Sydney-based Federation Asset Management has announced it will launch a multibillion-dollar platform that specialises in investing in long-duration batteries designed to enhance the country’s energy security and lower energy costs.

Federation, which manages more than $2 billion (USD 1.27 billion), said it sees significant investment potential in Australia’s energy storage market, citing strong risk-adjusted returns and the increasing need for grid stability as the amount of renewables entering the systems ramps up and the nation’s ageing coal plants retire.

“As Australia continues to expand its renewable energy capacity, particularly solar, storage solutions are critical to ensuring a reliable and cost-effective electricity grid,” the firm said in a statement. “Battery energy storage systems (BESS) offer an efficient solution to both grid stability and surplus energy storage.”

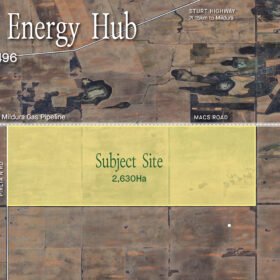

Federation, which teamed with Edify Energy to deliver the 150 MW / 300 MWh Riverina and Darlington Point battery energy storage systems in New South Wales (NSW), estimates that Australia’s battery energy storage sector represents an investment opportunity exceeding $100 billion.

Federation Partner Stephen Panizza said significant investment in infrastructure, technological advancements to improve storage efficiency, and coordination of storage systems are essential to meeting Australia’s growing demand for renewable energy.

“BESS is proving to be an excellent asset class – multiple revenue sources, low construction risks, minimal environmental impact, and low operating costs – all while playing a critical role in energy security,” he said.

Panizza told the AFR that Federation has committed between $10 million and $30 million to the new platform with the aim to have between six and eight separate battery projects with a combined capacity of about 4 GWh ready to take to financial close by the end of 2027.

The batteries are likely to be located across NSW, Queensland and Western Australia and will be supported by long-term offtake contracts, with some exposure to the spot market.

“To support continued growth in solar generation, lower energy costs, stabilise the grid and enable the retirement of aging coal plants, large-scale investment in BESS is essential,” Panizza said. “Federation is committed to leading the way and to remain at the forefront of Australia’s energy storage sector.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.