Solar power can cut living costs, but it’s not an option for many people – they need better support

As the cost of living soars, many Australian households are turning to rooftop solar to cut their energy costs. A Pulse of the Nation survey last month showed about 29% of Australians have installed or are considering installing solar panels on their homes. The same survey shows one in five Australians can’t afford to adequately heat or cool their homes.

Green loans spike as government supports new home loan program

The Bendigo Bank has reported a massive 600% spike in customers accessing green loans in the last year. The news comes just after the federal government’s green bank paired up with the Commonwealth Bank to begin offering builders and renovators working to high energy efficiency standards reduced rates on their home loans.

Next acquisitions for Octopus Australia’s new investment platforms revealed

The investment platforms from Octopus Investments Australia are set to acquire three new projects in the coming months in Queensland, Victoria, and New South Wales. Launched in 2022, the OREO and OASIS platforms “allow wholesale investors and mums and dads to invest alongside big institutional investors and get access to big projects in Australia,” Managing Director Sam Reynolds told pv magazine Australia.

Australia singled out as key investment market for Asian majors

Executives from Gentari, the clean energy subsidiary of Malaysia’s state-owned oil company Petronas, and Japan’s biggest steelmaker, Nippon Steel, are eying Australia for future investments in renewables projects and green-steel manufacturing.

Queensland’s $5 billion CopperString purchase to unlock 6 GW of renewables

The Queensland government will acquire the $5 billion (USD 3.37 billion) CopperString transmission line project which is set to unlock 6 GW of renewable energy resources and connect Queensland’s North West Minerals Province to Australia’s national grid. The shovel-ready project, many years in the making, is hailed as the biggest expansion to Australia’s energy grid in decades.

Renewable energy institutional investment has gone ‘from niche to mainstream’

Term Loan B funding may be a multi-trillion-dollar pool made available to renewable energy development. KeyBanc managing director Andrew Redinger shares his view of the evolving market in a white paper.

Sims announces plan to sell stake in LMS Energy

Metal recycling company Sims plans to offload its 50% stake in Queensland-headquartered renewable energy group LMS Energy which owns and operates six solar plants and 36 waste-to-energy facilities at landfill sites throughout Australia.

NSW commits $1.5 billion in concessions for green hydrogen projects

Two new green hydrogen projects in New South Wales will share in $64 million (USD 43.25 million) in support as the state government looks to accelerate the development of a hydrogen industry which is projected to attract more than $80 billion in private investment.

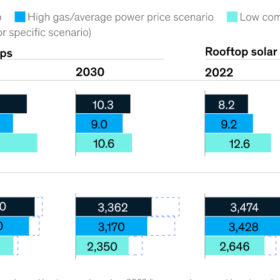

Study shows payback times for heat pumps could plunge by 2030

McKinsey & Company says in a new report that payback periods for heat pumps could fall by up to 38% by 2030.

Sono Motors scraps development of Sion solar cars

Sono Motors, a solar electric-vehicle manufacturer in Germany, has terminated its Sion passenger car development program, as it has failed to secure enough funding to support pre-series production. It says it will now focus exclusively on retrofitting and integrating its patented solar technology into third-party vehicles.