Investors remain ready to back renewable projects, survey finds

Sydney headquartered MinterEllison has released a wide-ranging international survey that found that renewable energy investors stand ready to increase their activities in the next two years. Australian renewable greenfield projects are particularly attractive, with U.S. investors most likely to play an increasingly active role in the marketplace.

Tempo Australia says on track to de-risk Cohuna solar project

With the trading suspension lifted, the ASX-listed contracting company says its fear of cost blowouts on a 34 MW Victorian project has been allayed by the ongoing good faith negotiations with client Enel Green Power.

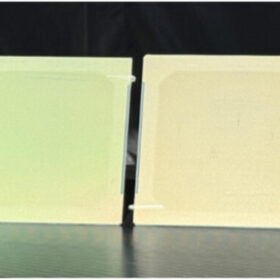

Bifacial beats Trump’s tariffs

Federal trade authorities have ruled that bifacial solar modules are no longer subject to the Section 201 ruling, which currently apply a 25% tariff to most solar modules imported to the United States.

J-Power to buy stake in Genex Power

Japan’s J-Power will invest up to $25 million in the Sydney-based publicly listed renewables developer. The investment will underpin the construction of Genex’s landmark pumped hydro project in northern Queensland.

Total Eren secures finance for Victoria’s biggest solar farm

The French renewables giant has reached financial close for the 256.5 MW Kiamal Solar Farm with the support of a group of Australian and European financial institutions. Additionally, Australia’s green bank Clean Energy Finance Corporation entered the project by taking a minority equity stake.

Sydney Opera House inks hybrid renewable PPA

The world famous iconic building has marked the World Environment Day with a series of sustainability announcements, including contracts to source wind and solar power from major NSW projects.

Australian musicians launch solar investment platform

Though a new platform established in response to the climate crisis, Australian musicians will be investing in solar farms across the country. The first solar farm being built with their help is Brigalow.

NSW’s Byron Shire Council allocates funds for 5 MW PV array

The Byron Shire Council has committed $465,000 to get the planning, design and tender process underway.

Solar feed-in tariff for regional Queensland reduced

In the next financial year, solar households in regional Queensland will receive over 16% less for the power they export into the grid.

Queensland launches $19 million hydrogen strategy

The Queensland government has launched a five-year plan to help drive the development of a renewable hydrogen industry and create more highly skilled jobs and export opportunities.