New analysis by industry consultancy Solar Nerds shows Formbay and One Stop Warehouse, which offer online trading platforms for certificates generated through the federal government’s rooftop solar rebate, have been the big movers following the fall of Greenbot.

Greenbot’s market share has been in sharp decline in recent months with the platform and affiliate Emerging Energy Solutions embroiled in controversy with hundreds of solar installers claiming the aggregators have traded millions of small-scale technology certificates (STCs) without passing payment on as they should.

The Clean Energy Regulator (CER) earlier this month permanently suspended Emerging Energy Solutions from participating in the small-scale renewable energy scheme after it went into liquidation earlier this year owing creditors more than $86 million.

The CER also suspended Greenbot’s registration, alleging that a failure of its platform had resulted in the improper creation of STCs. Greenbot however disputed the June ruling and in July, the Federal Court issued a temporary stay on the regulator’s decision.

While Greenbot remains free to trade rebate certificates for the installation of rooftop solar panels and other clean energy technologies, with the judicial review of the decision to suspend it expected before the Federal Court in Victoria sometime this month, the market has moved on its own.

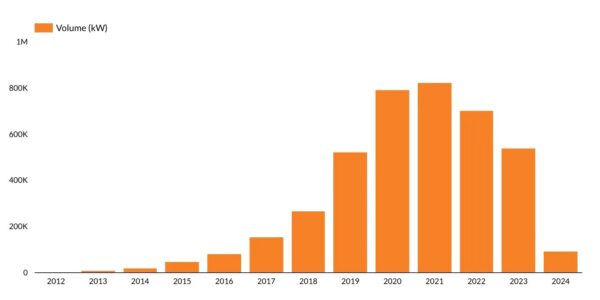

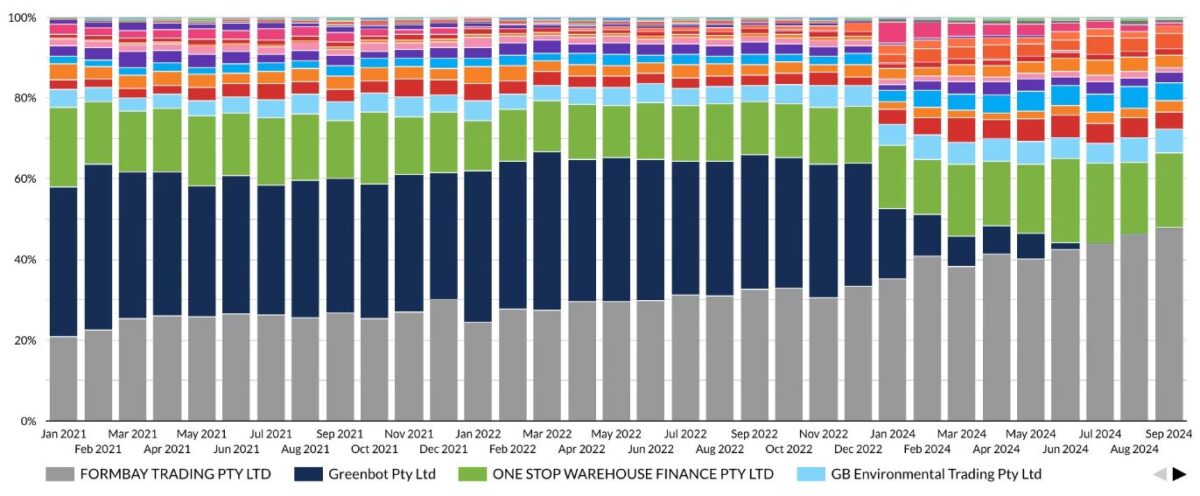

Image: Solar Nerds

Analysis by industry consultancy Solar Nerds shows Greenbot’s market share has disappeared in recent months.

Imraan Thanawalla, managing director of Solar Nerds parent company Solaris Finance, said rival STC trading platforms Formbay and One Stop Warehouse have claimed much of that business but there has been a more subtle shift in the market.

“You can see that Formbay has clearly had a big spike, and One Stop Warehouse, its numbers have increased too,” he said. “But the smaller STC traders seem to be winning as well.”

Thanawalla said that when Greenbot was trading well, the three majors accounted for about 80% of the market but Formbay and One Stop Warehouse currently account for approximately 65%.

“When you look at the charts, you can see that the smaller STC providers’ shares are increasing too,” he said.

Thanawalla said that while the market has undergone changes since the demise of Emerging Energy Solutions and decline of Greenbot, most installers have opted to find another aggregator to create and trade STCs on their behalf, rather than trading on their own.

“The charts show that nobody has come out of the Greenbot saga and said, ‘screw this, I’m trading on my own’. Maybe a few people have, but not enough to affect the aggregate numbers,” he said. “People are still trading with the traders.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.