India’s green hydrogen will be cheapest in the world, says power minister

Already 5.8 million tonnes of green hydrogen manufacturing capacity is in different stages of installation in India, said power minister R.K. Singh at a summit in New Delhi recently.

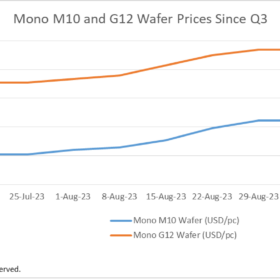

Solar wafer prices fall for first time in 3 months

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Origin lands $45 million to progress Hunter Valley hydrogen hub

Origin Energy has secured a $45 million (USD 28.7 million) commitment from the New South Wales government to advance the development of a commercial-scale green hydrogen manufacturing hub on Kooragang Island near Newcastle.

Australia in midst of solar market shakeup with TW Solar entrance, historic global pricing plunge

Australia’s solar market and pricing has been shaken up in recent months with the entrance of Tongwei Solar. Compounding this is the global free fall in panel pricing, which solar analyst Warwick Johnston says is yet to properly hit Australia. “There’s super cheap panels that are coming through and everyone will have to adjust their prices accordingly,” he says.

WA to charge royalties on natural hydrogen projects

With the regulatory scaffolding around natural hydrogen starting to be erected across the country, the Western Australian government has confirmed it will charge a royalty on hydrogen extracted from underground geological formations, otherwise known as natural or gold hydrogen.

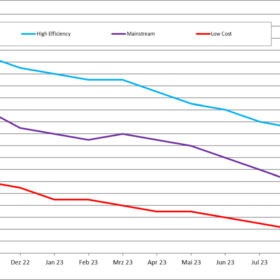

Solar module price falling, with no end in sight

Solar module prices have never fallen so sharply in such a short period of time. One reason for this is the “PV module glut” in warehouses in Europe, according to pvXchange’s Martin Schachinger.

Funding boost to progress Port Bonython green hydrogen plans

Plans to develop a large-scale green hydrogen production and export facility at Port Bonython in South Australia have received a significant boost with the state and federal governments investing $100 million (USD 64.4 million) to develop infrastructure that will support the proposed $593 million project.

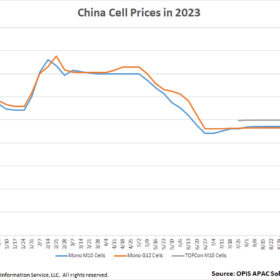

China solar cell prices hit record lows

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

Origin buyout faces hurdle as major investor ups stake

Brookfield’s plans to acquire Origin Energy face a potential snag with the energy company’s largest shareholder, AustralianSuper, saying the $18.7 billion (USD 12 billion) takeover deal offered by the Canadian investment giant “substantially” undervalues the business.

First $5 billion transferred to manufacturing fund, proposals so far dominated by renewables

Australia’s National Reconstruction Fund is up and running, with the federal government transferring the first $5 billion (USD 3.26 billion). The fund has already received around 100 proposals, with climate ventures and advanced technology reportedly dominating.