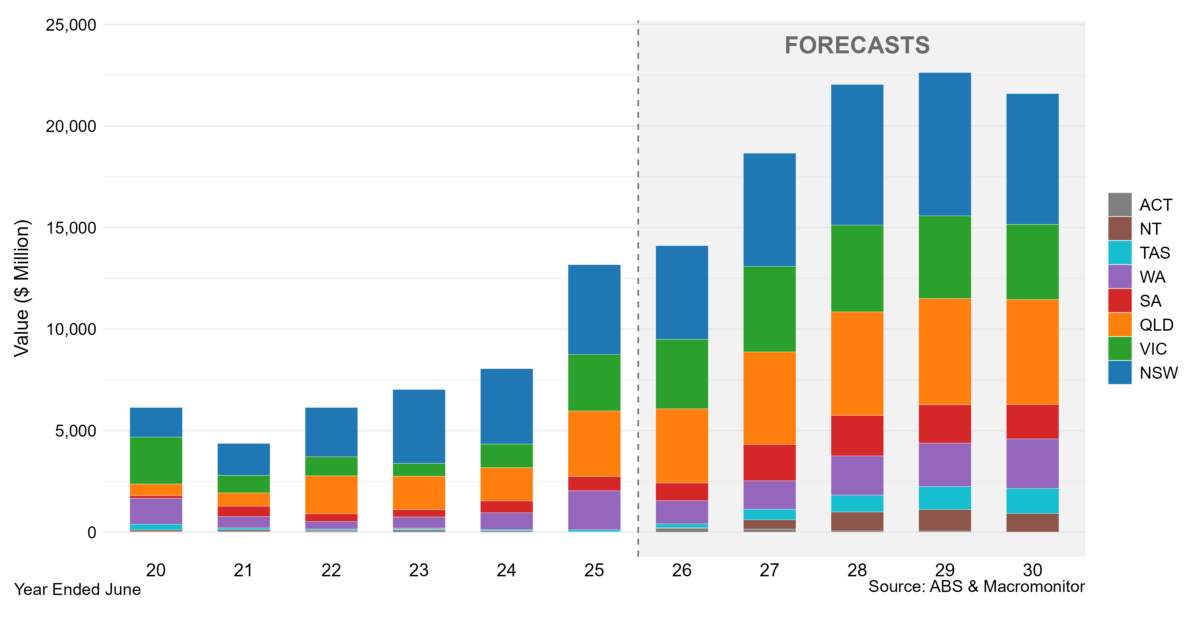

The Renewable Energy Construction Outlook – Australia, provides detailed forecasts for solar, wind, battery, hydro and biomass construction spending in Australia, estimating the value of work done in the renewable energy sector has surged from $4.4 billion (USD 2.9 billion) in 2020/21 to $13.2 billion in 2024/25 (in constant 2022/23 prices).

Acceleration is expected to be driven further by ambitious national targets, the federal government’s Capacity Investment Scheme (CIS), and the urgent need to replace retiring coal assets with 40 GW of new capacity by 2030.

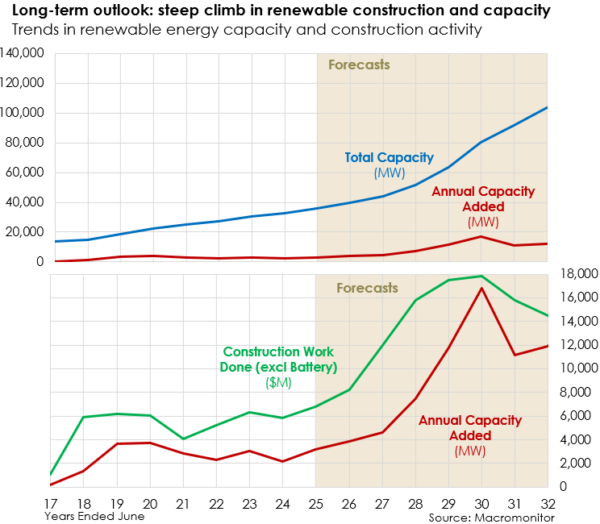

Over the five years from 2025/26 to 2029/30, Australia is projected to add an average of 8.9 GW of new renewable capacity each year, more than triple the 2.7 GW annual average of the past five years.

Macromonitor Economist and Report Lead Author Dr Abdul Hannan said the data confirms the energy transition has moved from planning to delivery phase.

“Activity has already tripled, and that momentum will build further. With over 10 GW of capacity awarded in late 2025 alone through the CIS, the pipeline for the next five years is substantial,” Hannan said.

Battery enery storage systems

The report also identifies battery storage as the breakout performer of the current financial year.

“Battery storage construction has become a cornerstone of the transition, rising from just $89 million in 2019/20 to $6.4 billion in 2024/25, and is forecast to remain near this level for the next three years,” Hannan said.

“Building large-scale battery storage is now critical for maintaining a stable grid through the transition.”

The report highlights that while solar construction is recovering and expected to peak at $6.4 billion in 2027/28, the wind sector is poised for the most dramatic acceleration, particularly with the development of offshore zones in Victoria and New South Wales (NSW).

“We forecast wind energy construction to accelerate to a record $10.1 billion in 2029/30 as we see onshore pipelines mature and offshore wind projects in Victoria and NSW move toward construction, wind will become the dominant driver of energy infrastructure spending,” Hannan said.

Transmisison

The report finds transmission construction is also set to rise strongly, led by major projects such as CopperString 2.0, HumeLink, and Marinus Link.

Despite the strong outlook, Macromonitor warns that high construction costs, grid-connection delays, and complex planning processes remain significant risks.

“Securing financial close continues to be a major barrier for many developers. As the CIS expands, a key test will be whether auction pricing can align with the requirements of lenders, often needing extra backing through corporate Power Purchase Agreements,” Hannan said.

After 2030, Macromonitor expects a moderate downturn in renewable energy construction though activity is still projected to remain above historical levels, which implies substantial ongoing growth in total renewable generation capacity.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.