Genex Power announced it has received an indicative, non-binding and conditional bid from Japan’s Electric Power Development Co, known as J-Power, to acquire all Genex shares it doesn’t already own. The offer represents a total valuation of approximately $380 million.

J-Power has already amassed a 7.72% stake in the Sydney-headquartered company and is a 50% joint development partner of Genex for its multi-staged Bulli Creek solar and battery storage project and its 150 MW Kidston Stage 3 Wind project, both in north Queensland. J-Power also extended a $35 million corporate loan facility to Genex in 2023.

The company is now seeking to acquire Genex in toto.

J-Power’s offer is by way of a non-binding scheme arrangement pitched at 27.5c per share with a 50.1% minimum acceptance condition. The offer also contains an alternative conventional takeover at 27c per share which J-Power proposes to make if Genex shareholders reject the scheme offer.

Genex said in a statement that its current intention is to unanimously recommend that its shareholders vote in favour of the scheme and, if the takeover offer is made by J-Power, accept it.

The revised offer comes after J-Power initially proposed a 24c per share scheme offer with a 23.5c alternative takeover in early February.

Genex, which listed in July 2015, said it has a committed portfolio of 400 MW and about 2.3 GW of renewable energy and storage projects in the development pipeline, including the flagship Kidston Clean Energy Hub in north Queensland.

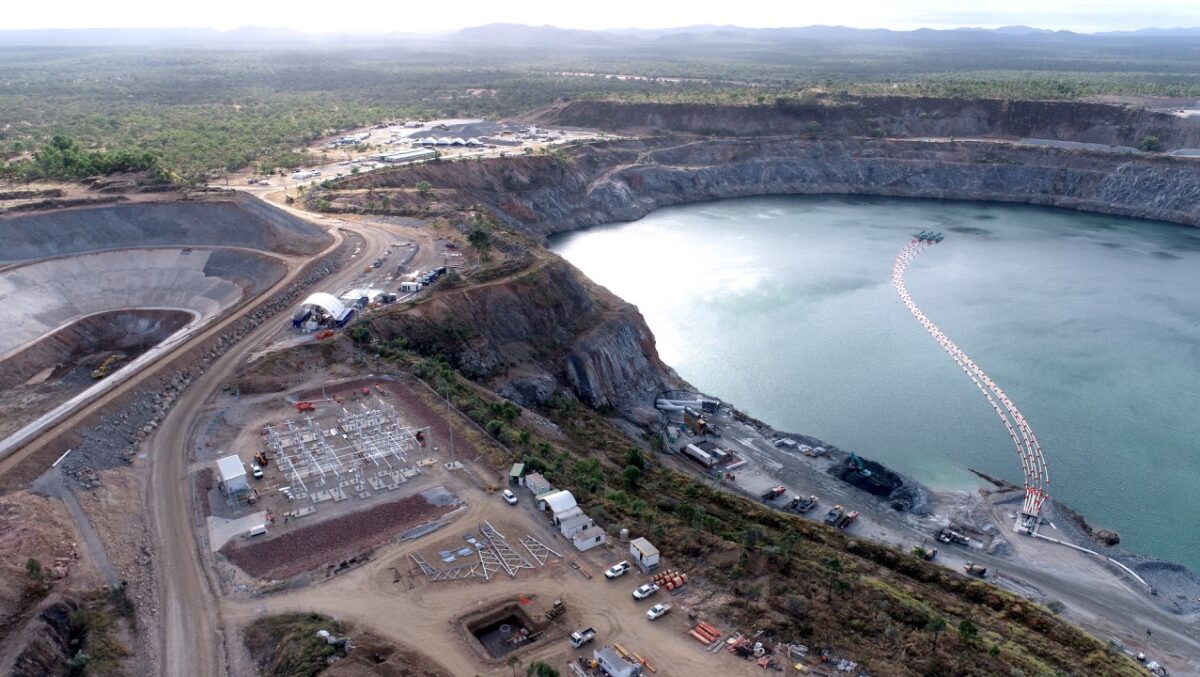

The hub includes an operational 50 MW solar farm and 258 MW of wind power and the 250 MW / 2 GWh Kidston pumped hydro project that is currently under construction. There is also potential for further multi-stage wind and solar projects to be deployed at the site.

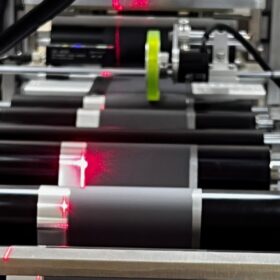

Genex also owns the 50 MW Jemalong Solar Project in New South Wales and the 50 MW / 100 MWh Bouldercombe battery energy storage system in central Queensland.

J-Power has said that it is committed to continuing its renewable expansion with the company targeting 1,500 MW or more of new renewable energy capacity by fiscal 2025.

The J-Power offer comes after Skip Capital and infrastructure investor Stonepeak Partners walked away from a joint 25c a share takeover bid for Genex in December 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.