New South Wales (NSW) distributed system operators Ausgrid, Endeavour Energy and Essential Energy got the regulatory go-ahead in April to begin charging “two-way fees”. The Australian Energy Regulator waved through the new charges, claiming it is a more equitable way of accommodating more solar generation on the distribution network.

And now we are getting an idea what the fees may look like.

Ausgrid, which serves a whopping 1.8 million customers in NSW, will charge $1.2 c/kWh on solar exported between 10am and 3pm. For evening exports, it will pay $2.3 cents/kWh – between 4pm to 9pm.

It isn’t yet clear whether or how retailers will pass on the new charges. And while there has been some hyperbole from all corners about slugging a fee on solar exports, it doesn’t seem an equitable outcome for people who have made the investment in rooftop PV. What is abundantly clear is that solar home-and-business owners won’t like it one bit. It will likely be yet another driver of distributed battery storage.

And it comes at a time when residential and C&I battery installations are already building momentum.

Beginning battery boom

The data collected by analyst SunWiz tells the tale of residential storage’s expansion. In its latest Australian Battery Market Report SunWiz found that 57,000 residential batteries were installed in 2023, with a storage capacity of more than 650 MWh – a new record for the Australian market. Year-on-year, the result represents 21% growth in residential storage installs.

And it’s a trend that SunWiz expects to accelerate in 2024. This year, the distributed market segment analysts expect approximately 70,000 residential batteries to be installed. So, what’s behind the growth?

There are a number of factors converging, and together they make for a compelling proposition.

More residential batteries are being sold because solar installers are increasingly realizing that selling batteries is good for their business. With PV module prices more affordable than ever, a solar-plus-storage system generates considerably substantially increased gross revenue per customer.

Image: CER

In rough figures, a residential battery costs come in around $10,000 for a 10 kWh system. This adds considerably to the total system revenue for the installer, when compared to a conventional rooftop PV system. And while the sales process will likely be more involved, with homeowners requiring consultation on system sizing, payback, use cases, and safety, it is an opportunity for installers to add considerable value to the end-customer.

In its recent Scaling the Residential Energy Storage Market report, BloombergNEF noted that, when it comes to residential batteries: “The average consumer … relies heavily on the installer for guidance.” And while providing quality advice may be time consuming, such guidance and positive customer experiences can build long-lasting trust and valuable customer referrals.

Hybrid progress

Thankfully, integrating batteries into their residential sales and installations is becoming easier for installers. Technological developments in the hybrid inverter space and the batteries themselves is making the battery value proposition simpler to demonstrate. Installations can be completed more quickly and the value the battery is delivering easier for householders to see for themselves.

While battery system prices remained stubbornly high, the value of residential energy storage lay primarily in its ability to provide backup power. And though keeping the lights (and beer fridge) on in the event of an outage remains important for some homeowners, particularly in areas where the network can be compromised by wild weather, electricity tariff structures are becoming a more powerful driver.

There is no doubt that there has been a sharp increase in public interest in batteries, which is a result of reduced FITs and increased electricity prices. Combined with installers seeing the value of batteries for their business and advancements in technology, it makes the perfect recipe for a big increase in home battery installations.

Important contribution

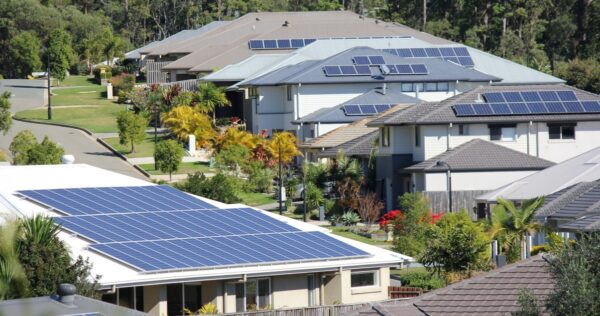

And with such high solar penetration, it’s vital for our electricity infrastructure to have more batteries in the grid. We are losing some of our solar generation due to export limitations. This limitation stops environmentally friendly electrons flowing into the grid, leaving space for electrons from coal and gas-fired generators. Due to constraints, solar power is being prevented from doing its important work.

In short, it makes perfect sense to store solar energy and use it later in the day and evening.

Utility companies should be promoting the battery uptake far more than they are, as it is in their interest. If you compare utilities with water corporations and see how active they are in supporting water saving measures and appliances that limit the use of water, electricity corporations are way behind in spreading the same message to the public – that they should be far more energy efficient.

Utilities appear to be doing far more on a medium and large scale – utility scale solar farms, battery systems, and community battery applications – but not so much with residential households. Admittedly, it is true that Origin and AGL have their own solar divisions where they are trying to make money by selling residential solar systems, which can be seen as that they are “doing something”, what is missing is a more educational approach to their customers. Instead, these utilities appear to be adopting solar sales as a business model where they try to make money from what they might see as a short-term “trend”.

It is very likely, as SunWiz forecasts, that battery installations in 2024 will increase and surpass 2023 numbers, despite current cost-of-living pressures. And there are reasons to believe that annual residential battery installations will exceed the 20% annual forecast.

Each day, a wider variety of products, and reduced pricing due to more production, are coming onto the market. More installers are getting into the business of battery sales and the public awareness of home energy storage continues to surge. While Australia currently trails countries like Germany and Italy, for battery attachment rates, there are good reasons to believe that we will catch up fast.

As we have for per-capita uptake of rooftop solar, Australia may very well take that mantel for residential battery installations soon. The ingredients are in place and there is no doubting the appetite from households.

Author: Durmus Yildiz, Managing Director, BayWa r.e. Solar Systems

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.