A few years ago, Australian businesses purchased their electricity contracts from an energy retailer, and when multi-year contracts came up for renewal, threw their weight behind negotiating better outcomes. Today, rocketing electricity prices – which saw commercial energy bills in some states more than double in the 2016-17 financial year – have coincided with an unprecedented boom in low-cost renewable energy projects.

Businesses on short-term energy contracts are particularly exposed to fluctuations in wholesale prices. In recent years prices have spiked around events such as the closure of South Australia’s Northern Power Station in 2016 and Victoria’s Hazelwood Power Station in 2017, which resulted in much tighter supply-demand balance. These two states in particular, and the National Energy Market as a whole, were affected when they turned to gas to fill gaps in generation, as gas prices have been held high by insufficient onshore supply to meet demand.

Given the costs of solar and wind have fallen, and energy bills have spiked, many find the pricing offered by either on or off-site PV or wind contracts compelling. However, many companies have been stymied by the complexities of varied renewable-energy offerings, the need for risk management during energy transition, and the costs of contracting in a market where every new deal has been bespoke.

To meet this challenge, innovative power purchase agreements (PPAs) and services for C&I customers have emerged at pace. And in Australia, 2019 is shaping up to be a watershed year.

Jon Dee, Australian cable anchor, on Sky News’ Smart Money, and Energy Transition Leader at Arup Australasia, says he is approached daily by executives who want to plug their businesses in to renewables, but are frustrated by the due diligence required to negotiate unfamiliar long-term arrangements with energy providers. “They’re not experts in the energy field, they’re experts in their particular sector or industry,” says Dee.

The drivers for more businesses to embrace PPAs are increasingly compelling: PPAs can provide a hedge against energy-market volatility; they enable companies to fulfill their social, corporate, and regulatory requirements to reduce emissions and operate sustainably; and, most meaningful for many companies, they cut energy costs.

The New South Wales guide to power purchase agreements, published in 2018 by Energetics and Norton Rose Fulbright, calculates that “a well negotiated PPA can potentially provide savings between 15 and 47% on the energy component of a typical electricity bill expected in 2020.”

Mentorship, marketplace benefits

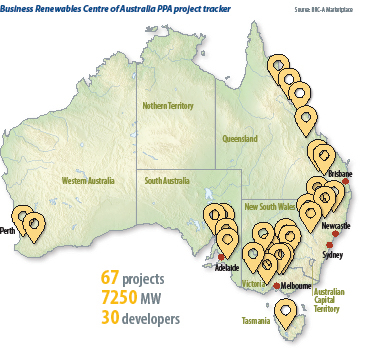

Demystifying what constitutes a well-negotiated PPA is part of the remit of the Business Renewables Centre of Australia (BRC-A), which in March launched its information-packed online members’ portal. Membership of the BRC-A is free, and in addition to simplified guides and templates, it offers would-be PPA buyers mentorship by businesses that have successfully negotiated the hurdles to renewable energy market participation. Additionally, it provides the opportunity to join buyers’ groups that share administrative costs and multi-megawatt contracts; as well as access to an Australian first: a renewable-energy marketplace, which opened with an incredible 7 GW of projects, from which corporate offtakers can choose their ideal energy partners.

“There’s a lot of appetite out there,” says Monica Richter, program director with BRC-A. “We’ve set this up to really accelerate large-scale PPAs in Australia. We want to support all parts of the ecosystem – buyers, project developers, and service providers – to create that sustained and simplified PPA market.”

Facilitator to disrupter

A different kind of renewable-energy marketplace will hold its first online auction of digitally enabled corporate PPAs in Australia this quarter.

WePower, founded in the Baltic states of Estonia and Lithuania, has focused its development on Australia because of the country’s “combination of high energy prices and tremendous renewable resources,” says WePower’s business development director, Jenya Khvatsky. He adds, “With roughly 500 projects in development and another 200 or so operational, there’s lots of volume to work with.”

The WePower standard contract for PPAs has been developed to be equitable to both buyers and sellers; and is available for review by corporates before auction. Its technology tokenizes each kilowatt hour that passes through its system, imbuing that token with contract details so that it can subsequently be easily traded on the WePower platform if and when a corporate consumer’s needs change.

WePower’s initial PPAs are contracts for difference (CFDs), a financial derivative product which provides a hedge against the rising prices C&I energy consumers are paying for electricity from retailers. Because some organizations don’t have the accounting processes in place to manage derivatives on, WePower is also accelerating the provision of standard retail products that will allow customers to buy electricity directly by auction and can be combined with WePower’s PPA.

WePower is first targeting customers with a load of around 1 GWh per year. The customer will register to view the marketplace of projects, both planned and in operation. Its own location, load profile, and corporate social responsibility criteria will inform the contract choices it makes. A company in regional NSW, with heavy daytime electricity consumption might choose to bid for a solar project in the state so that it can publicize its support of a local renewable development.

Buyers on WePower can diversify risk by purchasing PPAs from more than one project. The purchaser can contract with operating solar or wind farms for immediate participation, or contract for the cheapest electricity with projects that are eager to secure financing but may not commence delivering electricity for two or three years.

Capex-free rooftop PV

In some cases, the cheapest form of electricity a C&I consumer can tap is generated on-site. For businesses in urban or regional centers, rooftop PV is the most practical option.

Installation of solar on Australia’s vast C&I rooftop real estate has so far been limited by a number of factors. First, many companies are tenants and their lease length may not justify the 25 year (or more) lifetime of a solar installation; on the other side, landlords rarely want to commit to installing solar at any kind of scale because of the variability and uncertainties of tenancies in their building, shopping center, or industrial park.

Another factor which has resulted in small strips of solar being installed on seeming hectares of space is that small-scale renewable energy certificates (RECs) favor the modestly sized generator.

One incentive developed under Australia’s Renewable Energy Target for consumers are ‘small-scale technology certificates (STCs). These are offered for systems less than 100 kW, and have become a form of energy currency which can be traded for financial benefit. They make installing sub-100 kW systems particularly attractive.

Importantly, STCs are generated, and can be monetized on the day of installation, and are paid on system capacity, making them more attractive than ‘large-scale generation certificates’ (LGCs), which apply to installations larger than 100 kW.

“STCs are essentially 13 years of LGCs rolled up – and that is pretty hard to compete against,” explains Aidan Jenkins, CEO of Perth-based installer Infinite Energy. In January, Infinite was acquired by Japan’s Sumitomo and is looking to expand its rollout of rooftop PPAs to commercial customers. “You effectively get 13 years of deemed production rolled up and given up-front [with STCs]. Whereas the minute you step one watt above 100 kW you have to wait every quarter for your incentive. It skews the market.”

Rooftop PPAs

Two innovative companies, Epho and Solar Bay are looking to rent rooftop space from owners with large commercial real estate assets – they are targeting property managers such as Goodman, and asset managers like Real Asset Management (RAM Group). The plan is to lease the roof space from property owners and sign PPAs with tenants.

Epho has previously developed some of the biggest customer-owned C&I projects in Australia, including the 6 MW of solar now meeting 18% of Brisbane Airport’s energy needs. Its managing director, Oliver Hartley subsequently saw an opportunity to overcome “the misaligned interests between C&I landlords and the tenants” by taking over development, maximizing rooftop generation, and exporting excess power to the grid with Epho as the registered market participant.

Hartley illustrates how the Bright Thinkers Power Station (BTPS) works, with the imaginary case study of a cold-storage plant. The facility has more than 1.7 MW of PV potential on its rooftop expanse, but the business itself warrants only 850 kW, which offsets 30% of its electricity bill. “With our BTPS,” says Hartley, “Epho can put a 1.7 MW system on that roof and deliver excess power to the National Electricity Market (NEM) as a market participant.” The larger system also captures more energy at all times of day, increasing the solar power available as an on-site PPA to more than 40% of the cold-storage facility’s needs.

Under this model, Epho, as owner-developer, manages all contracts, as well as operation and maintenance of the solar array. Multiple tenants can each further their sustainability goals by contracting for PPAs with Epho. The landlord can count on a stable income stream from its new long-term rooftop tenant.

Taking a load off the grid

Solar Bay also constructs rooftop solar systems with no capital expenditure required from property owners, but is funded by investors who seek to have a positive social and environmental impact, and drive overall sustainability goals.

“Because our investors value the non-financial benefits of what we do, we can sell electricity at significant discounts compared to the cost of grid power,” says Cameron Quin, Chief Operating Officer and co-founder of Solar Bay.

The aim is to build a portfolio of generating properties that will ultimately contribute to a dispatchable virtual power plant. Assets in the group are remotely monitored, their energy-use patterns recorded over time. Solar Bay is modeling how individual PV systems could increase their utility with different storage technologies. Quin says each of Solar Bay’s contracts is formulated, and every installation is designed, with the “future in mind.”

That is, Solar Bay installs infrastructure for future expansion. On particular sites under development, says Quin, “We’re doubling the cabling to the roof, to be able to double the system size in the future. We’re putting 500 amp breakers into mains switchboards so that installing batteries at a later date becomes significantly easier. We’re future proofing these solar systems for when we invest heavily into batteries and the dispatchable VPP.”

RAM recently signed with Solar Bay to begin installation of solar arrays and embedded networks across its 11 shopping centres and a medical centre. “We’re renting every one of RAM’s rooftops and installing more than A$4 million (US$2.8 million) worth of solar across the properties,” says Quin. The resulting offering to RAM’s 250 tenants will deliver 15-20% cheaper energy in the short term. Solar Bay is preparing to deliver further benefits, such as providing backup electricity supply, and contracting off-site renewables for energy not generated on-site.

Even before Solar Bay’s VPP becomes a reality, which Quin anticipates could be in 2021, its network of offtakers in large shopping centres and industrial parks will contribute to lowering overall electricity prices as the combined assets reduce demand on the grid.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

I assume that technology will continue advancing and that having a rooftop installation might become an albatross rather than an asset. Since 99% of the country is desert wasteland anyway, it is better to put the solar panels out there and keep them separate from the buildings. The WePower market model makes more sense than buying a system as it allows the most efficient producers to compete and the customers to benefit from that competition. And you can document that you are actually using renewable energy rather than guessing.