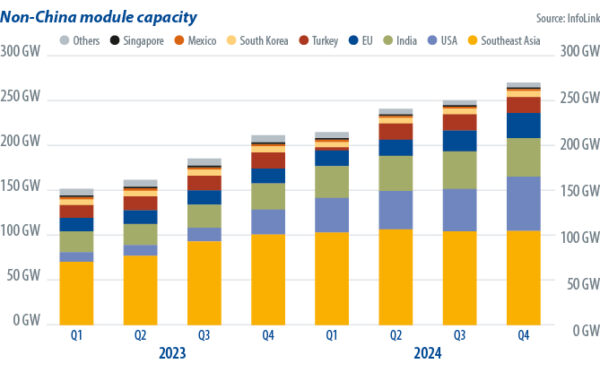

Driven by policy, 2023 brought overseas production capacity, especially in the United States and India, where facilities will come online in 2024. InfoLink’s statistics show annual module production capacity outside China will have increased at least 78%, to 270 GW over the early 2023 to late 2024 period. Some manufacturers are considering expanding capacity in Europe and the Middle East, which would change an industry landscape dominated by Chinese modules.

It is worth noting that these overseas expansion projects are mostly for modules, given entry barriers such as capital expenditure and technical difficulty for other links in the PV supply chain. There are a few cell expansion plans and scattered polysilicon and wafer projects. New cell and module players are unlikely to wean themselves off Chinese supply completely within two to three years.

Overall, the solar industry will continue to grow in 2024 despite the impact of grid capacity constraints and labor shortages on installations. Production capacity expansion and declining prices will drive demand effectively, providing bright prospects for solar developers.

Meanwhile, soaring manufacturing capacity, an intense price war, and technological shifts will challenge the supply side’s capability to control costs and invest in R&D and sales. The supply and demand landscape will become more complex and the industry will change more quickly as production capacities overseas come online.

About the author: Richard Chen is a solar research assistant at InfoLink. He is responsible for collecting the financial information and customs data of PV manufacturers. He monitors utility-scale project progress and auctions overseas and helps the analyst team to forecast demand.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.